Global trends in private M&A: Covid-19 update

Headlines in this article

Related news and insights

Publications: 04 April 2024

Publications: 04 April 2024

Integrating Sustainability: Luxembourg's Legal Advancements with the CSRD

Publications: 03 April 2024

Chief Information Security Officers and cyber whistleblowing: considerations for PE firms

Publications: 02 April 2024

Our analysis of private M&A deals signed so far this year shows just how fundamentally the market has changed since the onset of the coronavirus crisis.

Over the last eight years, we have analysed around 1,300 private M&A deals that Allen & Overy advised on globally.

Usually, we report on M&A trends annually.

But the Covid-19 coronavirus pandemic has brought about such significant changes in market practice that we have produced a special update comparing deals signed so far this year with those signed in 2019 and previous years.

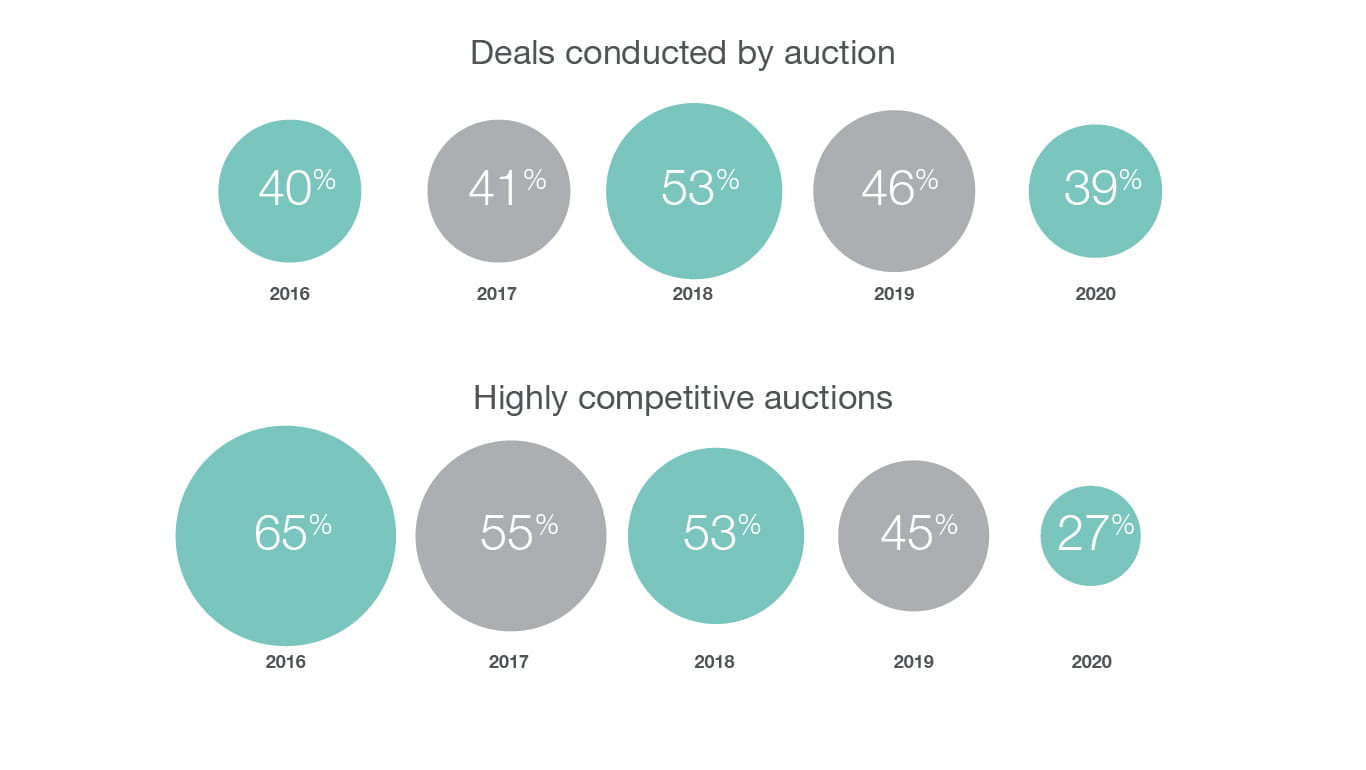

Dramatic decline in buy-side competition

When the pandemic first hit, many deals close to signing went ahead, though some in sectors that looked set to be badly affected were put on hold.

A number of auction processes still at an early stage saw competition between bidders diminish almost immediately, as doubts over valuations grew and as corporates refocused on cash preservation.

