What is the Lehman Brothers Waterfall I litigation all about?

Related people

Headlines in this article

Related news and insights

Blog Post: 04 April 2024

EU court’s judgment sheds new light on how the ECB should apply national administrative measures

Publications: 03 April 2024

Publications: 03 April 2024

Publications: 02 April 2024

On 17 May 2017 the Supreme Court handed down an important judgment in the poetically named "Waterfall" litigation involving Lehman Brothers International (Europe) (in administration) – or "LBIE" for short.

When LBIE was placed into administration back in September 2008, no-one could have predicted that the administrators would be able to pay the principal claims of LBIE’s creditors in full and be sitting on a surplus of approximately £8bn. It seems that LBIE was only ever cash flow, and not balance sheet, insolvent. Various parties are now fighting over the £8bn surplus, given the substantial sums involved. In the case of Waterfall I, the litigation went to the highest court in England and Waterfall II looks set to do the same.

So, what is the Waterfall I litigation all about? In this short video, I share some views on the recent decision of the Supreme Court in Waterfall I and the impact it might have on the LBIE administration. At first instance, A&O acted for Lydian, an unsecured creditor that was arguing in favour of the currency conversion claims and we won this issue at this stage. Ironically though, Lydian was owned by one of the funds that bought the sub-debt through the Wentworth joint venture and so another unsecured creditor took over the arguments on appeal.

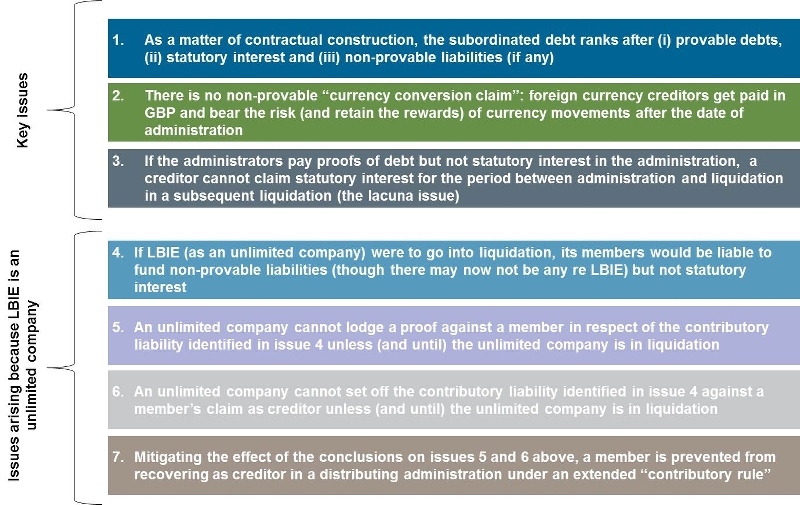

For a brief summary of all 7 issues considered by the Supreme Court, please see below. It should be noted that all amounts referred to in the video are estimates: the statutory interest claims, in particular, could be significantly impacted by the issues that remain in play in Waterfall II.

Watch the video that explains what Lehman Brothers Waterfall I litigation is all about.

The Supreme Court's decision in a snapshot - 7 issues