Great Fund Insights: AIFMD II - Unveiling the timeline for the new loan origination regime

Related people

Jean-Christian Six

Partner

Luxembourg

Yannick Arbaut

Partner

Luxembourg

Miao Wang

Partner

Luxembourg

Brice Henry

Partner

Paris

Antoine Sarailler

Partner

Paris

Dorothee Atwell

Partner

Frankfurt am Main

Ellen Cramer-de Jong

Partner

Amsterdam

Salvador Ruiz Bachs

Partner

Madrid

Cristiano Tommasi

Partner

Rome

Matt Huggett

Partner

London

Nick Williams

Partner

London

Dominic von Wulffen

Partner

London

MaameYaa Kwafo-Akoto

Partner

London

Emma Danforth

Partner

London

Related news and insights

News: 27 March 2024

Publications: 05 March 2024

AIFMD II introduces, among other changes, new rules for alternative investment fund managers (AIFMs) and the alternative investment funds (AIFs) managed by them involved in loan origination. AIFMD II must be implemented by Member States into national law within 24 months of the date of entry into force of AIFMD II, ie by 16 April 2026 at the latest. The implementation date for the AIFMD II rules will be the date of implementation in the Member State of the relevant AIFM.

In this alert, we focus on the main changes and implications of the new rules applicable to loan origination, the implementation timeline, the transitional provisions applicable to existing funds and to the loans originated before 15 April 2024. A separate alert will deal with the other key changes introduced by AIFMD II.

1 Scope and new AIFM functions

The new regime comprises two sets of rules, one which only applies to AIFs falling within the new definition of “loan-originating AIF”, while the other is relevant for all AIFs that originate loans, irrespective of whether loan origination is their main strategy or they qualify as loan-originating AIFs.

1.1 Loan-originating AIFs vs. AIFs that originate loans

A loan-originating AIF is defined as an AIF:

- whose investment strategy is mainly to originate loans; or

- where the notional value of the AIF’s originated loans represents at least 50% of its net asset value.1

Loan-originating AIFs will be subject to all the new requirements2. AIFs that do not fall within the definition of loan-originating AIFs but engage in loan origination will have to comply with only certain new requirements.

Originating loans or loan origination are defined as “the granting of a loan directly by an AIF as the original lender or indirectly through a third party or special purpose vehicle (SPV) which originates a loan for or on behalf of the AIF, where the AIFM or the AIF is involved in structuring the loan, or defining or pre-agreeing its characteristics, prior to gaining exposure to the loan”. The definition implies that secondary loan acquisition, where the AIFM or AIF are not involved in “structuring the loan, or defining or pre-agreeing its characteristics”, is not in scope.

It should be noted that AIFMD II does not include a definition of what constitutes a “loan” and in our view the acquisition by an AIF of debt securities (ie notes or bonds) issued by a portfolio company does not qualify as loan origination.

1.2 Exemptions for shareholder loans

Shareholder loans are defined under AIFMD II as loans “granted by an AIF to an undertaking in which it holds directly or indirectly at least 5 % of the capital or voting rights, and which cannot be sold to third parties independently of the capital instruments held by the AIF in the same undertaking”.

AIFMs managing AIFs that originate only shareholder loans are exempted from the requirements listed in section 2.2 (Leverage caps) and the requirements listed in section 3.5 (Policies, procedures and processes for the granting of loans and credit risk management) do not apply to the origination of shareholder loans, provided in both cases that the notional value of those loans does not exceed in aggregate 150% of that AIF’s capital. This exemption is relevant in particular for private equity fund managers whose only lending activities are the granting of shareholder loans alongside equity investments in portfolio companies.

The definition of shareholder loans was refined during the legislative process by the French presidency of the Council “to be more in line with existing market practices and avoid the application of the whole loan-origination framework to loans that do not entail the same risks for investors, the fund and borrowers” and to capture loans granted by private equity vehicles to companies in which they already hold equity or granted by real estate vehicles to real estate holding companies “because of the simplicity of this funding solution compared with a capital increase”.

Looking at the definitions of shareholder loans and loan origination, in our view loans to SPVs in the holding chain of a portfolio company and other asset can be disregarded for the purpose of the new rules and that the granting of loans to SPVs does not constitute a loan origination activity within the meaning of the new regime.

1.3 New permitted activities for EU AIFMs

“Originating loans on behalf of an AIF” and “servicing securitisation special purpose entities” are new functions added to Annex I, point 2, of the AIFMD as other functions that an AIFM may additionally perform in the course of the collective management of an AIF.