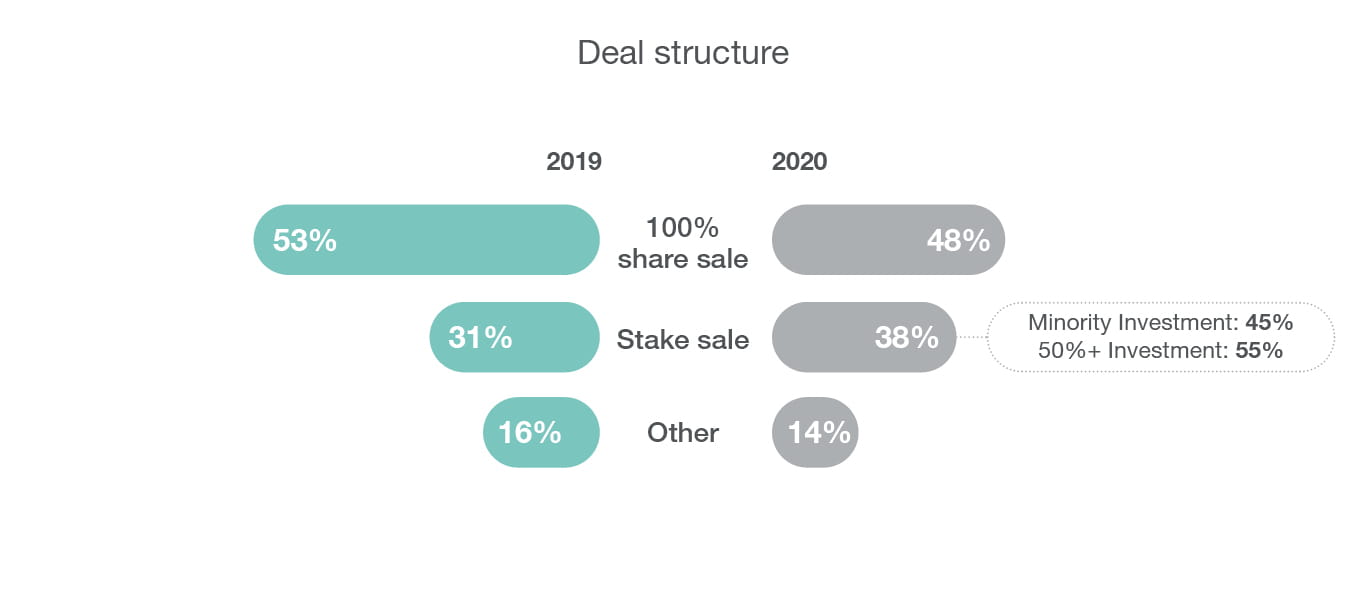

Deal structures changing with slight uptick in distressed M&A

Many potential M&A investors have been thinking about using deal structures that allow them to realise the benefits of M&A without full exposure to the downside.

In particular, parties are seeking to solve valuation issues, while also mitigating solvency risk and, in some cases, committing less funding. Just as in the wake of the financial crisis, investors are debating whether to acquire, invest or collaborate.

We already have some evidence that deal structures are changing. This includes:

- an increase in stake sales, including minority investments

- some planned acquisitions being turned into long-term collaborations or supply arrangements

- a slight uptick in distressed M&A, with more likely to follow

Pre-Covid deals in heavily impacted sectors unravelling

The vast majority of deals that were signed pre-Covid are proceeding as expected. However, some in the most heavily impacted sectors (including retail, travel and tourism) are unravelling or being renegotiated.

Some buyers are hoping that “material adverse change” provisions will take them out of deals, but many are also running an alternative argument: alleged breaches of pre-closing “ordinary course” covenants.

In other deals, buyers are getting creative when deal terms provide no obvious get out. The outcomes of these situations also vary, and some are still to play out through litigation or otherwise.

But they point to areas of an M&A deal that might merit more focus during negotiations over the coming months, particularly if a second wave of Covid-19 coronavirus hits.

Sellers now have laser focus on execution risk

With sellers now focusing intently on execution risk, a buyer able to offer an unconditional deal will be at an enormous advantage. In higher value deals, where some degree of conditionality is almost inevitable, substantive deal risk is being heavily scrutinised.

Certainty of funds is also critical, and financing conditions have become even rarer.

And termination rights linked to material adverse change or material breach of warranty are scarcer than ever.

One surprise finding is that we have not so far seen a coronavirus-related increase in the use of reverse break fees. But if more buyers refuse to complete despite conditions having been satisfied, more sellers may start pressing for these.

Governments and regulators moving the goalposts

Over the last few years, we have seen a swing towards protectionism, particularly in the U.S. and Europe. Covid-19 coronavirus has accelerated and expanded that trend.

Many governments are introducing, or increasing the scope of existing, foreign direct investment regimes, fearing:

- threats to national security

- loss of control over critical infrastructure

- the potential for opportunistic acquisitions, especially by buyers affiliated with a foreign government

The pandemic is also impacting deal timetables, as the ability for some authorities to conduct merger reviews has become more constrained.

This means it is taking longer than ever to close M&A deals. Long-stop periods in our 2020 deals ranged from one to 24 months, with an average period of seven months. That is one month longer than the equivalent period in 2019.

