Future of the in-house legal function: Why is now the time for transformational change?

Headlines in this article

Related news and insights

News: 21 December 2023

News: 13 January 2023

Publications: 20 July 2021

Publications: 09 December 2020

The Evolution of the Lawyer – using technology to assist clients

The traditional operating model of the in-house legal function is coming under increasing scrutiny. Cost pressures, regulatory overload and innovation-based opportunities to enhance operational efficiency are among the forces disrupting the way in-house lawyers deliver their services.

In this collection of bite-sized perspectives, Jonathan Brayne, chairman of Fuse, Allen & Overy's tech innovation space, explains why internal legal departments face a decade of transformational change, and how General Counsel and heads of legal operations should respond.

This series of short perspectives about the future of the in-house legal function, the digitalisation of its operating model and the impact of innovation-based change on the way legal services are delivered is being published first on LinkedIn and is written principally to answer some of the questions that I am often asked by General Counsel and heads of legal operations. This series will be regularly updated with new perspectives over the coming weeks.

The issues and insights that I have addressed below are drawn from two in-depth reports that we have published over the past few months:

- The future of the in-house legal function

- An Innovation playbook for the 'future-fit' legal function

1: In-house legal transformation – why now?

When I talk to in-house lawyers, I am often asked: why is now the moment for transformational change, when it so obviously hasn't happened up to now?

My answer is that in the last two or three years, certain 'pull' factors have come into play that are accelerating change in a way the previously existing 'push' factors did not.

We are all familiar with the 'push' factors: things like cost pressures, regulatory overload, the challenges of managing a legal function at scale and across numerous countries. But these push factors have so far only resulted in incremental change.

What is new are the 'pull' factors that are causing a shift towards transformational change. Among these pull factors, the most significant, in my view, are:

- advances in technology now make all manner of approaches to legal service delivery possible which previously were not

- the explosion in the range, breadth and depth of services offered by legal service providers has radically extended the choices available to in-house legal functions

- the entry of a new generation of young lawyers into the workplace with very different expectations about what tools and working styles are appropriate.

2: Legal function transformation – three trends

The first thing that happened to me when Allen & Overy issued our paper 'The future of the in-house legal function' was that a journalist asked: "Can you summarise in one minute what form the transformation of the legal function that the paper talks about will take?"

….so here goes…..

It will follow three broad trends:

- legal functions will devote much more effort to performing their routine, business-as-usual work in more efficient ways so as to free their often senior, highly trained lawyers up to perform work which is valued more by their business clients;

- legal functions will concentrate on risk anticipation and prevention in order to reduce the amount of time and effort wasted over recent years on risk remediation (ie on litigation, arbitration and regulatory investigations); and

- the response of legal functions to large-scale change and compliance programmes of the kind that have consumed time and money in recent years (for example related to Brexit, anti-money laundering, IR35 and data privacy rules such as GDPR – and, in the financial industry, MiFID, initial and variation margin for derivatives and IBOR transition) will become much more sophisticated.

All three trends will be powered by some combination of technology, process and creative resourcing.

But to be clear, what I will be saying about these trends is not prescriptive, nor is it a recommended or target operating model. There is no right or wrong approach. Each legal function will shape its own response. A large legal function will adopt a different approach from a small one; an energy company's response will be different from that of a technology company.

3: Technology platforms will transform routine in-house transaction support work

Is there an internal legal function out there that does not spend a substantial proportion of its time on everyday, high-volume transaction support? And as we do that work, don't we all sometimes suspect, even if we don't say it, that there must be a better way of doing this that doesn't tie up so much of our time?

There is. Legal functions will invest time and effort in streamlining that business support work to free up in-house lawyers for value-added work.

They will template a wide range of counterparty documentation which standardises not only their organisation’s opening position in a contractual negotiation, but also the ‘playbook’ of fall-back and negotiated provisions they are prepared to accept .

They will adopt technology platforms that allow them to embed those 'Legal approved' templates and playbooks into document automation processes.

The platforms will allow the draft contract to be shared with, reviewed, commented on and approved by colleagues; shared and negotiated with counterparties; and ultimately e-signed.

Deal processes like collecting and approving conditions precedent or reviewing data rooms and preparing due diligence reports will be streamlined through the platform; real time status reporting on these processes and on deal progress will become feasible.

And because all this happens on platform, it will generate great data about the contract, which can be queried at both a contract and portfolio level. This 'platformisation' will allow legal functions to know for the first time, at a granular level, the contents – and creation process – of their contract and deal portfolios.

