Pipeline gaps and digital will drive life sciences deals

Related people

Headlines in this article

Related news and insights

Publications: 04 April 2024

Publications: 04 April 2024

Integrating Sustainability: Luxembourg's Legal Advancements with the CSRD

Blog Post: 03 April 2024

European Commission opens unprecedented abuse of dominance probe in animal medicines sector

Often seen as a safe haven sector in times of crisis, the life sciences have not only been centre stage during the Covid-19 coronavirus crisis but are riding it out well.

Life sciences share prices are back to 2019 levels, having fallen sharply at the outset of the pandemic.

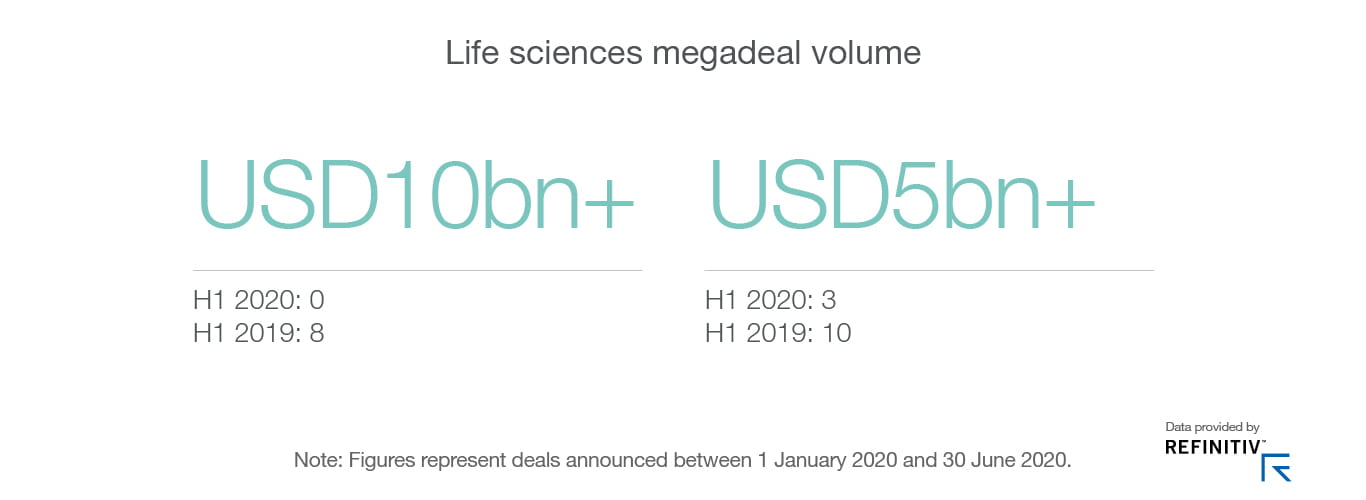

However, transaction value and volume have gone into reverse, falling by 79% and 15%, respectively. Some key deals have been delayed, including the planned merger of Pfizer and Mylan.

The slowdown in deals looks particularly stark coming after a very strong 2019, where the USD78 billion Bristol Myers Squib acquisition of Celgene became the ninth largest deal on record.

R&D badly hit by the pandemic

The pandemic has seen many life sciences companies go flat out to develop anti-viral tests and vaccines. In wider consumer health, they have focused on safety equipment, disinfectants and hand gels.

With key research staff redirected to this work, other R&D programmes have been badly hit and, in an effort to protect participants from the Covid-19 coronavirus, clinical trials are at a near standstill.

Companies could therefore face major gaps in their R&D pipelines in future, disrupting traditional funding models. Filling the gaps could involve:

- M&A

- consolidation deals

- strategic IP collaborations and portfolio reshuffles, driven by cost cutting

With key research staff redirected to this work, other R&D programmes have been badly hit and, in an effort to protect participants from the virus, clinical trials are at a near standstill.

Digital transformation accelerates

The lockdown has placed a huge premium on technologies that allow healthcare professionals and their patients to interact remotely. This steep rise in adoption seems unlikely to be reversed, even once lockdown measures are eased globally. We also expect increased use of technology to optimise processes and reduce costs. Diagnostics have been one of the most active areas, and we expect to see rapid adoption of key technologies, such as:

- AI/Big Data, not least in a bid to speed up drug discovery

- 3D printing

- telemedicine

Partnerships between pharma companies and non-traditional industry players like big tech will be achieved through M&A or other forms of alliance, with the pandemic speeding up this trend.

Digital transformation will extend this deal activity for some time. However, we may see more collaborations rather than cash-driven transactions due to lack of funding.

In the shorter term, we could also see a spike in disputes over agreements done in haste during the crisis, with companies testing Force Majeure and material adverse change clauses.

Download report

Read our latest report, Global M&A outlook: Adjusting to adversity.

Download PDF