Recital (13) of AIFMD recognises that “Investment funds providing loans can be a source of alternative financing for the real economy. Such funds can provide critical funding for Union small and medium-sized enterprises, for which traditional lending sources are more difficult to access.” The Recital further addresses the issue of diverging national regulatory approaches that hinder the establishment of an efficient internal market for loan origination by AIFs and states that the AIFMD should recognise the right of AIFs to originate loans. The Recital states that “common rules should also be laid down to establish an efficient internal market for loan origination by AIFs, to ensure a uniform level of investor protection in the Union, to make it possible for AIFs to develop their activities by originating loans in all Member States and to facilitate access to finance by Union companies, a key objective of the capital markets union as set out in the Commission’s communication of 24 September 2020 entitled ‘A Capital Markets Union for people and businesses – new action plan’. The last sentence of the recital then clarifies that “the provisions laid down in this Directive that are applicable to AIFMs that manage AIFs that originate loans should not prevent Member States from laying down national product frameworks that define certain categories of AIFs with more restrictive rules”.

It seems that the intention was to allow for loan origination activities to be carried on in other Member States on a cross-border basis and to create some form of passport, but no specific provisions to that effect are included in the operative provisions of AIFMD II. In particular, the last sentence of Recital (13) could be used by a Member State to restrict loan origination when implementing AIFMD II. However, in our view such restrictions should only be possible in relation to the Member State’s national product frameworks and not impede cross-border lending. At this stage, it remains unclear if the addition of the loan originating function in Annex I of AIFMD will effectively remove barriers for cross-border lending into all Member States, in particular where the local jurisdiction provides for stringent banking monopoly restrictions.

Finally, Member States can in any case prohibit loan origination by AIFs to consumers in their territory as set out in Section 3.4 (Prohibited activities) below.

2 New requirements applicable to loan-originating AIFs only

2.1 Restriction on open-ended structures

A loan-originating AIF may only be structured as an open-ended fund if the AIFM can demonstrate to its competent authority that the AIF's liquidity risk management system is compatible with its investment strategy and redemption policy.

The European Securities and Markets Authority (ESMA) will develop draft regulatory technical standards (RTS) before 16 April 2025 to determine the requirements which must be complied with by open-ended loan-originating AIFs. The RTS will set out the conditions relating to:

- the liquidity management system and redemption policy that must be implemented by the AIFM of an open-ended loan-originating AIF;

- the obligation to maintain an adequate cash buffer; and

- stress-testing requirements,

taking into account the underlying loan exposures, the average repayment time of the loans and the overall granularity and composition of the portfolio of the loan-originating AIF.

Transitional provisions

- The requirements specific to open-ended loan-originating AIFs must be complied with by AIFMs as from the implementation date in their home Member State.

- AIFs established before 15 April 2024, are grandfathered:

- indefinitely if they do not raise capital after 15 April 2024; or

- until 16 April 2029, if they raise capital after 15 April 2024.

2.2 Leverage caps

Loan-originating AIFs must comply with a leverage limit of:

- 175% if they are open-ended; or

- 300% if they are closed-ended,

subject to the right of the AIFM’s competent authority to impose stricter limits3.

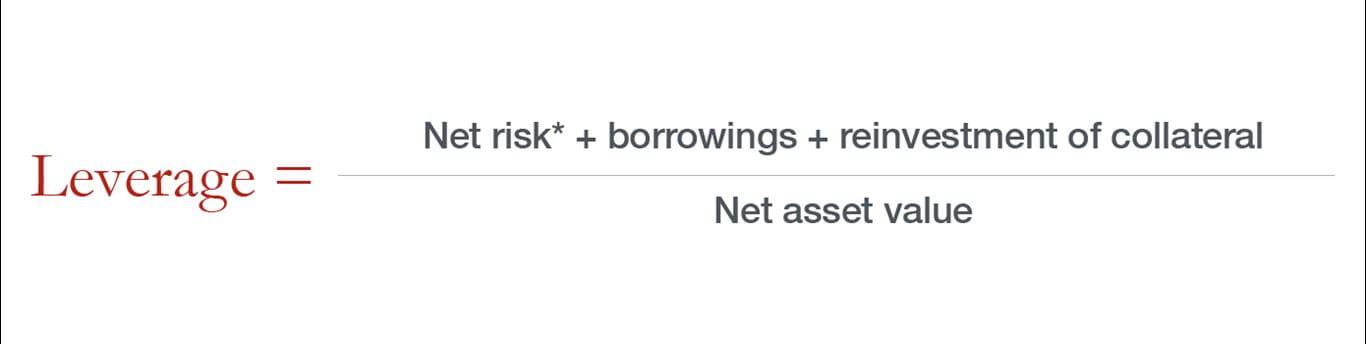

The leverage limit is to be expressed as the ratio between:

- the AIF's exposure calculated according to the commitment method; and

- its net asset value (NAV).