Much of the technology to achieve all this exists today, though it will often need to be configured to the particular requirements of an organisation. What remains is for these multiple separate technologies to be combined into integrated end-to-end platforms.

4: In-house legal functions can empower business colleagues through self-service contracting

In all the conversations I have with clients about their innovation activities, the words that often intrigue them most are 'self-serve'.

The pressure on in-house legal functions to improve client experience, reduce cost and enhance quality and speed to market will make them ever more imaginative about how to empower their business colleagues (ie internal clients) to act – and transact – on behalf of their organisation without requiring the constant intervention of in- house lawyers.

Self-serve is the tool for this and in my experience it is increasingly commonly used. In perspective 3 I talked about moving high-volume transactions onto deal platforms. Those platforms can be made available to business colleagues, who will be able to generate, negotiate, amend and sign contracts on the platforms without intervention by the legal function.

Integration with sales technologies such as Salesforce can make the contract process flow seamlessly from the conclusion of a sale.

In addition, the contract data captured on the platform will facilitate contract monitoring and performance, risk management and opportunity identification.

But the templates, playbooks and processes, and therefore the outcomes, will have been designed, quality assured and kept up-to-date by the legal function so that the contracting process will be occurring within a ‘safe space’ and accepted risk parameters.

Clients still worry that business colleagues will go 'off piste' and negotiate rogue contractual provisions that are not approved by the legal function. But these platforms can control that. You can, for example, lock the contract down if a provision is introduced which is not in the playbook. Alternatively, for a fallback provision that you want to use only in exceptional circumstances, you can introduce a workflow requirement that allows the document to be released only when an approval (eg from the legal or finance function) has been given through the platform.

You can see why self-serve contracting is an intriguing prospect: an improved, friction-less client experience that frees up in-house lawyers to spend more time on value-added activities.

5: Self-serve for routine legal queries is a win-win for in-house legal functions and their clients

Earlier this week I spent what turned out to be quality time on the helpline of one of the world's great computer hardware companies. A voice asked me my name, what product I was calling about, why I was calling and so on. I answered as I would to you. With minimal fuss, I then left the world of chatbots and found myself talking to a human about the detail of my problem.

I thought to myself afterwards: why not in the legal domain?

Chatbot and logic technologies allow business colleagues to find answers to frequently asked legal questions with a consistent user experience on laptops, tablets and mobile phones, without having to track down and engage with the in-house legal function expert.

Already today, logic, or decision tree, technologies are being used to answer routine questions by obtaining from the user, in writing on screen, the underlying facts in a structured way through pre-programmed diagnostic questions. The legal function embeds logic behind those facts to produce automated, written answers.

Two examples:

- a major supermarket chain has created an application to deal with the high number of 'slip and trip' claims made by its customers. The user enters the facts of each claim in response to a questionnaire and the tacit knowledge of the legal experts has been encoded into legal logic that automatically produces a recommendation to settle or fight the claim and an indication of the correct settlement amount.

- aosphere, Allen & Overy's affiliated provider of cross-border online data*, offers a product – Eligible Collateral Checker – that allows derivatives market participants, by inputting the facts of each uncleared derivatives relationship, to establish through the legal logic embedded behind those data, what types of collateral are eligible to be posted and received.

These examples are based on structured questionnaires. Chatbot technologies that allow a person to pose a free-form question in natural language and receive a natural language answer are still relatively immature in the legal space. However, it is realistic to think that chatbots could be used widely, for example, to triage incoming legal support requests and direct them to the correct person within the in-house legal function – or to the policy document or contract template that contains the answer.

A global financial institution client has used a chatbot to triage queries from business colleagues about the rules relating to cross border transfer of personal data. At Allen & Overy, we have piloted a chatbot to answer routine HR service queries - and the move from there to legal queries is altogether feasible.

We are, after all, used to this experience when we call a retail customer support line.

6: Use of automated transaction platforms by in-house legal functions

Most in-house lawyers I talk to are intrigued by the idea (see perspectives 3 and 4) that a routine transaction process can be templated and playbooked onto a tech platform, and made available to business colleagues to self-serve.

But reservations often remain about the risks of allowing the contracting process to occur entirely without direct, hands-on legal function involvement. Some transaction types may be sufficiently complex or high risk that the legal function chooses to operate the platform and run the contracting process itself – keeping tight control over it.

There are now many such examples – such as in the entertainment, food and beverage and financial services industries.

