Better Arbitrate First: Court’s advice to a creditor of a disputed debt subject to an arbitration agreement

Related people

Headlines in this article

In Founder Group (Hong Kong) Ltd (in liquidation) v Singapore JHC Co Pte Ltd (2023), the Singapore High Court set out the principles applicable to an application by a creditor seeking an order for winding up. The case is a useful reminder that where parties have included an arbitration clause in their agreement, the party that will be a creditor under the terms of the agreement (e.g. a supplier of goods or services) will find it difficult to apply for an order of winding up if the debt is disputed.

Key takeaways

- This case is a useful reminder that where parties have included an arbitration clause in their agreement, the party that will be a creditor under the terms of the agreement (e.g. a supplier of goods or services) will find it difficult to apply for an order of winding up if the debt is disputed. As noted by the Court in this case, the safer approach would be to commence arbitration and obtain an arbitral award instead of applying for an order of winding up in the first instance. In this case, even though the company was insolvent, the matter was still remitted to be arbitrated first.

- The case also usefully explains that a creditor who is unable to show that the company is unable to pay its debts but seeks to wind up a company on the ground that it would be just and equitable to do so would need to show that its interests as a creditor are or are likely to be adversely affected if the order is not granted.

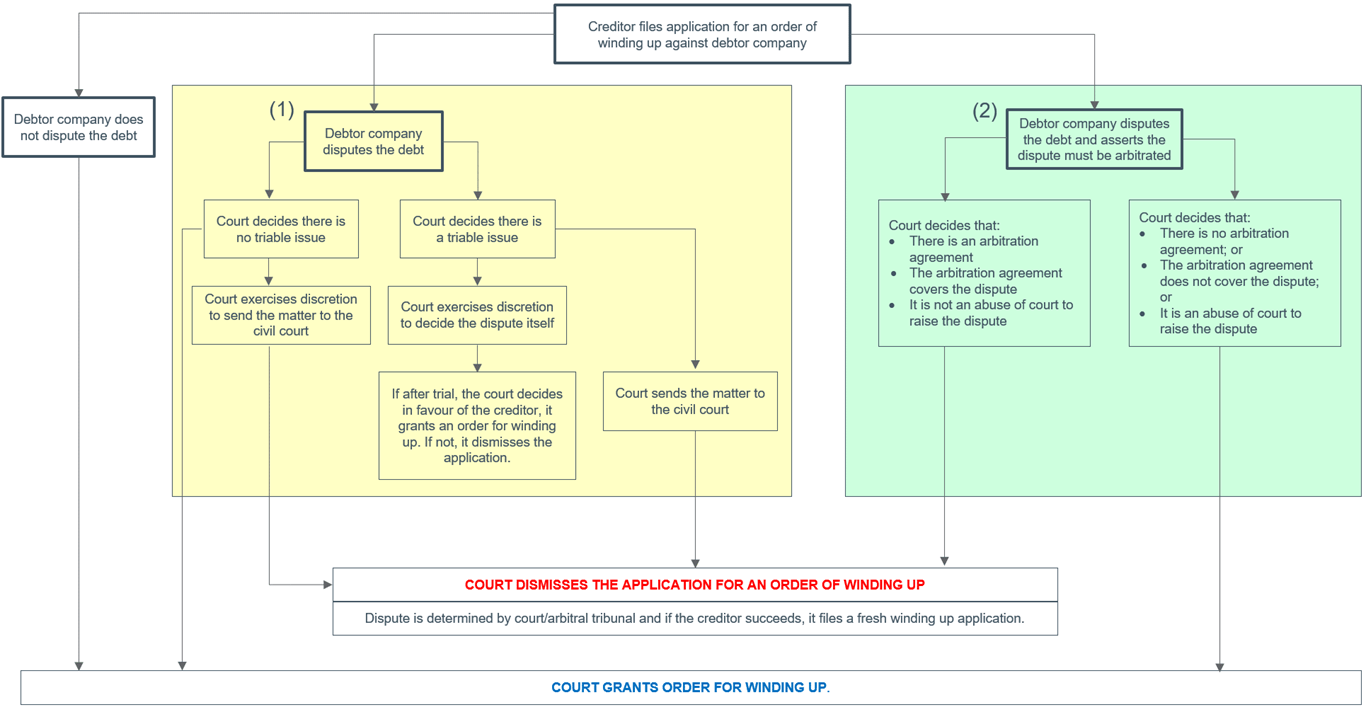

- This update includes a flow chart setting out the approach of the court when a person brings an application seeking a winding up order against a company based on a debt that it claims to have against the company and the company disputes the debt.

In the recent case of Founder Group (Hong Kong) Ltd (in liquidation) v Singapore JHC Co Pte Ltd [2023] SGHC 159, the Singapore High Court set out the principles applicable to an application by a creditor seeking an order for winding up.

