Private Markets Global Trends 2024

Related people

Headlines in this article

Related news and insights

Publications: 03 April 2024

Chief Information Security Officers and cyber whistleblowing: considerations for PE firms

Publications: 13 March 2024

Surge in EU and UK private antitrust damages actions continues

Publications: 13 March 2024

Abuse of dominance enforcement declines as new forums emerge

Publications: 13 March 2024

Fundraising: selectivity is name of the game

Total private capital fundraising remained stable at USD1.1tn in 2023 and is expected to stay the same in 2024. The industry faces a range of ongoing challenges, including inflation, rising interest rates, higher debt financing costs, volatility of public markets, supply chain disruptions, and labor challenges.

Despite this, fundraising is expected to reach USD1.5tn in 2028, surpassing 2021's record year (Preqin's Future of Alternatives 2028 report). In 2023, North America continued to lead global fundraising, accounting for 44% of the total, while multi-region funds raised 38%. The Asia Pacific and Europe trailed with 10.6% and 6.5%, respectively.

According to PitchBook Data, private capital's fundraising windows continued to increase, reaching an average of 15.8 months in the first half of 2023. This is slightly longer than 2022 (15.4 months) and has increased from 2008 (13.1 months). Fund managers are continuing to revert to their investors with requests to extend the fundraising timeline. We’re also seeing sponsors seeking flexibility in the fund documentation to put in place net asset value (NAV) facilities and perform GP-led transactions and continuation funds.

As a result, investors continue to opt for established managers with a proven track record of navigating diverse market conditions. The top 25 competitors, which secured over a third of the USD506bn of new capital allocated to private equity in the first nine months of 2023, tend to be big, well-known firms that offer multiple strategies to suit different investor profiles. Emerging managers have struggled to compete and are carving out a niche through their specialism.

Private capital firms are seeking capital from new sources, such as high-net-worth individuals, insurers, and non-US investors, including the Middle East, due to investor constraints such as over-allocations, the denominator effect, lack of exits/realisations and a steep decline in fund distributions. We’re seeing managers using various methods to raise capital (e.g. offering a co-invest opportunity or launching a side car vehicle alongside their main fund).

This aligns with what we are seeing in the Middle East region where SWFs, institutional investors and family offices generally rationalising and deepening their relationships with managers whom they know across product lines and geographies. They are selectively re-upping with managers.

We anticipate these trends to continue in 2024, although there are bright spots (e.g. private credit, GP-led secondaries and infrastructure).

Digital disruption: escalating global opportunities for private capital

Disruption from digital technologies such as AI and cloud is set to offer private market players major investment opportunities globally in 2024. For private market players in the Middle East, as their flow of investments into digital technologies continues to grow, they’ll potentially be able to bring these back into the region, opening up further opportunities.

Underpinning this positive scenario is the ongoing headlong expansion in the digital economy worldwide. Recent research by the World Bank has indicated that 70% of new value created over the coming decade will be based on digitally-enabled platform business models.

The technology leading the charge towards digitalisation will be AI in its various forms, including generative AI. According to Statista, the global AI market is set to grow at over 15% compounded annually over the coming six years, more than doubling from around US$306bn in 2024 to US$739 by 2030.

Where the growth is, private capital will follow. It’s estimated that global private investments in AI will reach US$158 billion in 2025, up by 72% from the level in 2022.

Against this background, private capital sponsors are well placed to deploy their deep pools of capital to seize the opportunities emerging globally – not just in AI, but also software, cloud computing and other technologies, as well as digital infrastructure and datacentre deals. All of these investments are recognised as robust, stable, and cash generative. And BlackRock predicts that new opportunities with "favourable deal structures" will continue to emerge across asset classes, providing higher-quality prospects for investors.

For private market players in the Middle East, the possibility of bringing their burgeoning technology investments opportunities back to the region is boosted by the massive potential of new technologies for the region’s economies. AI alone is projected to deliver an uplift of up to US$150 billion to the GCC countries. And industry estimates suggest the Middle East’s digital economy as a whole is growing at around 20% a year, taking it from US$180 billion in 2022 to US$780 billion by 2030.

To maximise the opportunities in the technology space, sponsors will need to pay particular attention to due diligence aspects such as IP ownership, data protection and cybersecurity. They’ll also have to be ready and able to navigate the regulatory frameworks for approvals from the foreign direct investment, antitrust and sanctions, and export control perspectives.