Under the commitment method, leverage is the sum of the absolute values of all positions (with derivative instrument positions converted into equivalent position in an underlying asset) taking into account netting and hedging arrangements (Articles 6 to 10 of the Commission Delegated Regulation (EU) 231/2013 (AIFMD-CDR)):

*Net risk = sum of exposures taking netting and hedging strategies into account

Subscription lines, ie borrowing arrangements fully covered by contractual capital commitments from investors in the loan-originating AIF, do not constitute exposure for the purposes of calculating that ratio. It is interesting to note that, contrary to the provisions on the calculation of leverage under the AIFMD-CDR, it is not specified that such subscription lines must be temporary in nature to be excluded from the calculation of leverage.

In the case of breach of the leverage limit for reasons beyond the control of the AIFM, the AIFM must “within an appropriate period of time, take such measures as are necessary to rectify the position” taking into account the AIFs investors interest.

Transitional provisions

- The leverage limits must be complied with by AIFMs as from the implementation date in their home Member State;

- AIFs established before 15 April 2024 are grandfathered:

- indefinitely if they do not raise capital after 15 April 2024; or

- until 16 April 2029, if they raise capital after 15 April 2024, but during the grandfathering period they may not increase leverage beyond the higher of:

- 175% (for open-ended loan-originating AIFs) or 300% (for closed-ended loan-originating AIFs); and

- where the leverage is higher than the applicable 175% or 300% limit, respectively, the level of leverage which they applied on 15 April 2024.

3 New requirements applicable to any AIFs that originate loans (including loan-originating AIFs)

The following requirements apply to all AIFs that originate loans (including, for the avoidance of doubt, loan-originating AIFs).

3.1 20% concentration limit for certain categories of borrowers

The notional value of the loans originated to any single borrower by an AIF that originates loans cannot exceed 20% of the capital of the AIF where the borrower is one of the following:

- a “financial undertaking”,4 which includes any of the following entities:

- a credit institution, a financial institution or an ancillary banking services undertaking5;

- an insurance undertaking, a reinsurance undertaking or an insurance holding company6;

- a MiFID investment firm or a MiFID financial institution7; or

- a mixed financial holding company8 (ie a parent undertaking, other than a regulated entity, which together with its subsidiaries, at least one of which is a regulated entity which has its head office in the EU, and other entities, constitutes a financial conglomerate); or

- an AIF; or

- a UCITS.

The 20% concentration limit:

- is without prejudice to more restrictive product diversification requirements under the ELTIF, EuVECA or EuSEF Regulations;

- is calculated by reference to the capital of the AIF defined as “the aggregate capital contributions and the uncalled capital commitments, calculated on the basis of amounts investible after deduction of all fees, charges and expenses that are directly or indirectly borne by investors”;

- must be complied with by the date determined in the AIF’s governing documents or prospectus which must not occur later than 24 months from the date of the first subscription for shares or units in the AIF, unless the competent authority of the AIFM allows an extension for a maximum of one year upon submission of a duly justified investment plan;

- ceases to apply when the AIFM starts to sell the AIF’s assets in order to redeem units or shares as part of the liquidation of the AIF; and

- is temporarily suspended (for the period necessary and up to 12 months considering the AIF’s investors interests) where the AIF’s capital is increased or reduced.

Transitional provisions

- The concentration limits must be complied with by AIFMs as from the implementation date in the AIFM’s home Member State.

- AIFs established before 15 April 2024, are grandfathered:

- indefinitely, if they do not raise capital after 15 April 2024;

- until 16 April 2029, if they raise capital after 15 April 2024. But during the grandfathering period, they must not increase exposure vis-à-vis any single borrower beyond the higher of:

- 20%; and

- if higher than 20%, the exposure to such borrower on 15 April 2024.

3.2 Risk retention requirement

When an AIF transfers a loan originated by it to third parties, it must retain 5% of the notional value of such loan:

- until maturity for loans whose maturity is up to eight years and for loans granted to consumers regardless of their maturity; and

- for a period of at least eight years for other loans.

The risk retention requirement ceases to apply:

- when the AIFM starts to sell the AIF’s assets in order to redeem units or shares as part of the liquidation of the AIF;

- when a disposal is necessary to comply with EU sanctions or with product requirements (eg when retaining the originated loan would breach investment or diversification requirements);

- when a disposal is necessary to enable the AIFM to implement the AIF’s investment strategy in the best interest of investors (eg when there is a change in the asset or sector allocation); or

- when a disposal is necessary due to a deterioration in the risks associated with the loan, detected by the AIFM as part of its due diligence and risk management process, and the purchaser is informed of that deterioration when buying the loan (eg when the borrower is in default and the loan no longer complies with the AIF’s strategy).

The AIFM may, upon request by its competent authority, have to demonstrate that it meets the conditions mentioned for the application of the relevant derogation from the risk retention requirements.

In the absence of regulatory guidance, it is unclear how the AIFMD II risk retention requirements will interact with the risk retention requirements under the Securitisation Regulation.