Other, simpler transactions may lend themselves to being 'in-sourced' to a service centre that is established by a legal function in a lower cost jurisdiction and becomes the operator of the transaction platform. The mainstream legal function can be the escalation point for issues that cannot be resolved in the service centre, but the routine aspects of the work are conducted at a lower cost. Again, many examples exist in-house – and Allen & Overy pioneered this approach back in 2012 with the establishment of our legal services centre in Northern Ireland.

This approach has the merit of retaining the entire process within the organisation and under the direct control of the legal function, whilst taking advantage of lower cost people and space. And it frees up often highly experienced in-house lawyers to concentrate on more value-added work. But it requires the legal function to manage a remote service centre efficiently to deliver the desired outcomes, which is not a skillset that every legal function has.

7: Transaction platforms in managed services

This is a topic which, from my many conversations with clients, can divide opinion: should they outsource high volume, standard contracts and transactions to a tech-enabled managed service provider or should they build and operate the platform internally within the legal function?

Tech-enabled transaction execution platforms (see perspective 3) can be used within an organisation in three ways: by business colleagues to self-serve (see perspective 4); by the legal function itself; and by an in-house lower cost service centre (see perspective 6).

Another possibility is to outsource a category of transaction to a third-party managed service provider which operates off a platform and charges predictable fees to deliver outcomes (ie signed, risk-compliant contracts) under service level agreements.

If the provider delivers a similar service for multiple clients, economies of scale may allow lower costs – and possibly higher quality – than can be achieved within any one legal function.

The managed service option may also obviate the need for the legal function to create its own transaction platform and template its playbook of contract provisions, either because the provider creates the platform as part of the deal or because it has already created the platform for other clients and can configure it for use by an additional client.

The outsourcing last year by BT to DWF of insurance claim and real estate work is perhaps the most recent, well-publicised example of this managed service trend. Allen & Overy provides this service in selected situations.

But I should manage your expectations: a well-informed senior manager in one large legal function recently told me that the provider market for legal managed services was not as mature as they would like – that the provider market's risk appetite for attractive, certain pricing on large-scale services across a wide range of activities was still limited.

8: Will law firms move to executing their clients' deals on transaction platforms?

This series of short perspectives concentrates on innovation within in-house legal functions, but it was only a matter of time before I was asked how the migration of transaction execution onto technology platforms would affect law firms. That question came last week, so the next two or three articles will explore it.

Although legal functions tend to handle their organisation's high-volume, 'business-as-usual' transactions in-house, they also engage law firms to handle 'out-of-the-ordinary' transactions, ie those that are infrequent, time pressured or where the legal costs are borne by a third party.

Yet what is an 'out-of-the-ordinary' transaction for a client will often be a 'business-as-usual' or 'flow' transaction for their law firm because it is executing similar deals for multiple clients.

These areas of law firm work, where there is a high volume of transactions involving similar process and documentation, will also over time move onto deal platforms. These will make smart use of technology to remove as much human intervention as possible, smart use of resourcing to reduce the cost of that human intervention and smart use of process to make that human intervention efficient.

Examples in the financial markets might include areas of mainstream corporate lending, real estate finance, leveraged finance, asset finance, vanilla corporate debt instruments and securitisation.

The logic will also prove compelling in areas outside the financial markets, for example, high-volume M&A work for lower-value deals, and certain types of real estate and fund establishment work.

9: Why would law firms cannibalise their business by moving deals onto transaction platforms?

My last article (perspective 8) suggested law firms, like in-house legal functions, would start to execute 'flow' transactions on tech-enabled deal platforms.

Yet the obvious ‘victims’ of this conversion of ‘tailored’ deals into ‘flow’ deals will be the law firms themselves: the essence of this way of working will be to consolidate all of an organisation’s deal flow of a certain kind onto a single technology platform which adopts standardised documentation and processes.

Deals will take less lawyer time to execute, the per-deal fees will reduce, potentially radically, and the quality of the data available about a client's contract portfolio will improve radically. All of this serves the client's best interest.

Sceptics might doubt whether law firms will disrupt their business model in this way, even if it is in the client's best interest. My view is that the interests of an innovative law firm and its clients are fully aligned on this development.

For the law firm, there is the positive incentive: by establishing the platform for a client, the law firm will create the possibility of handling all the deal flow of a certain type for that client, whereas previously the client may have shared that work among two or more law firms.

And there is the negative incentive: unless it creates the platform, the law firm may lose out on all or most of that deal flow to whomever does create the platform.

10: Transaction platforms – will law firms lose out to other providers?