With greater certainty now surrounding the outlook for borrowing costs, and the risk of a deep recession appearing to recede, there is real potential for a pickup in transactions in the first half of 2024. That prospect is fuelling rising expectations that the huge pools of private capital amassed in 2023 could start to translate into actual investments this year – with technology set to be in the forefront.

Infrastructure: hitting the sweet spot?

Private infrastructure struggled to attract capital in 2023, raising a total of only US$47.4bn across 79 fund closes worldwide during the year – a sharp slowdown from the record-breaking US$176bn raised in 2022. However, the enduring appeal of infrastructure remains strong. Despite the dip in traditional markets, infrastructure remains a valuable investment, offering clear potential to act as a hedge against inflation and macroeconomic turbulence.

Energy – especially from low- or no-carbon sources – represented one of the few bright spots for venture capital activity in 2023. The Biden administration’s Infrastructure Investment and Jobs Act and Inflation Reduction Act (IRA) helped companies invest in startups focused on clean energy and renewable energy resources, with the EU responding in kind through its Green Deal. A further factor favouring infrastructure investment in 2023 was the move by many companies to shift their supply chains closer to consumers.

Together, these factors saw demand for infrastructure investments pick up strongly in late 2023. And this support is projected to continue through 2024 in response to climate change and fluctuations in energy prices – with infrastructure beginning the year trading at historically attractive valuations, and the energy transition from fossil fuels to renewables set to maintain the momentum.

The opportunity to invest in energy infrastructure is especially close to home for private capital providers in the Middle East, a region where the traditional focus on fossil fuels is now combined with a renewables revolution. And the region’s investors are superbly placed to help meet the huge future demand for capital to fund the energy transition in emerging markets worldwide.

Interestingly, infrastructure debt has appeared to defy the challenging fundraising environment, and looks set to remain robust in 2024. According to a study by Infrastructure Investor, 30% of respondents plan to increase their allocations to infrastructure debt over the coming year, more than any other infrastructure strategy. This again points to a brighter future for infrastructure assets.

The overall message? The value of infrastructure as an investment cannot be ignored, especially in the current uncertain economic climate. As we move into 2024, it will be fascinating to see how well it continues to perform – and whether it can maintain its position as an attractive asset class. Currently, the omens are good.

