The SEC adopts amendments to beneficial ownership reporting requirements

Related people

Headlines in this article

Related news and insights

Publications: 05 April 2024

National Security Division Announces New Self-Disclosure Policy in M&A Transactions

News: 01 April 2024

Publications: 01 April 2024

Publications: 20 March 2024

Allen & Overy’s Nicole Daley on the rebound in M&A activity in the pharma industry

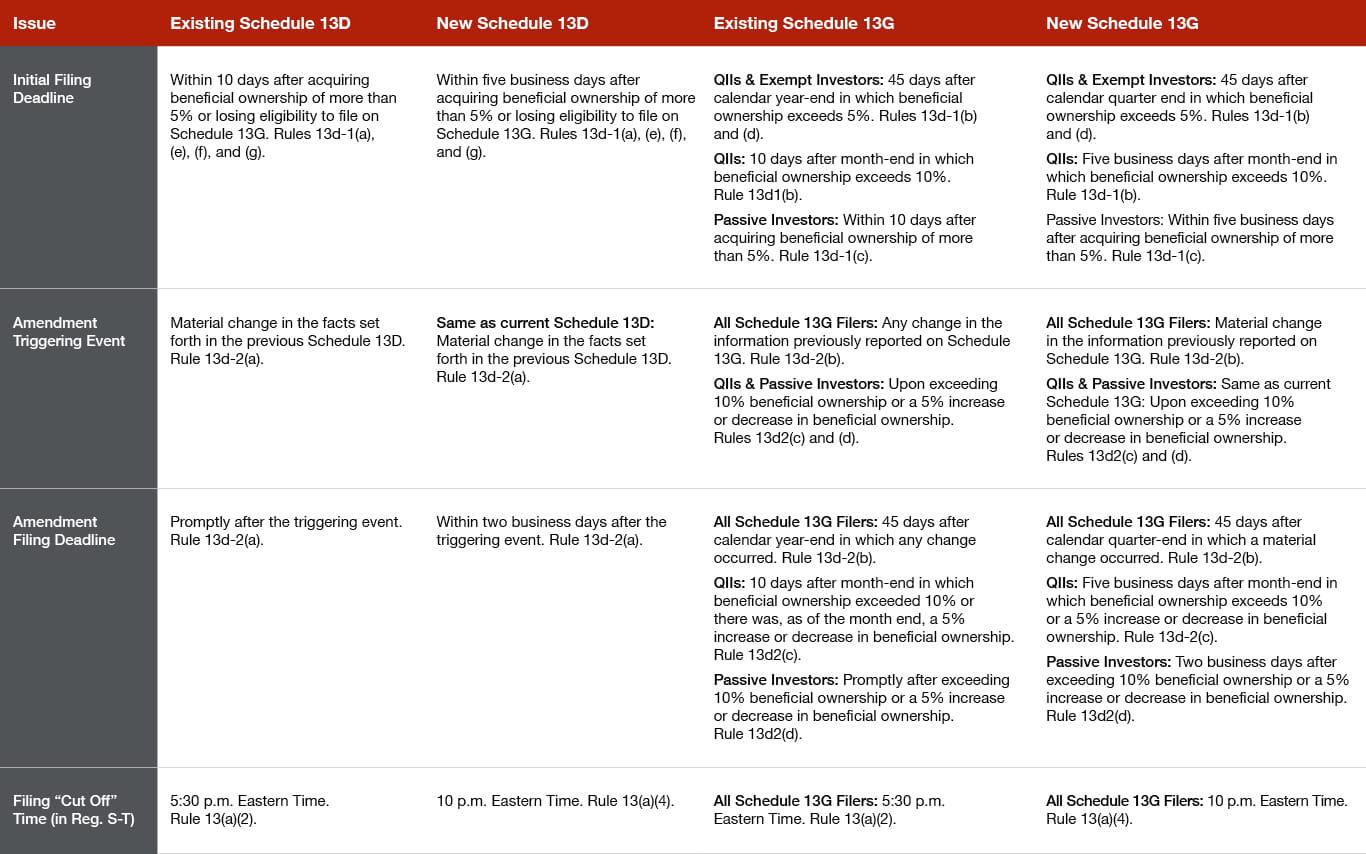

A summary of changes to Schedule 13D/G reporting.

On October 11, 2023, the U.S. Securities and Exchange Commission (the SEC) adopted its final rule (the Final Rule) amending certain beneficial ownership reporting requirements under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934 (the Exchange Act).

The Final Rule primarily shortens filing deadlines, clarifies Schedule 13D disclosure requirements for cash-settled derivatives and establishes data formatting requirements for Schedules 13D and 13G. The adopting release also provides guidance regarding activity that may result in “group” status. Schedule 13D filers will need to comply with the Final Rule when it goes into effect 90 days after publication in the Federal Register (expected to be mid-to-late January 2024). Compliance with the revised Schedule 13G filing deadlines will be required beginning on September 30, 2024, while compliance with a new requirement for filing of Schedules 13D and 13G using the SEC’s structured, machine-readable data language will be required starting on December 18, 2024.

Background on Schedule 13 Reporting

Sections 13(d) and 13(g) of the Exchange Act and Regulation 13D-G adopted by the SEC thereunder require significant shareholders of public companies to provide the public markets with information about changes in their beneficial ownership1 of registered voting equity securities and any plans they may have to change or influence the control or management of the issuer.

