Shifting Strategies in U.S. Intellectual Property Disputes: Lessons from 2023

Headlines in this article

Related news and insights

News: 04 April 2024

Allen & Overy files amicus brief in support of disability rights in reproductive healthcare

News: 04 April 2024

News: 15 March 2024

Allen & Overy advises Zendesk on its acquisition of AI-powered service automation leader Ultimate

Publications: 05 March 2024

Changes in the global patent litigation landscape: The impact of the UPC

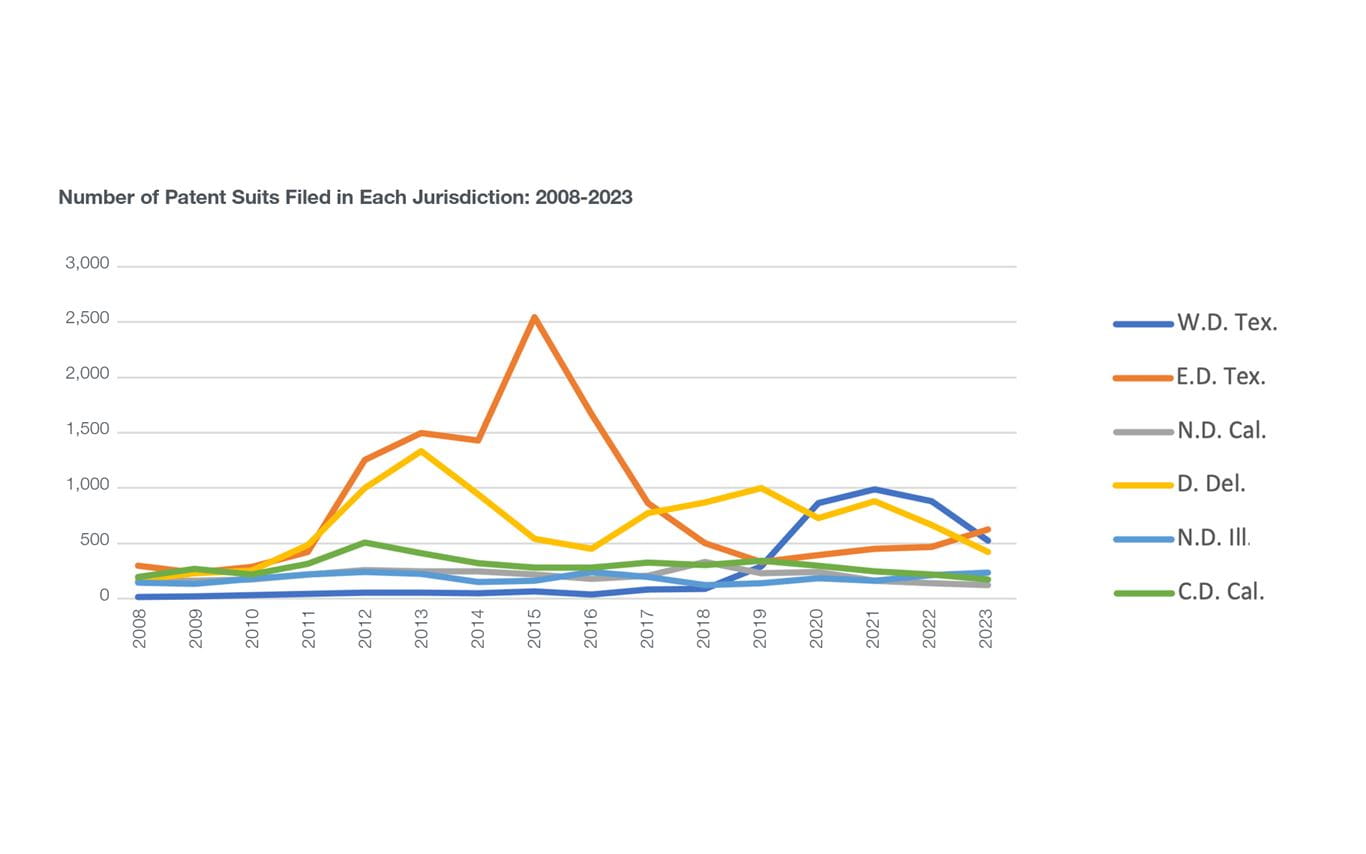

The plunge in patent suits for 2023 is well documented. The year’s 3,111 new patent lawsuits represent a decade-long low, almost a 50% drop from the decade high of 6,095 suits in 2013. The same is true for U.S. Patent Trial and Appeal Board (PTAB) petitions (1,188 in 2023 against 1,797 in 2015) and International Trade Commission proceedings (32 in 2023 against 60 in 2017).

Reasons for the decline

Practitioners and commentators ascribe the decline to several factors, including the intensification of discovery on litigation financing in some forums, changes in plaintiff-friendly standing orders and reduced activity by a few specific high-volume plaintiffs.

Another potential reason is that the deal pipeline for intellectual property assets was briefly interrupted by the potential for changes to the Alice framework for determining whether patents are invalid because they are directed to patent-ineligible concepts (Alice Corp. v. CLS Bank Int’l, 573 U.S. 208 (2014)).

Specifically, most NPE patent litigation – something like 90%, in fact – targets high-tech companies. High-tech patent portfolio movement may have slowed in 2021 and 2022 because buyers and sellers were waiting to see if the Supreme Court would re-examine its 2014 Alice decision in American Axle & Manufacturing, Inc., v. Neapco Holdings LLC, et al., 2018-1763. Alice set out the rules that courts apply to determine if a patent is actually eligible for patent protection. By almost any measure, the Alice decision caused federal courts to invalidate technology patents much more often than they did before. If the Supreme Court had revisited and changed the Alice rules, high-tech patent valuations could surge. So, certain asset buyers and sellers may have paused to see if a Supreme Court decision would affect the market.

When the Supreme Court ultimately declined to revisit Alice in June 2022 (by refusing to grant a certiorari petition in American Axle & Manufacturing, Inc., v. Neapco Holdings LLC), deals resumed. In the second half of 2022 one large technology company sold nearly 5,000 patents to another patent-monetization entity. In May 2023, another announced that it had sold about 32,000 patents to a patent-monetization company for $170 million in cash at closing. Assets from both portfolios will trickle down to NPEs and find their way into federal courts across the country.

Where plaintiffs have focused their filings

The District of Delaware, the Western District of Texas and the Eastern District of Texas remain the top forums for plaintiffs filing patent litigation. At the end of last year, the Eastern District of Texas surpassed the Western District as the most popular forum for plaintiffs. The change was driven by a new order in the Western District of Texas that caused patent lawsuits to be randomly assigned among all of the district’s judges, instead of being directed only to Judge Albright.

While the District of Delaware remains a popular forum (primarily because defendants often cannot challenge jurisdiction there), new rules about the litigation financing discovery may have contributed to a fall-off in new cases filed in that jurisdiction.

Increase in re-examinations to reduce uncertainty

While PTAB petitions are down overall, we have noted an increase in ex parte re-examinations, which occur when the USPTO re-examines patent applications due to substantial new questions of patentability. They rose 6.7% in 2023 versus 2022. One reason these proceedings are becoming more widespread is because they have got quicker, with it now typically taking less than 18 months from filing a re-examination request to the issue of a certification. In addition re-examinations do not create estoppel, while IPRs prevent petitioners from trying to invalidate patents in federal courts on grounds that could have been raised at the PTAB.

An additional consideration is that the Fintiv rule, which compels PTAB judges to deny IPRs on the basis that parallel district court cases will finish first, doesn’t apply to re-examinations. Re-examinations are also anonymous, unlike IPRs, and if someone loses an IPR, they can still go to the USPTO and request an ex-parte re-examination.

PTAB proposed rule changes

In April, the U.S. Patent and Trademark Office announced plans to change several rules impacting PTAB proceedings, including those around discretionary institution practices, petition word limits and settlement practices for America Invents Act proceedings.

The package of proposals includes limitations on both PTAB proceedings against patents owned by under-resourced inventors and challenges to patents that have previously had their validity upheld in U.S. District Courts or the PTAB. One proposed change expands the ability of PTAB judges to enter discretionary orders to deny patent challenges, while there is also a proposal to change petition word limits, potentially allowing additional word limits to be purchased by a petitioner. The USPTO hopes fewer parallel actions will be necessary if word limits are relaxed, permitting a more thorough discussion of a petition’s merits and potentially allowing a single petition to challenge more claims, and on more grounds.

The USPTO is also considering requiring a patent owner and a petition to affirmatively disclose parties that have any interest in the proceedings, including any ownership interest in the patent owner or petitioner, any government funding to the patent, any third-party litigation funding support, and any stake any party has in the outcome of the proceeding.

These proposed rule changes went out for consultation last year and we can expect that exercise to result in new rules sometime soon.

Outlook for case numbers

Looking forward, while the downward trend in patent filings in district courts is unlikely to continue, the same may not be true for PTAB actions. The number of patent portfolios that have made their way into the hands of patent-monetization entities in the past year will undoubtedly fuel an uptick. At the same time, as patent owners get access to new tools such as generative AI, which raises the prospect of patents and even pleadings being substantially drafted by AI, it will become cheaper and easier to get district court filings underway.

At the PTAB, however, we can expect filings to be flat or even continue on a downward trend, as the extension of discretionary orders hits volumes and efforts to reduce parallel actions lead to fewer cases even if there is no change in the number of patents being challenged.