One reader of the last article in this series – 9: Why would law firms cannibalise their business by moving deals onto transaction platforms? – assumed that it would be law firms that build and control these platforms because they have the high-end legal and market knowledge that must be embedded in the underlying documents and processes. But that outcome is not so clear.

To persuade clients to entrust deal flow to any platform, the provider will have to demonstrate that it has the expertise and, in particular, market knowledge to create or use a technology platform, engineer efficient deal processes, recast deal documentation and develop insightful data.

Since these are not conventional law firm skill sets, many law firms may not be agile enough to exploit this opportunity, and alternative legal service providers may emerge as the more successful providers.

As these other legal suppliers become more experienced in handling what was formerly in-house executed deal flow, they will acquire the expertise to tackle ever more complex areas.

But client organisations may be reluctant to put all their deal flow of a certain type through any single legal provider. They may also be reluctant to bear the entire investment cost of creating the platform.

This suggests that the natural provider of any such platform may well be an independent utility, perhaps sponsored by an industry collaboration or association.

11: Will industry associations dominate transaction platforms?

It's always puzzled me why industry associations, some of which have been strikingly successful at producing industry standard documentation for their most common forms of agreement, have not taken the next logical step: namely, developing technology platforms to automate and streamline the generation, negotiation and signing of those same agreements and, with those platforms, a playbook of both opening and fall back contractual provisions.

With advances in technology, that may be about to change. The Loan Market Association, the trade association for the wholesale lending markets, has announced that it is launching a project to automate industry standard documentation, collaborating with Allen & Overy and Avvoka, a platform provider resident in Fuse, A&O’s tech innovation space.

Trade associations and other industry collaborations are in many ways best placed to front this kind of initiative: they are uniquely placed, as representatives of market participants, to push standardisation of documents and processes.

FIDIC, the international standards organisation for the engineering and construction industry, and ISDA, the International Swaps and Derivatives Association, are two examples of industry associations that have succeeded in making their standard documentation ubiquitous in their industries. Many sectors have similar bodies.

And the best trade associations are perceived to have an agenda that is aligned with that of their industry participants, whereas the market may be less willing to become dependent on a private platform provider such as a law firm or alternative legal service provider.

With all these factors in their favour, trade associations have a key role to play.

12: What future for law firms in a world of automated processes and transaction platforms?

When Allen & Overy published 'The future of the in-house legal function', a colleague said it sounded as though his working life was going to be comprehensively disrupted.

And it's true that some of the transactions which corporates and financial institutions have traditionally engaged law firms to execute in a tailored way will become flow work that is executed over platforms in the way I have been describing in earlier articles in this series.

But other types of transaction – which might include high-value or 'bet-the-company' M&A work, or deals involving highly customised structures or contractual arrangements – will not lend themselves to wholesale migration onto platforms. Law firms will continue to be engaged to execute these on a tailored basis.

That does not mean that these transactions will continue to be executed by law firms without regard to the advances in technology, resourcing and process that are entering the rest of the market. The law firms that clients engage on these transactions will be the firms which demonstrate that they are adopting technology, lower cost resourcing and process to execute all those parts of the deal that lend themselves to that approach, even if other parts do not.

In practice, there will be no clear divide between platforms for flow deals on the one hand and tools used to streamline tailored deals on the other. They will morph into one another.

Law firms sometimes counter the proposition that their work can be streamlined by saying that what they do is unique and too tailored to lend itself to these techniques, but I think we all know that there are elements of every deal, even the most complex and consequential, that can be streamlined.

These tailored, but streamlined, deals will form the main pillar of work for those law firms which have traditionally been ‘transaction law firms’ and which do not extend their services into the other areas outlined in these articles.

Those deals will represent a diminishing proportion of legal market spend. It is likely the market will sustain a reducing number of pure, boutique law firms which specialise in this ‘high end’ type of work and a reducing number of full service law firms for which tailored transactions are one part of a larger portfolio of work that includes, for example, platform-based flow work. Other firms that currently operate in this space will be looking to find what other, or additional, market niche they can occupy.

13: In-house legal functions will concentrate on risk anticipation - to reduce risk remediation

Early in the series, I said that one of the three broad trends in in-house legal function innovation over the next decade would be that teams will devote much more effort to performing their routine, business-as-usual work in more efficient ways so as to free their often senior, highly trained lawyers up to perform work which is valued more by their business clients. Each subsequent perspective has elaborated on how that will happen.

There has been surprisingly little dissent from that.

The second broad trend is that legal functions will concentrate on risk anticipation and prevention in order to reduce the amount of time and effort wasted over recent years on risk remediation (ie on litigation, arbitration and regulatory investigations).