Transitional provisions

The risk retention requirement:

- does not apply to loans originated by AIFs before 15 April 2024; and

- has to be complied with by AIFMs as from the implementation date in the Member State of the relevant AIFM in respect of all loans originated after 15 April 2024.

As a result, existing AIFs may have in their portfolios certain loans to which the risk retention requirement will apply and other loans to which this requirement does not apply depending on the date of their origination.

3.3 Allocation of proceeds and disclosure obligations

The proceeds of loans minus any allowable fees for the loan administration must be attributed in full to the AIF that originated loans. All costs and expenses linked to the administration of loans must be clearly disclosed in accordance with Article 23 of the AIFMD. Furthermore, article 23(4) of the AIFMD has been amended to include that AIFMs must disclose to their investors periodically the composition of the originated loan portfolio.

Transitional provisions:

The requirements on allocation of proceeds and disclosure:

- do not apply to loans originated by AIFs before 15 April 2024; and

- have to be complied with by AIFMs as from the implementation date in their home Member State in respect of all loans originated after 15 April 2024.

3.4 Prohibited activities

Prohibition to grant loans to certain related entities:

AIFs are prohibited from granting loans to the following entities:

- the AIFM or the staff of that AIFM;

- their depositary and the depositary’s delegates that act in respect of the AIF;

- the AIFM’s delegates and their staff;

- an entity of the AIFM’s group,9 except if it is a financial undertaking that only finances borrowers other than those mentioned above in the first three categories.

Consumer lending:

Based on “overriding reasons of public interest”, Member States may decide to prohibit, in their territory, AIFs from:

- lending to consumers; and

- servicing consumer loans.

However, Member States cannot prohibit, in their territory, the marketing of AIFs that grant or service consumers loans in other Member States.

Prohibition of the “originate-to-distribute investment strategy”:

AIFs cannot pursue an originate-to-distribute strategy, whether such strategy is the exclusive strategy or only represents a part of the investment strategy of the AIF.

Transitional provisions

The prohibited activities:

- do not impact loans originated by AIFs before 15 April 2024 except for the prohibition to originate loans to consumers (if applicable in the Member State of the borrower); and

- will apply as from the implementation date in the home Member State of the relevant AIFM to all loans originated after 15 April 2024.

3.5 Policies, procedures and processes for the granting of loans and credit risk management

AIFMs managing AIFs engaging in loan origination, including when those AIFs gain exposure to loans through third parties, must (i) implement effective policies, procedures and processes for the granting of loans and for assessing the credit risk and administering and monitoring their credit portfolio, (ii) keep those policies, procedures and processes up to date and effective; and (iii) review them regularly and at least once a year.

These requirements do not apply to the origination of shareholder loans, where the notional value of such loans does not exceed in aggregate 150% of the capital of the AIF.

Transitional provisions

The requirements to implement policies, procedures and processes for the granting of loans and credit risk management:

- do not apply to loans originated by AIFs before 15 April 2024; and

- will apply as from the implementation date in the home Member State of the relevant AIFM to all loans originated after 15 April 2024.

Footnotes

1. This definition was absent from the Commission’s initial proposal and reflects a compromise between the co-legislators, who wanted to include only AIFs with a genuine loan originating strategy as the main investment strategy (qualitative criteria) but also to introduce a quantitative criterion to avoid circumvention of the rules.

2. Unless they are grandfathered

3. Article 25(3) allows the competent authorities of AIFMs to impose stricter limits after notification of ESMA, ESRB and the AIF's competent authority “if the use of leverage contributes to the buildup of systemic risk in the financial system or risks of disorderly markets”.

4. As defined in article 13, point (25), of Solvency II (Directive 2009/138/EC of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance).

5. Within the meaning of article 4(1), (5) and (21) of CRD (Directive 2006/48/EC of 14 June 2006 relating to the taking up and pursuit of the business of credit institutions).

6. Within the meaning of article 212(1)(f) of Solvency II, ie a parent undertaking which is not a mixed financial holding company within the meaning of Directive 2002/87/EC and the main business of which is to acquire and hold participations in subsidiary undertakings, where those subsidiary undertakings are exclusively or mainly insurance or reinsurance undertakings, or third-country insurance or reinsurance undertakings, at least one of such subsidiary undertakings being an insurance or reinsurance undertaking.

7. Within the meaning of article 4(1)(1) of MiFID (Directive 2004/39/EC of 21 April 2004 on markets in financial instruments).

8. Within the meaning of article 2(15) of Directive 2002/87/EC of 16 December 2002 on the supplementary supervision of credit institutions, insurance undertakings and investment firms in a financial conglomerate.

9. As defined in article 2(11) of the Accounting Directive (Directive 2013/34/EU of 26 June 2013 on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings).