A market utterly transformed, as M&A deals stall

Related people

Headlines in this article

Related news and insights

Publications: 04 April 2024

Publications: 04 April 2024

Integrating Sustainability: Luxembourg's Legal Advancements with the CSRD

Blog Post: 03 April 2024

European Commission opens unprecedented abuse of dominance probe in animal medicines sector

Publications: 03 April 2024

Chief Information Security Officers and cyber whistleblowing: considerations for PE firms

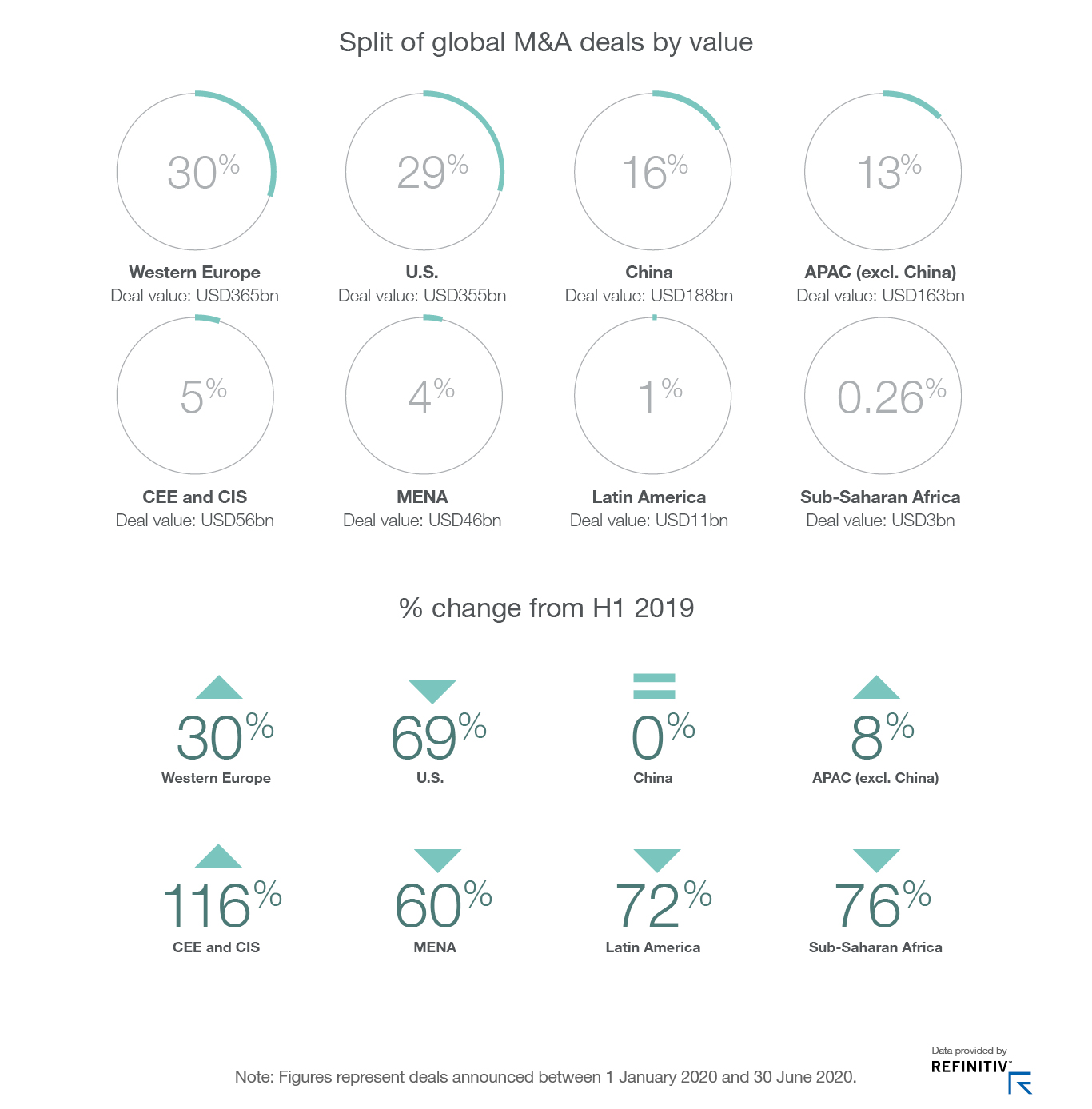

The Covid-19 coronavirus pandemic has brought the global M&A market to a juddering halt and is likely to radically change dealmaking for the foreseeable future.

The figures for H1 make bleak reading:

- global deal value fell by 41%

- the number of transactions declined by 16%

- megadeals over USD10 billion were down by 48%, while those over USD5bn were 25% lower

This impact was particularly severe in Q2, as the crisis peaked.

But even on a first-half basis it was dire, hitting all regions and sectors.

Safety first

Domestic deals, which helped the market to keep ticking over in the latter part of 2019, declined in value by 50% and in number by 12%.

Cross-border deals continued their already steep decline, with deal value down 15% and volume 24% lower.

This partly reflects the way investor confidence has been hit.

“Safety first” is the watchword for most businesses. The priority is to conserve cash and protect revenue streams rather than investing in M&A.

Equally, it reflects the logistical difficulties of transacting in a “locked-down” world. Megadeals that are still completing are taking an average of 300 days to close. Last year, the average was 240 days.

Recession?

Q3 may well see these themes intensify, especially with a severe recession in prospect.

And yet, there are reasons to believe that the M&A market will revive, although not to the level seen in the record-breaking last cycle, which began in early 2014.

Reasons include:

- a likely rise in distressed deals and restructurings as vulnerable businesses look for liquidity

- an upsurge in tech-related deals as digital transformation accelerates in sectors such as the life sciences, retail and financial services

- the search for cost-efficiencies through collaborations, joint ventures and consolidations

Dry powder

There is one other vital factor. Buyers (notably private equity funds) have plenty of dry powder to deploy and continue to assess opportunities, once buyer and seller price expectations line up. Credit markets also remain pretty robust.

The market will revive, but will continue to look very different.

The priority is to conserve cash and protect revenue streams rather than investing in M&A.

Download report

Read our latest report, Global M&A outlook: Adjusting to adversity.

Download PDF