The smart businesses are recognising that the true cost to them of remediation, which includes the legal and related costs, the fines, the financial damages awards, the reputational and brand damage and the opportunity cost of ‘unproductive’ management time, far exceeds the cost of risk anticipation.

Legal functions will position themselves to drive initiatives that embed, at the heart of their organisations, governance, culture and corporate purpose, conduct and operational risk controls and smart responses to regulatory change and policy. This concentration on organisational culture is being encouraged by regulators in the field of conduct risk as a way of moving away from ineffective rules-based or policy-based approaches to one in which the right conduct flows naturally from the right culture.

This legal risk anticipation role is not a responsibility that many legal functions currently embrace but the legal function, which has ethical and professional duties and responsibilities at its core, is best placed of all corporate functions to be the guardian of such as initiative within business organisations.

Despite that, in highly regulated industries such as financial services this role – particularly for conduct risk – has often devolved to a separate compliance function, in part because of scepticism on the part of regulators as to whether legal functions can deliver organisation-wide compliance at scale. The rising tide of regulatory oversight and enforcement has also resulted in the compliance function receiving a multiple of the funding made available to the legal function.

In regulated sectors therefore it remains to be seen the extent to which the risk anticipation function will reside in Legal vs Compliance.

14: How will technology facilitate risk anticipation and prevention by in-house legal functions?

I had no sooner posted my last article - 13: In-house legal functions will concentrate on risk anticipation - to reduce risk remediation - saying that legal functions will spend more time on risk anticipation so as to reduce time wasted on risk remediation, than a friend asked simply 'how?'

A key enabler for risk anticipation and prevention is technology. Highly regulated business sectors are already harnessing technology to support these initiatives and to make compliance across their global organisation feasible.

The largest participants in these sectors deploy technology to assist with regulatory horizon and life cycle management – hence the catch-all expression 'regtech'. They also undertake the following activities:

- Monitor regulatory change across multiple countries and allocate internal accountability for their organisation’s response to any change. In Fuse, Allen & Overy's tech innovation space, we have hosted various companies in this field. Introduce workflow and process to ensure compliance or reduce risk. aosphere, A&O's affiliated provider of cross border online legal data*, has many clients that licence electronic compliance systems from vendors which build aosphere legal data (for example related to substantial shareholdings or restrictions on marketing financial products) into their rules engines.

- Introduce conduct monitoring technologies which scan internal e mail, messaging and voice traffic to identify anomalous or non-compliant conduct in real time. These are widespread in financial trading rooms following the market-rigging problems revealed since the financial crisis. But A&O has clients exploring this to identify other types of misconduct such as anti-competitive behaviour.

- And provide staff training using smart online training tools. Examples abound.

But participants that are not among the largest, or are not in such highly regulated sectors, will need to find ways of harnessing technology to tackle these challenges.

And even the largest corporate organisations currently struggle to anticipate regulatory change on the far policy horizon: identifying changes in public sentiment which herald a shift in the focus of regulatory supervisors tasked with prioritising enforcement activity across a wide range of law and regulation. Technology will support this activity.

15: A radical future for automated or digital compliance?

The previous article explored the use of technology to assist with horizon scanning for regulatory change across the world and with regulatory life cycle management.

Much more radical moves are afoot in this area of regulatory compliance: considerable research and development is being conducted into such notions as ‘digital regulatory reporting’ or ‘machine executable regulation’.

The aim of these R&D initiatives is to build compliance into an organisation’s business processes. At present in various business sectors, for example, companies generate data from their business activities in one form and are then required by regulators to report that data in a different form. Armies of admin personnel, and mountains of spreadsheets, are needed to find, extract, manipulate into the correct format and then submit those data manually. This adds cost, delay, error and friction into an organisation’s compliance efforts.

These R&D initiatives aim to automate or streamline regulatory compliance by expressing the regulations, the information required by regulation to be reported and the business processes by which that information is generated as open source code. Companies which integrate that code into their business systems will be conducting business in a way that is automatically reg-compliant or that automatically generates data in a reg-compliant format, without the need for extensive intervention of humans and spreadsheets.

The financial services sector is particularly interested in this field:

The UK financial regulator - the Financial Conduct Authority - and the Bank of England, together with various financial market participants, explored the application and feasibility of digital regulatory reporting to two use cases during 2018 / 19: UK domestic mortgage reporting and calculation of the Common Equity Tier 1 (CET1) capital adequacy ratio.