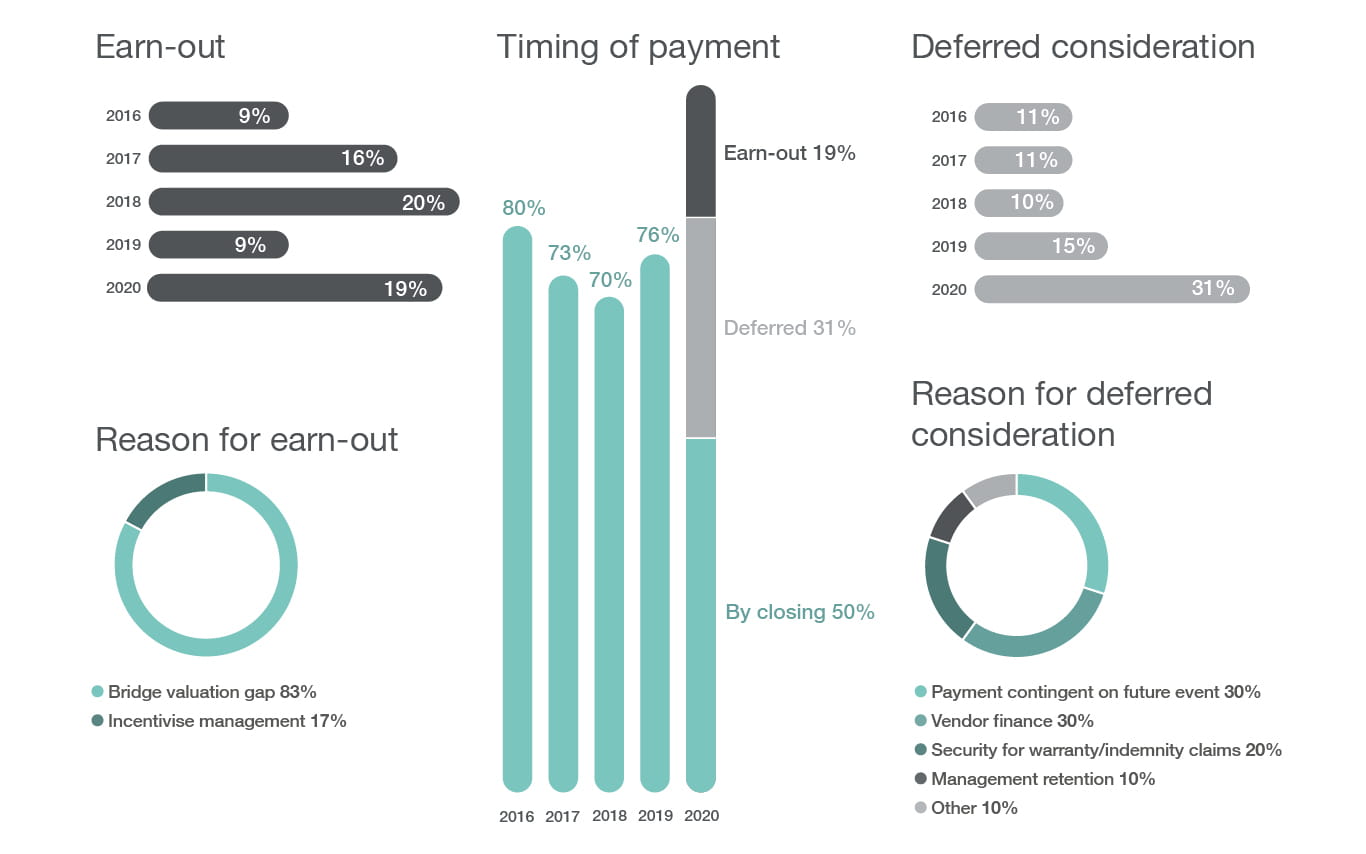

Valuation challenges turn pricing structures on their head

Companies have found it difficult to assess, with any certainty, what impact the pandemic will have on their future earnings. Without reliable financial projections, it is very hard to price a deal.

Consequently, where deals are going ahead, parties are looking to pricing structures that will help to mitigate risk and bridge valuation gaps.

In a marked increase on previous years:

- half our 2020 deals involved an earn-out or deferred consideration structure

- half (excluding private equity exits) involved a price adjustment

The financial metrics involved have changed too.

As a result of these “future pricing” structures the risk of disputes has increased, making dispute resolution mechanisms especially important at the moment.

Buyers are focused primarily on the risk of overpaying, and are mitigating that through new pricing structures.

Significant movement in warranty packages

Much market commentary has suggested that buyers might succeed in obtaining stronger warranty and indemnity packages in the current climate.

But close analysis of our deals shows that, while most trade sellers are still providing a decent set of operational warranties, they are pushing back hard on warranty repetition, buyer’s awareness and liability caps.

We have also seen a temporary reversal of the trend towards W&I insurance, as underwriters seek to exclude liability related to the one issue that is currently top of mind: Covid-19 coronavirus.

Overall a nuanced picture

There has been speculation that the short to medium-term economic changes brought about by Covid-19 coronavirus might result in a shift to a fully-fledged buyer’s market for private M&A deal terms. But the picture is far more nuanced.

Buyers are focused primarily on the risk of overpaying, and are mitigating that through new pricing structures.

Sellers are keenly focused on the risk of a failed deal, and are pushing back hard on termination rights and unnecessary conditionality. They are also focused on contractual risk allocation, intent on avoiding deal value being eroded as a result of significant future liabilities under warranties and indemnities.

Download report

Read our latest report, Global M&A outlook: Adjusting to adversity.

Download PDF