Traditional retail faces fight for survival

Related people

Headlines in this article

Related news and insights

Publications: 04 April 2024

Integrating Sustainability: Luxembourg's Legal Advancements with the CSRD

News: 27 March 2024

Allen & Overy advises on the sale of majority stake in GasNet

Publications: 26 March 2024

News: 21 March 2024

Allen & Overy advises arrangers on takeover of Encavis by KKR

Few sectors have been harder hit by the Covid-19 coronavirus crisis than retail. With the exception of pure online grocery retailers, there have been almost no winners from the pandemic.

Traditional retailers have been driven to close stores and furlough staff, while desperately trying to preserve cash. Big names have been forced into administration and those with a poor online presence (or none at all) face a fight for survival.

Big bricks and mortar supermarkets have seen footfall drop dramatically due to social distancing.

Even online clothing retailers have seen declining sales, with locked-down consumers losing their usual appetite for fast fashion.

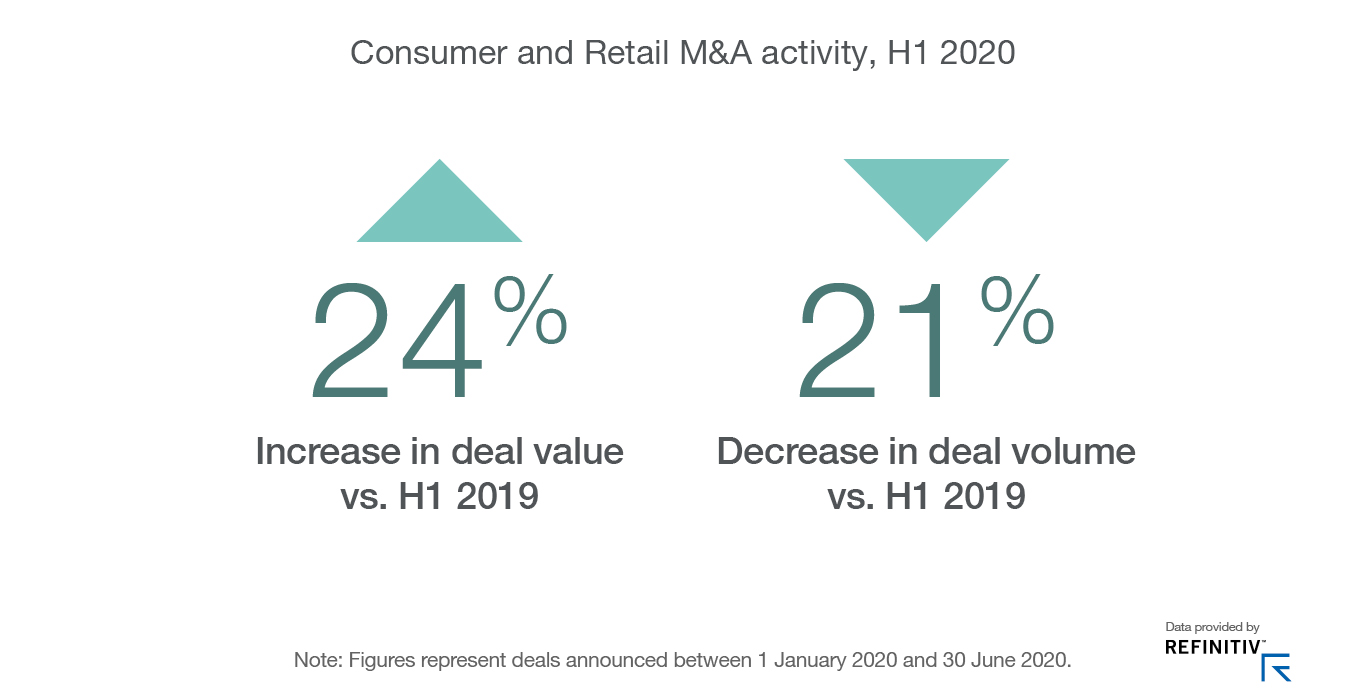

In this febrile environment, it is almost impossible to value assets and the impact on transactions has been profound as the crisis escalated. Despite this, the numbers tell an interesting story:

- H1 deal value increased by 24%, while volume fell by 21%

- Q2 transaction value increased by 29%

The increase in value is widely driven by the USD81billion Unilever unification transaction, which has boosted the numbers during this uncertain period.

Retail’s rapid transition

There will be no early let up.

With recession looming in the autumn, many consumers are likely to rein in spending or divert it to home and healthcare products. The impact on spending will grow as furloughing ends and unemployment climbs.

In economies like Germany where shops have already re-opened, consumers seem to be staying away, with safety measures undermining the shopping experience they once enjoyed.

Other likely trends include:

- faster decline of high streets, with retailers closing stores to focus on high-profile outlets where rents have been renegotiated

- a move by supermarkets away from convenience stores and back to big edge-of-town sites, where shoppers can visit less frequently but get wider choice under one roof

- government measures to protect food security and supply chains

With recession looming in the autumn, many consumers are likely to rein in spending or divert it to home and healthcare products.

Full steam ahead for digitalisation

The crisis has sped up the digital transformation of retail by some five years, and this is where deal activity is likely to grow fastest, including:

- collaborations between tech delivery platforms and bricks and mortar retailers

- investment in key technologies such as AI, the Internet of Things and drones

- established brands teaming up with disruptive partners to communicate environmental and social values to consumers online and through social media

- distressed deals, with financial buyers seeking buy and build opportunities, pairing struggling brands with delivery platforms to give them new life online

Download report

Read our latest report, Global M&A outlook: Adjusting to adversity.

Download PDF