Under section 124 of the Insolvency, Restructuring and Dissolution Act 2018 (IRDA), a court may order a company to be wound up upon an application being made for such an order by, among other persons, a creditor. For the court to grant the order, the applicant must show one of the grounds set out in section 125 of the IRDA. These include the following:

- That the company is unable to pay its debts; or

- That the court is of the opinion that it is just and equitable that the company be wound up.

Accordingly, the Court in this case considered whether such an order could be made where the company disputes the validity of the creditor’s debt and that dispute is covered by an arbitration agreement. It also discussed the factors that would be considered by a court where a creditor seeks to wind up a company on the “just and equitable” ground. The decision provides a thorough and useful overview of the state of the law in this area.

Facts

The applicant (Applicant) was Founder Group (Hong Kong) Ltd, a company in liquidation in Hong Kong. It had entered into three contracts to supply copper cathodes to the defendant, Singapore JHC Co Pte Ltd (Company). It claimed that the Company owed it US$43 million and that as a creditor it was therefore entitled to apply to have the Company wound up.

However, the Company disputed the existence of the debt. It claimed that the supply contracts were never fulfilled, and in fact had never been intended by the parties to be fulfilled. Accordingly, even though it had made an audit confirmation statement (which it withdrew before the application) as to the existence of the debt, it had no payment obligation to the Applicant. Furthermore, because the contracts had each contained an arbitration clause, the correct forum for the Applicant to make its claim was not in court via a winding up application but by commencing arbitration proceedings. Accordingly, as it was not a creditor for the purposes of section 124 of the IRDA, the Applicant had not been entitled to take out the winding up application.

The Court found in favour of the Company in all respects.

Approach of the court where there is a disputed debt

The Court first set out the law as to:

- The approach of the court when deciding whether to grant an order for winding up when the debt of the creditor making the application is disputed by the company; and

- How this approach changes when the dispute over the debt is covered by an arbitration clause.

We have set out the Court’s explanation in the flow chart below.

The area marked (1) in yellow shows the approach of the court in the ordinary case where the company that is the subject of the winding up application disputes the debt on which the winding up application is made and there is no arbitration agreement governing the dispute.

The area marked (2) in green shows the approach of the court where the claim is disputed and that dispute is covered by an arbitration agreement.

Approach of the court where the disputed debt is not governed by an arbitration agreement

As shown in the flow chart in the yellow area marked (1), the Court will consider whether there is a triable issue on the dispute. This is the same test as that which would apply to an application for summary judgment. The rationale is that if the applicant would be able to obtain summary judgment on its debt claim, it should not ordinarily be required to go the extra step of first getting a judgment before seeking to enforce it by insolvency proceedings. If, however, the company shows that there is a triable issue on the claim, the court will ordinarily require the applicant to commence litigation proceedings for the claim. If it succeeds in proving its claim in a trial, it can then recommence insolvency proceedings against the company.

In either case, however, as a matter of practice, the court retains the discretion:

- To require the applicant to commence civil proceedings for the claim even if there are no triable issues; or

- Even though there are triable issues, to determine the claim itself in trial proceedings conducted as part of the winding up application proceedings instead of requiring the applicant to take out separate civil proceedings in respect of the claim.

Difference in approach when the dispute is covered by an arbitration agreement

The approach is entirely different, however, where the claim is disputed and that dispute is covered by an arbitration agreement. As shown in the area marked (2) in green in the flow chart, in that case, the test is no longer whether there is a triable issue in respect of the dispute. Instead, the test is as follows:

- Whether, on a first impressions basis, there is an arbitration agreement between the parties;

- If so, whether, on a first impressions basis, the arbitration agreement covers the disputed debt claim; and

- If so, whether the defendant is abusing the court’s process by raising the dispute or cross-claim.

This test was first set out by the Court of Appeal in AnAn Group (Singapore) Pte Ltd v VTB Bank (Public Joint Stock Co) (2020). The rationale is that parties have bargained for arbitration and should in general be held to that bargain.

This test favours the defendant company that is the subject of the winding up application in the following ways:

- It does not look at the merits of the dispute, even at the level of whether these are triable issues;

- It does not conclusively determine whether the dispute is covered by the arbitration agreement but only does so on a first impressions basis, leaving it to the arbitral tribunal to make the final determination;

- It considers the question of abuse of process without considering the merits of the dispute in relation to the debt; and

- The court will never exercise its procedural discretion to decide itself the question of whether there is a debt.

Not an abuse of process to withdraw an admission in an audit confirmation

In this case, the arbitration clause in all three agreements stated that parties had to “submit all disputes in connection with the contract or the performance of the contract to arbitration”. On a first impressions basis, it was clear that there was an arbitration agreement and, given how wide the clause was, the dispute over the claim fell within its ambit.