A person who acquires beneficial ownership of more than 5% of a class of registered voting equity securities must file a report with the SEC on Schedule 13D, which requires detailed disclosure of a wide range of information, including information as to the identity of the filing person and the purpose of the acquisition. A filer must amend its Schedule 13D promptly where there is a material change in the facts that have been disclosed, including a 1% or greater change in its ownership of the class of securities and any change in previously disclosed plans or intentions with respect to the control or management of the issuer. Investors that have acquired securities without the purpose or effect of changing or influencing control of the issuer and that satisfy certain other conditions may qualify to file a short form report on Schedule 13G instead of filing a Schedule 13D.

The SEC proposed the latest set of amendments to these rules and invited comments in March 2022,2 and it re-opened the comment period in May 2023.3

Shortened Filing Deadlines

As described in the table below, under the Final Rule, shareholders who report on Schedule 13D will be required to file within five business days of their acquisition of more than 5% of a class of registered voting equity securities, and they must file amendments within two business days after a material change occurs. The day-count commences on the first business day after the date of the relevant acquisition or disposition. Under the existing rule, a shareholder is required to file an initial Schedule 13D within 10 calendar days after becoming a beneficial owner of more than 5% of the relevant class of securities, and to file amendments “promptly.”

An investor who qualifies to report on short-form Schedule 13G based on its status as a qualified institutional investor (QII) (as defined under Rule 13d-1) or an exempt investor (a holder of more than 5% of a class of equity securities at the end of a calendar year, but who has not made any “acquisition” subject to Section 13(d)), must file its initial Schedule 13G within 45 days after the end of the calendar quarter in which it became a beneficial owner of more than 5% of the class of securities. Currently, such investors have until 45 days after the end of the relevant calendar year to file. QIIs will be required to file amendments to a Schedule 13G within five business days after the end of the month in which their beneficial ownership first exceeds 10% (rather than the currently required 10 calendar days) or their beneficial ownership increased or decreased by 5%.

Under the Final Rule, an investor who qualifies to report on Schedule 13G based on its status as a passive investor (under Rule 13d-1(c)) must file its initial Schedule 13G within five business days (rather than 10 calendar days) of acquiring more than 5% beneficial ownership and must file amendments within two business days after its beneficial ownership exceeds 10% of the class (existing Rule 13d-2(d) requires “prompt” filing).

Amendments to a Schedule 13G will be required only if a “material change” occurs (rather than “any change”), but within 45 days after the end of the calendar quarter in which the change occurred, rather than 45 days after the end of the calendar year as currently required.

In addition, under the Final Rule, if an investor becomes ineligible to report on Schedule 13G, it must file a Schedule 13D within five business days of the event that causes ineligibility. This period is currently 10 calendar days.

EDGAR Cut-Off and Data Formatting Requirements

The Final Rule effectively extends the deadline for electronically filing through the SEC’s EDGAR filing system from 5:30 p.m. to 10:00 p.m, Eastern Time, on any given business day.

The Final Rule will also require all disclosures, including quantitative disclosures, textual narratives, and identification checkboxes, on Schedules 13D and 13G to use the SEC’s approved XML-based language. Investors who have historically relied on more basic platforms for filing reports on Schedule 13D/G may find that they are no longer adequate.

Group formation

Under Sections 13(d)(3) and 13(g)(3) of the Exchange Act, parties acting as a “group” for the purpose of acquiring, holding or disposing of securities of an issuer are treated as a single “person” for purposes of Section 13(d). In the adopting release for the Final Rule, the SEC clarifies its view that the determination that two or more persons are acting as a group does not require an “agreement” between them and that, depending on the particular facts and circumstances, concerted actions by two or more persons for the purpose of acquiring, holding or disposing of registered voting equity securities of an issuer are sufficient to constitute the formation of a group. This guidance is consistent with the SEC’s long-held positions, including in administrative proceedings.4

The SEC had proposed, but did not adopt, an amendment that would have specified certain circumstances under which two or more persons could coordinate and consult with one another, and even engage with an issuer, without being deemed to represent a “group”.

The SEC had also proposed, but did not adopt, a rule expressly stating that if a person disclosed its intent to file a Schedule 13D to another person with the purpose of causing that other person to acquire securities (and such person did then in fact acquire), then those persons would be deemed to have formed a “group.” Despite the SEC’s decision not to adopt this proposed rule change, the SEC made it clear that it would consider such actions to constitute formation of a group for 13D purposes under the current rules.

Derivatives: cash settlement, new disclosure

The Final Rule amends Item 6 of Schedule 13D to eliminate any doubt that a Schedule 13D filer must disclose any cash-settled options or security based swaps referencing a covered class of securities (unless originated by, or offered or sold by, the issuer).

The SEC had proposed, but did not adopt, an amendment that would have deemed holders of certain cash-settled derivative securities (other than security-based swaps) as beneficial owners of the referenced class of securities, even if they did not have the right to vote or dispose of the underlying shares. Instead, the adopting release cites existing guidance regarding Rule 13d-3 to emphasize that an investor’s use of a cash-settled derivative security could potentially result in the person beneficially owning the underlying reference equity securities (e.g., because the transaction structure confers the right to vote or dispose shares, or is part of a plan or scheme to evade the reporting requirements). This clarification augments the SEC’s 2011 guidance regarding the applicability of Rule 13d-3 to security-based swaps.5

The SEC also did not adopt other proposed rules that would have allowed certain persons to transact in derivative securities in the ordinary course of business without the concern that they had formed a group.