Similar techniques are being explored by the International Swaps and Derivatives Association (ISDA) through its common domain model. The aim here is not primarily to facilitate regulatory compliance, but rather to reduce costs and improve the efficiency of back-office processes by creating a machine-readable data model for derivatives products, processes and calculations.

I would welcome information from readers about similar initiatives in other business sectors. This is undoubtedly the right direction of travel for regulatory compliance, but the challenge of persuading whole industries, with entrenched practices and billions of dollars invested in legacy systems, to transform in this way is considerable.

16: How technology will reshape certain aspects of disputes work

However good in-house legal and compliance functions become at anticipating and preventing risk (see last three articles), they will always have to devote effort to damage limitation and event remediation, which typically may include defending their business following a compliance breach, or other misconduct, or from adverse litigation or arbitration claims, or pursuing claims against others whose actions have adversely and wrongly affected their business.

And this, in turn, will continue to be a major source of work for law firms. But even absent major changes in the way the court systems operate and justice is administered (for example, towards virtual court rooms and online justice), technology, in particular, will reshape how certain aspects of litigation are conducted:

- The second generation of AI-driven applications is making more feasible the management, review and bundling of mountains of written and oral evidence (eDiscovery) so as to identify and organise with greater precision and speed the critical pieces of evidence, thereby reducing the need for humans to labour at this task.

- In those litigation cases requiring the production, routinely in standardised form or in high volumes, of submissions, replies or similar documents, technology will be used to streamline the production, extract data from public sources and so on. Litigators will say that every case is unique and major cases, in particular, do not lend themselves to templating and automating of draft documentation, but even in these cases Allen & Overy is finding opportunities to streamline – which illustrates once again that even if only a portion of a typical task can be streamlined, it can still be worth the investment.

- AI-driven technologies will take over much of the work related to searching for case precedent.

- Many organisations have high volumes of lower value claims which are triaged and sometimes dealt with by the legal function – for example employee claims, personal injury claims in industrial businesses or ‘crash-and-bang’ and ‘slip-and-trip’ claims in retail businesses.

Technology applications already exist for predicting the outcomes of disputes like those.

And logic systems are already automating the decision making process for whether to defend or settle such claims. The user answers a questionnaire that elicits the essence of the facts in a structured way and the logic embedded in the software behind those answers automates the tacit knowledge and thought process that the lawyer undertakes to make that decision based on those facts. In article 5, I gave as an example the supermarket business that has adopted this approach for ‘slip and trip’ claims.

17: In-house legal’s approach to lar-scale regulatory change

In earlier articles I explained that in-house legal function transformation will follow three broad trends, of which I have explored two:

- more efficient performance of business-as-usual work so as to free lawyers up for more value-added work

- more emphasis on risk anticipation and prevention so as to reduce time wasted on risk remediation.

The third broad trend will be that the legal function response to large-scale regulatory and corporate change events will transform.

The wave of regulatory and market change that started with the global financial crisis, and then continued in response to other 21st century phenomena such as the digital and data revolutions, has forced large-scale change programmes on to the agenda of in-house legal and compliance functions.

These functions are charged with managing their organisation's response to such global, cross-border compliance and implementation challenges as Brexit, anti-money laundering, IR 35 and data privacy rules such as GDPR; and, in the financial industry, MiFID, initial and variation margin for derivatives and IBOR transition.

These challenges are likely to remain a significant part of a legal or compliance function’s area of responsibility as the long-term consequences emerge of the global phenomena that gave birth to them.

Yet until recently, the tools at a legal functions’s disposal to develop a response to these challenges were limited. In the absence of a single provider offering an end-to-end solution, they would typically cobble together a project team that might comprise a range of both internal personnel and external providers: for example, a law firm for legal and regulatory advice, a consulting firm for programme management and perhaps an outsourcing firm for the lowest possible cost resourcing. Without a single, turnkey provider offering all the necessary skillsets, the programme would often suffer from cost overruns and delays and would not deliver the outcomes originally sought.

18: Why the corporate response to large scale regulatory change will transform

Large-scale regulatory and market change of the kind discussed in my last article typically requires an organisation to retrain its people, re-engineer its processes and/or amend its contracts with business counterparties (‘re-paper’, in the jargon) - all at scale. That often means engaging with thousands, perhaps tens of thousands, of customers or counterparties.

The large-scale ‘repapering’ challenges presented by Brexit and, in the financial world, derivative margin requirements and IBOR transition are good examples of this phenomenon.

