Gun-jumping and breaching merger remedies generate heavy sanctions

Related people

Headlines in this article

Related news and insights

Publications: 21 March 2024

Publications: 21 March 2024

Publications: 21 March 2024

Publications: 21 March 2024

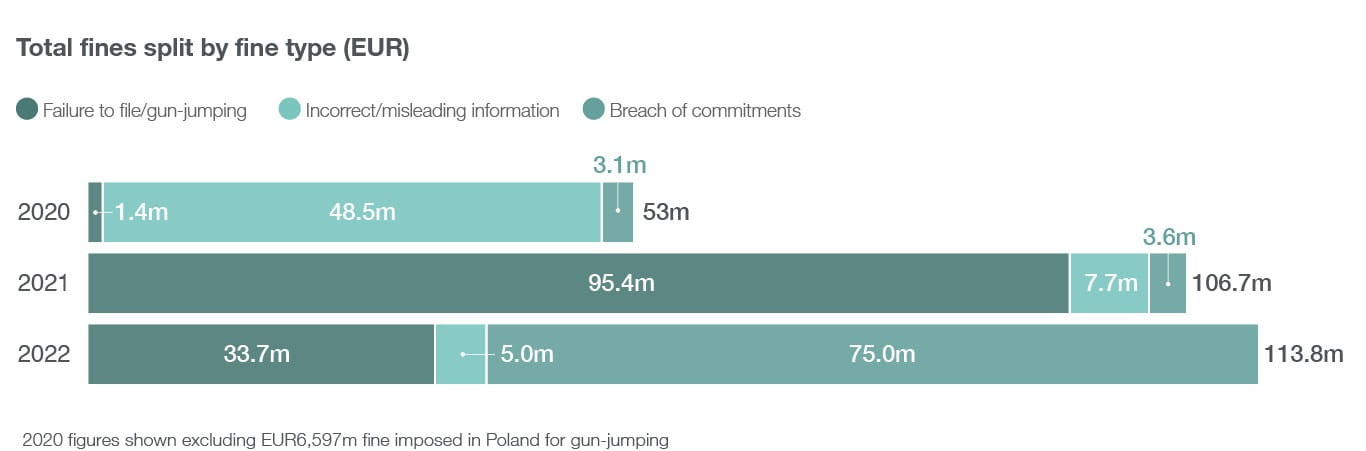

Antitrust authorities continued their aggressive campaign against procedural merger control infringements in 2022. A total of EUR113.8m fines were imposed in 70 decisions across the jurisdictions surveyed.

This is an increase of 7% from 2021. China was once again the most prolific enforcer, with State Administration for Market Regulation (SAMR) gun-jumping decisions making up nearly half of the overall volume. Elsewhere, breach of merger remedies was an enforcement priority, attracting the highest individual fines of the year.

China remains the headline enforcer

Continuing a trend that goes back five years, in 2022 SAMR adopted the highest number of procedural enforcement decisions of any of the authorities surveyed. It imposed 32 separate fines for gun-jumping.

However, this is a material decrease compared to the 107 decisions reached in 2021. The drop suggests that SAMR may be nearing the end of its long-running campaign to investigate past gun-jumping cases in the tech sector, which have made up the vast majority of decisions in the past two years.

While the number of gun-jumping decisions has been high in China in recent years, the level of fines imposed has not. This is likely to change going forward.

Important new rules took effect in August, significantly increasing the maximum fine for gun-jumping. For deals raising no antitrust concerns, fines are capped at RMB5m (EUR700,000) – ten times the previous level. Where a transaction has, or may have, the effect of restricting competition, penalties can be as high as 10% of turnover. SAMR could even increase those fines by two to five times if it finds the violation is extremely serious.

EC gears up for major gun-jumping fine

The European Commission (EC) imposed no fines for procedural enforcement in 2022.

However, the authority took important steps in a landmark investigation into Illumina and GRAIL. It issued a statement of objections, alleging that the parties jumped the gun when they completed their deal (later blocked by the EC) while the EC’s phase 2 investigation was ongoing. It is rumoured that the EC is preparing to impose maximum possible fines, which would amount to 10% of global turnover.

The EC also secured a win when the General Court upheld its decision to fine Canon EUR28m for a “warehousing” structure. The Court confirmed that actions that contribute to a change of control over the target – and even those that do not necessarily constitute a change of control itself – are enough to constitute a breach of EU merger control rules.

This is a wide test, and one that may encourage the EC to challenge further multi-step deals. Parties should therefore be cautious where an initial transaction step could trigger an EU notification requirement.

French authority shows breaching merger remedies comes at a price

Merging parties received a stark reminder from the French Competition Authority (FCA) that complying with remedy packages is vital. The FCA fined Altice EUR75m for failing to implement commitments entered into in relation to its acquisition of SFR in 2014.

The authority had already fined Altice EUR40m in 2017 for initial non-compliance with the commitments. It also imposed several injunctions setting a schedule for implementation of the commitments, some of which had penalty payments attached. Last year, the FCA found that Altice did not properly comply with the injunctions within the time limits set. The additional fine settles the penalty payments and sanctions Altice for non-compliance with the 2017 injunctions.

UK CMA continues to police “hold separate” orders

After imposing a record fine on Meta in 2021, the Competition and Markets Authority (CMA) continued to scrutinise merging parties’ compliance with initial enforcement (“hold separate”) orders (IEOs). The CMA typically puts IEOs in place to prevent integration before it reaches a final decision. They are standard in completed deals.

In 2022, the CMA imposed a further GBP1.5m (EUR1.8m) fine on Meta in relation to its (now prohibited) acquisition of Giphy, this time for allegedly breaching the terms of the IEO by “failing to notify the CMA of key staff resigning and departing the employment of Meta.”

The authority also sanctioned JD Sports and Footasylum nearly GBP4.7m (EUR5.5m) after their CEOs met and exchanged commercially sensitive information in violation of an IEO and the parties failed to alert the CMA of the breach.

These cases evidence the wide-ranging nature of the obligations that the CMA can impose on merging parties, which can stretch across all activities of the acquirer and not just its UK operations.

The CMA’s powers to sanction breaches of merger remedies and failure to respond to information requests are currently much weaker than those for IEO infringements (maximum fines of GBP30,000 (approx. EUR35,000) compared to up to 5% of global turnover). This is set to change, with the UK government planning a 5% turnover cap for all procedural merger control breaches. Even heavier procedural fines in the UK are therefore only a matter of time.

No sign that authorities’ appetite to pursue procedural breaches is waning

In several other jurisdictions, we saw increased powers or new initiatives to deal with procedural infringements.

The Irish Competition and Consumer Protection Commission (CCPC), for example, will soon get powers enabling it to bring summary proceedings for failure to file a notifiable transaction and for failure to comply with CCPC information requirements, rather than having to rely on the Director for Public Prosecutions to initiate them.. In Hungary, maximum fines for gun-jumping increased on 1 February 2023.

Some authorities are even contemplating novel ways to detect more infringements. Brazil’s antitrust authority is reportedly considering an online tool to expose potential gun-jumping. No details are available yet, but if implemented successfully it could prompt other jurisdictions to develop a similar tool.