Growth and competition in private debt: tailored solutions come to the fore

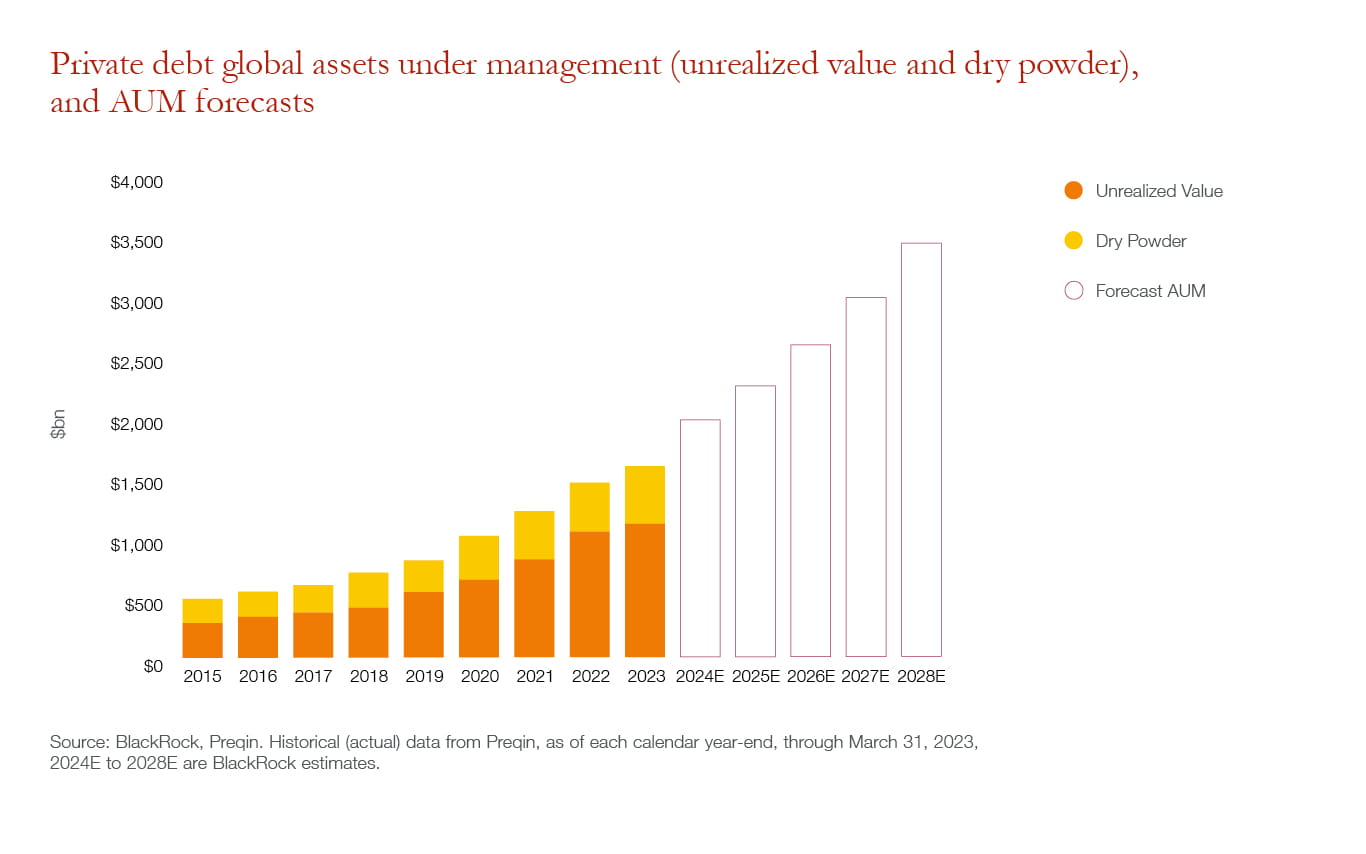

The private debt market is going through a period of strong growth, as the public financing markets undergo structural shifts that favour the asset class. These growth tailwinds underpin BlackRock’s forecast that assets under management will more than double from US$1.7 trillion in 2023 to US$3.5 trillion by year-end 2028.

As we move into 2024, investors are likely to continue favouring private debt, for several reasons. Foremost among these – as Blackrock highlights – are that it can offer better yields relative to risk; some insulation from interest and inflation fluctuations through floating rates; a wide variety of strategies and products to choose from; and relative stability in turbulent markets.

Such attributes are expected to see global investor demand for private debt remain strong in 2024. While Preqin reports that total global fundraising in 2023 – at US$193.4bn from 188 fund closes – fell short of 2022's US$218.5bn, there’s increasing demand from institutional investors such as pension funds, insurance companies and SWFs, which are expected to increase their allocations to the asset class.

This growth comes despite a warning from the Bank of England in December 2023 that global private credit and leveraged lending markets could face "sharp revaluations" if the macroeconomic outlook deteriorates, with higher interest rates potentially making it harder for companies to refinance debt. In issuing this warning, the Bank of England joined several other policymakers and market players who’ve expressed such concerns.

Nevertheless, market confidence and optimism around the outlook for private debt are on the rise – including about the supply of capital from investors in the Middle East. But while the opportunities in private debt are growing, the question remains of how to win out in today’s competitive and complex environment.

In my view, success will require private debt managers to differentiate themselves in several ways – including by offering more tailored solutions; focusing on specific sectors, geographies, strategies and borrowers; and applying strong origination and underwriting capabilities, robust portfolio management, and close alignment of interests with investors and borrowers.

Achieving these points of differentiation will involve a corresponding change in fund strategy. Direct lending was the most popular approach in 2023 – but, going forward, private debt managers will need to seek opportunities in emerging markets, niche sectors and innovative structures, such as hybrid structures combining elements of equity and debt. From an investor perspective, there’s also growing interest in other segments such as special situations, mezzanine debt, real estate debt, infrastructure debt and venture capital debt.

Looking at private debt globally, the US and Europe remain the regions that are most favoured – and therefore offer the biggest opportunities. So they will be the main focus for the increasing growth and competition anticipated in some private debt asset classes in 2024.

Asset manager consolidation: accelerating M&A is reshaping the landscape – and driving diversification