Tackling these challenges requires an affected organisation to deploy some or all of the following resources and capabilities:

- identifying, extracting and uploading to technology platforms data and documents from management information systems;

- applying artificial intelligence to review and extract data from those documents;

- querying, organising, sharing and downloading data;

- deploying workflow and logic systems to automate the process of analysing that data, developing insights and producing outputs (whether they take the form of a report, a regulatory filing, an instruction to a person to complete a task or a draft agreement);

- outreach to counterparties, often thousand or tens of thousands of them, to negotiate and sign agreements or to retrain;

- deploying, training, supervising and quality assuring potentially large numbers of lawyers – and non-lawyers – to complete the tasks (for example, negotiation) that still cannot be wholly performed by technology; and

- feeding back into management information systems the vastly enhanced data that will result from these processes.

Almost no client organisation has all the legal and market expertise, human resources and technology skills to fashion their own response to these challenges, especially while maintaining already lean day–to-day operations.

However, as the occurrence of these challenges has multiplied and the technology to tackle them has improved, so the provider market has matured.

Increasingly, global client organisations are able to buy an end-to-end solution from a single provider, or joint venture of providers, that takes most of the challenge off the shoulders of the organisation and delivers a reg-compliant outcome. Allen & Overy’s Markets Innovation Group is an example of an end-to-end provider, but there are other alternative legal service providers in that space too.

19: The challenge for in-house legal of tackling a fragmented legal tech and legal service provider market

It will be apparent from the 18 two-minute reads already published in this series that the transformation of the legal services market which we are on the brink of experiencing will be brought about, in each case, by some combination of technology, data, resourcing and process.

Yet today, the market for both technology applications and resourcing is fragmented. Each offers a bewildering and growing range of providers. There are no clear market leaders capable of tackling most legal function challenges. Each supplier has its niche target area or area of expertise. In the jargon of the legal tech industry, the market mainly offers ‘point solutions’, each of which tackles a very particular task or pain point.

The consequence is that any in-house legal function trying to create an overall solution to a challenge will have to integrate several technologies and source a range of human skillsets – and then forge them into a technology platform and team capable of overcoming the challenge. The next few articles will look at legal technology.

