Benefit estimates and quotations

Mistakes are a fact of life, but what are the consequences if, despite the best efforts of trustees, employers and administrators, a member is issued with an incorrect or misleading benefit quotation?

A beneficiary’s entitlement is determined by a scheme’s governing documentation, rather than by any benefit estimate or quotation. However, there can be financial implications for schemes when mistakes are made, particularly where a beneficiary has relied to their detriment on the incorrect information. This may be due to:

- The Pensions Ombudsman (TPO) making an award of compensation for distress and inconvenience as a result of maladministration (or the trustees making an offer to settle a member complaint).

- TPO directing that a member be put in the position that they would have been in if the correct information had been provided.

- TPO concluding that a member has a successful estoppel claim (this is rare).

In this note, we consider some steps that trustees and providers can take to avoid mistakes and, if mistakes do occur, the potential repercussions for a scheme.

Internal controls

There is a statutory requirement that schemes have adequate internal controls in place – namely, systems and arrangements for securing that the scheme is administered and managed in accordance with its rules and legal requirements. There are no set rules for the internal controls a scheme should have: trustees must determine, using a risk-based and proportionate approach, what internal controls are needed to ensure that the scheme is being well managed. In this context, that will include a strategy for good record-keeping, the management of timely and effective retirement processes and the provision of realistic yet robust disclaimers, where members are being given indicative figures rather than a definitive quotation.

Accurate record-keeping

Trustees and administrators have data protection obligations in relation to the processing of personal data, including in relation to data accuracy.

The Pensions Regulator (TPR) also views proper record-keeping as an essential part of good scheme governance, and in recent years has emphasised the importance of data quality. A pension scheme must be administered under the provisions of its governing documentation and the requirements of law. Failing to keep accurate records about members and the existence and nature of their entitlement is inconsistent with that duty. Where member data is not accurate and complete, TPR expects schemes to have a measurable and timely data improvement plan to enable the quality of member data currently held to be improved, and the quality to be maintained in the future.

Good record-keeping is essential for ongoing scheme administration and, in a DB scheme, for any liability management exercise that trustees may choose to undertake. Accurate record‑keeping reduces instances of mistakes in quotations, payments and communications, thereby avoiding the risk of disputes and additional costs to the scheme.

Effective retirement processes

The lead-up to retirement – or other life events, such as redundancy – is a time when members may make life-changing financial decisions which are sometimes irreversible. It is therefore vital that a member’s decision-making process be supported by a scheme’s ability to send the right information at the right time, and to inform members about all of their options. There must be a clear and timely communication process through which accurate information is provided. This is especially true for schemes with multiple benefit structures, where it is important that each period of a member’s service be taken into account.

Proximity to retirement is also a relevant factor in the level of compensation for distress and inconvenience that may be awarded by TPO. TPO’s guidance states that one of the factors for an award of compensation at the level of £2,000 (or above) is where a member is prevented from making informed life decisions at critical times (for example, a decision to retire early or resign from employment that might not have otherwise been taken).

Mr Major (2011 Deputy Pensions Ombudsman decision)

Click here to read more Mr Major (2011 Deputy Pensions Ombudsman decision)Robust qualifications to indicative quotations

As part of having a robust, effective retirement process in place, a scheme should ensure that quotations concerning benefits and transfer values are clear and that they set out the assumptions on which the quotation is based, in addition to stating whether the quotation is an estimate or is guaranteed. This can help to protect the scheme against a finding that the member has suffered financial loss due to reasonable reliance on any incorrect information underlying the quotation.

Mr N (2016 Deputy Pensions Ombudsman decision)

Click here to read more Mr N (2016 Deputy Pensions Ombudsman decision)The risk of getting it wrong

Member reliance

Care should be taken when preparing communications and quotations to ensure that the information provided to members is accurate and complete, particularly as the financial consequences of failing to do so can be significant. If a mistake is made and a complaint is made to TPO, relevant considerations will include whether:

- the information given was wrong;

- the scheme was to blame for the error; and

- it was reasonable for the member to have relied on the information. This can be difficult for the member to establish.

If TPO decides that the information was incorrect, TPO will consider how the error came about and whether it would have been reasonable for the recipient to have noticed it or checked to see if it was correct. If it was reasonable for the recipient to have relied on the incorrect information, TPO will then consider whether any loss has been suffered as a result, and whether the recipient would have acted any differently had they been given the correct information. TPO will also consider whether the individual took reasonable steps to mitigate any loss suffered.

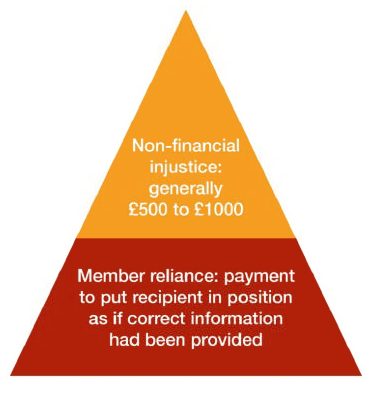

If a member has incurred financial loss as a result of incorrect information on which they reasonably relied, TPO will seek to put the member back into the position in which they would have been, had the correct information been provided. TPO could direct a scheme to make payments to compensate for any financial loss, and this could involve either paying a sum of money directly to the individual, or the scheme increasing the individual’s future pension.

Non-financial injustice

As mentioned previously, TPO may also award a sum for non-financial injustice guidance sets out fixed bands for compensation awards. This covers the distress and inconvenience experienced by the complainant in relation to the maladministration and the complaint process. The distress and inconvenience must be a direct result of the maladministration. The remedy may simply be an apology – a monetary award depends on the facts of the case, but is generally £500 to £1,000.

TPO commonly awards compensation for distress and inconvenience in circumstances where the underlying complaint is not upheld. So in this context, TPO may find that a member has no legal entitlement to the additional (incorrectly stated) benefits, or to compensation for financial loss, but that they are entitled to be compensated for distress and inconvenience.

The more effectively a scheme manages the retirement process and responds to disputes, the less likely it is that such an award would be made. Factors that TPO will consider include whether the error was obvious and could have been remedied much earlier (prior to a TPO complaint), the number of instances of maladministration (and how long it took to correct this), the extent of the inconvenience, and the respondent’s handling of the complaint. TPO is likely to look much more favourably on trustees demonstrating that:

- processes were in place to reduce the risk of issues arising in the retirement process;

- any complaint has been considered thoroughly, without undue delay;

- the scheme corrected any mistakes as soon as they were identified; and

- the scheme has already offered some form of compensation, if appropriate.

To read more about handling disputes as part of an internal dispute resolution procedure, visit www.allenovery.com/IDRP.

To read more about complaints to TPO, visit www.allenovery.com/TPO.

To read more about compensation for distress and inconvenience, visit www.allenovery.com/TPOcompensation.