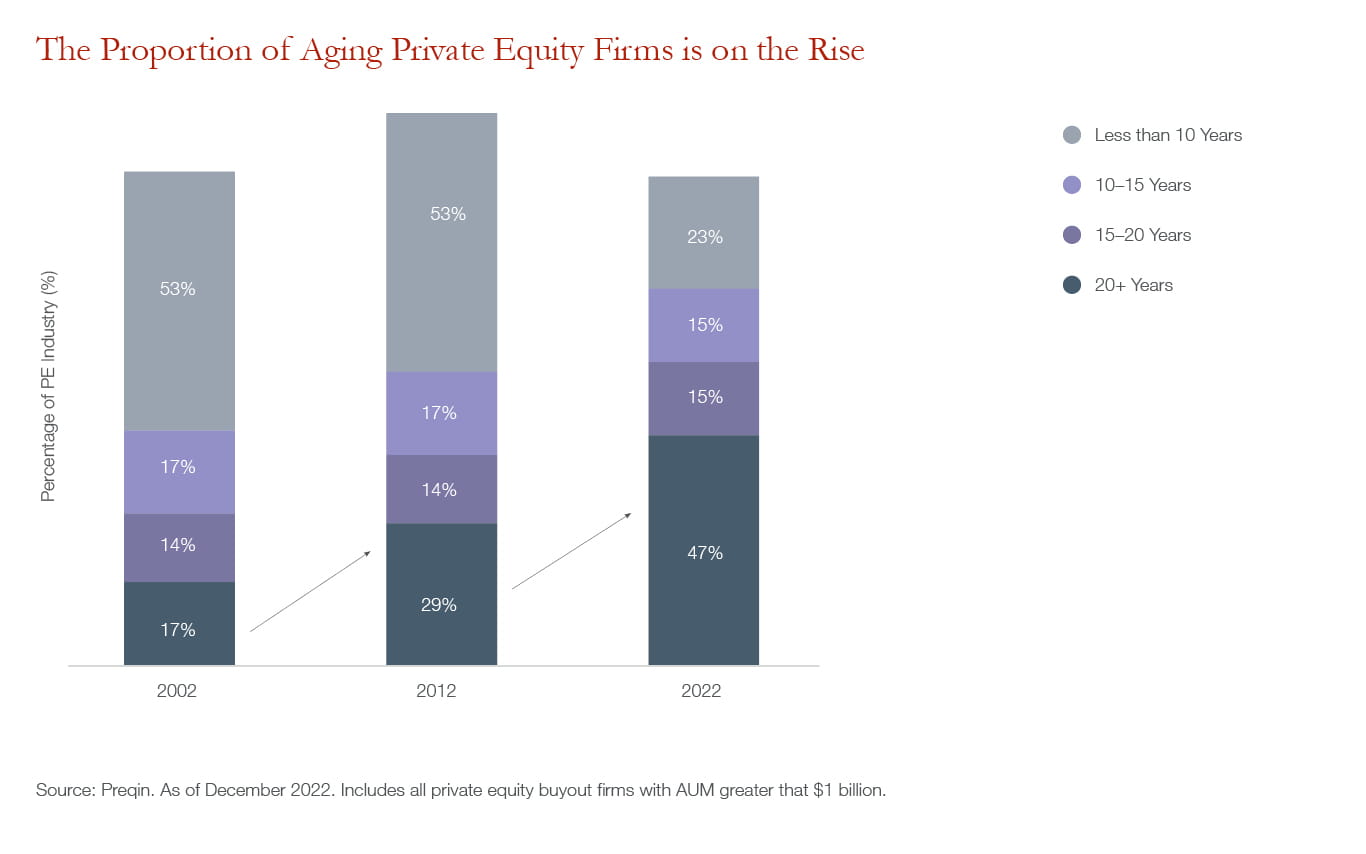

With fundraising becoming even more concentrated in the biggest funds, PwC has estimated that as many as 16% of existing asset and wealth managers will either no longer be active or be bought up by bigger groups by 2027. Additionally, Partners Group chief executive David Layton has forecast that the number of managers will shrink from the current 11,000 or so participants to as few as 100 over the next decade.

As such projections underline, a major reshaping of the asset management industry globally is underway. And it’s a process that has much further to run. The pace of M&A deals between sponsors is accelerating, with research published by GSAM in August 2023 finding that of 116 strategic deals completed by the 50 largest GPs in the decade through 2022, nearly 40% took place in the past two years.

This accelerating consolidation is seeing market participants change their strategy. The largest sponsors have diversified their offerings to capture different opportunities in the market, expand into new geographies, access greater fee-related income streams and tap different types of investors. We’re seeing these trends emerge across private credit, infrastructure and mid-market strategies. Other sponsors looking to follow suit will likely need to raise capital to do so.

Meanwhile, the proliferation of sponsors and funds in recent years means the number of potential targets for M&A deals has never been higher. With many established sponsors at a critical juncture in their journey – GSAM estimates that nearly half of GP firms that are 20-35 years old have yet to initiate a succession plan – pursuing strategic alternatives may be necessary in many cases.

As we move further into 2024, we anticipate that consolidation among asset managers will continue, reflecting investors’ preference for selecting larger fund managers. The long-term effect? To create an industry consisting of fewer, bigger and more diversified players.