The Applicant sought to argue that it was an abuse of process for the Company to raise the dispute. One instance where a party will be seen to be abusing the court’s process by raising a dispute as to the debt is where the party has previously fully admitted the claim as to both liability and quantum. In this case, the Company had previously made an unqualified admission in an audit confirmation as to existence of the debt and as to quantum. However, the Court observed that an audit confirmation is, at law, only an out-of-court admission that may be withdrawn at any time. For example, the party who gave the confirmation may have done so in error and is correcting that mistake. It was therefore not an abuse of process for the Company to have withdrawn its admission.

The Court therefore held that the Applicant could not establish that it was a creditor for the purposes of bringing an application for an order of winding up under section 124 of the IRDA.

Application to be dismissed and not stayed

The Court then had to consider whether the application should be dismissed or whether it should allow the application to be stayed until the dispute was determined by arbitration. The Court held that the application should be dismissed. It explained that it would be a very rare case where a court would allow the application to be stayed. This is because the commencement of a winding up application resulted in very serious legal and commercial consequences for the company involved:

- Under section 130 of the IRDA, any disposition of the company’s property (among other things) is void unless the court otherwise orders. The Court noted that this is the functional equivalent of a freezing order.

- A winding up application must be advertised. The consequence of this is that banks will often withdraw or reduce lines of credit and suppliers will often withdraw credit for future supplies or refuse to do business with the company altogether.

- As soon as a winding up application is presented, every repayment of the company’s debts is subject to potential challenge as an unfair preference. This can make the company’s creditors reluctant to accept repayment directly from the company.

In view of these harsh consequences, it would require exceptional circumstances to justify a stay. Examples of such circumstances would include balance sheet insolvency or the existence of other winding up applications having been made by other creditors.

In this case, not only were there no exceptional circumstances that would justify a stay, the Court was of the view that the Company had bona fide and substantial grounds to dispute the debt. In this regard, the Court noted that the Applicant could show no evidence of delivery of the copper cathodes to the Company. Furthermore, if this were a genuine debt, the Company had not sought to bring a claim to enforce it for six years while it was still under the management of its directors.

What is “just and equitable” to a creditor

Finally, the Court considered whether the Applicant would have been granted an order to wind up the Company if it had succeeded in showing that it was creditor. The Applicant had sought the order to wind up on two grounds: that the Company was unable to pay its debts and that it would be just and equitable to wind up the Company. As regards the ground that the Company was unable to pay its debts, the Court stated that the Company was indeed insolvent as its balance sheet showed that its current liabilities exceeded its current assets. What is of greater interest, however, is the Court’s explanation of how it would deal with the “just and equitable” ground.

The Court explained that when considering the “just and equitable” ground, the factors that a court would consider would be different if the applicant were a member of the company than if the applicant were a creditor:

- Where an applicant for an order of winding up on the “just and equitable” ground is a member of the company, the court will consider whether the shareholder running the company (typically, the majority shareholder) is subjecting the applicant (typically, the minority shareholder) to injustice or inequity in the way it is running the company. This is because shareholders are parties to the company’s constitution and have an interest recognised and protected by law in remedying any injustice or inequity in the way in which parties to the constitution perform their obligations under it.

- The same considerations do not apply, however, to an applicant for an order of winding up on the “just and equitable” ground that is a creditor. A creditor is not a party to the company’s constitution and is not subject to the default principle of majority shareholder rule. Unlike a minority shareholder whose capital is locked in the company subject to majority rule, a creditor can demand repayment of his debt any time after it falls due. A creditor has no interest protected by law in how a solvent company is managed internally. Therefore, for a creditor to be able to rely on the “just and equitable” ground for winding up (instead of the usual ground of being unable to pay its debts), it must be able to show that its interests as a creditor are or are likely to be adversely affected. This may be the case if the company is balance sheet insolvent in a manner that adversely affects a creditor without being cash flow insolvent, or if the company is cash flow insolvent but only if the court looks beyond the period of 12 months.

As the Applicant had not been able to establish that it was a creditor for the purposes of section 124 of the IRDA and had not been able to show exceptional circumstances to stay the application, the Court therefore dismissed the application for an order of winding up.

Conclusion

The case is a useful reminder that parties choosing to provide for arbitration in their agreements should be aware that it will be much harder for the party that will be a potential creditor under that agreement to file for winding up unless it first obtains an arbitral award in its favour. Unless it can meet the higher thresholds imposed for establishing that it is a creditor for the purposes of section 124 of the IRDA, the Court’s advice to commence arbitration proceedings first rather than taking out a winding up application should be borne in mind.