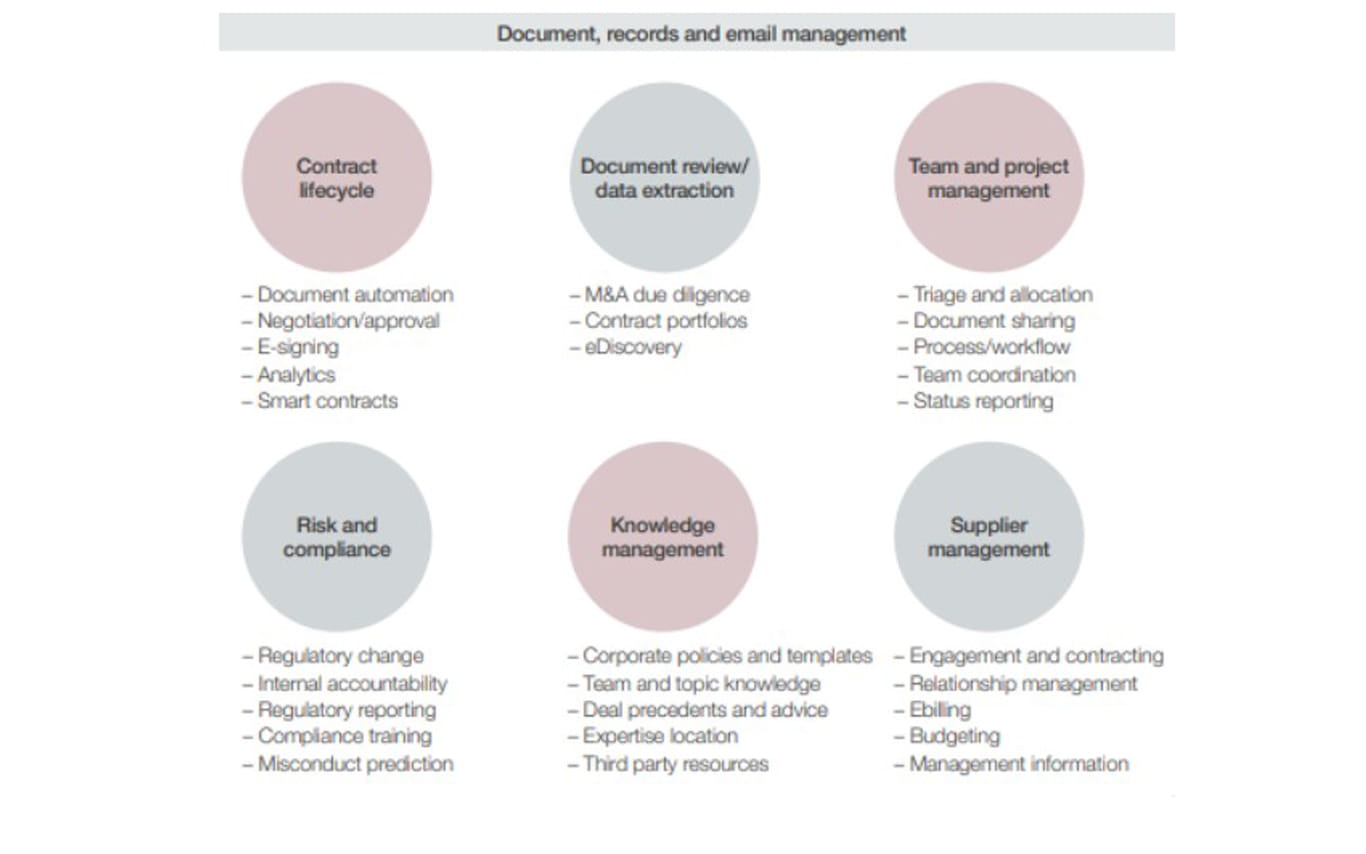

Our experience in Fuse, Allen & Overy’s tech innovation space, is that the tasks which technology can help in-house legal functions perform fall into these seven categories:

20: How in-house legal can harness a fragmented and confusing legal technology market

Whether you’re an in-house legal function or a law firm, building a technology platform that can handle just one challenge, for example, the end-to-end process for a certain kind of high-volume, routine transaction, your organisation will most likely have to integrate multiple technology applications. And those applications might be from different technology providers and categories – for example, contract lifecycle, document review / data extraction, team and matter management and perhaps also knowledge management (see last article for those categories).

The difficulty for an in-house legal function is that it may have multiple challenges of that kind, requiring it to create multiple different platforms. For example, it may have other types of high volume transaction which would also lend themselves to a platform approach. Or it may need technology to streamline other tasks – for example, to triage, allocate and monitor matters coming into the legal function.

There is, however, currently no single technology provider (such as, for example, SAP or Oracle in the enterprise technology field) whose platform can meet most of the needs of most legal functions, without reinventing the wheel in each organisation.

As things stand, there are at least five choices available to an in-house legal function:

- wait until one or more technology suppliers emerge with one or more platforms that can be deployed ‘out of the box’ to streamline many of the tasks

- identify one or more suppliers that can, in return for service fees, build or configure the necessary platforms to the particular needs of that organisation, host, maintain and update the platforms and their content and either allow the organisation to operate it themselves (i.e. software-as-a-service (SaaS)), or operate it as a service provider so as to deliver an outcome to the organisation using the platform (i.e. a managed service)

- build or configure its own platform(s), integrating multiple technology applications where necessary

- use generic (i.e. not legal specific) software already licensed by the organisation.

21: The pluses and minuses of 5 different approaches to technology procurement by in-house legal functions

Each of the five approaches to tackling the fragmented nature of the legal tech market that I suggested in my last article has pluses and minuses.

The ‘wait for an out-of-the-box solution’ approach is attractive because it is likely to be the least costly and risky approach, but a solution of that kind which can meet most needs of most legal functions may not emerge for some years. There are encouraging signs that technology providers are now pursuing or actively exploring this market, but in the short to medium term (say, three years….maybe five), any platform will be a ‘minimum viable product’, covering only some of a legal function’s needs. The build out to a fully formed platform will take place over a period of several years after that. So this approach may expose the legal function to criticism within its organisation for not tackling the challenge of digital transformation which other parts of the organisation are tackling.

Both the software as a service (SaaS) and managed service approaches potentially offer the advantage that they may avoid capital investment and provide access to cutting edge technology for an annual fee. in-house legal functions typically find it very difficult to access budget and resource to license or build technology. An organisation’s technology stack is not something the legal function controls. The legal function is often not a priority of the IT department and the internal corporate governance around technology licensing or building is hard to navigate. By contrast, all legal functions routinely pay fees to law firms and other service providers, so the idea of accessing technology through a browser as a service in return for a fee can be attractive.

On the other hand, many organisations, particularly those with large, business critical technology departments, will approach this issue with an assumption that they will want to build or configure their own solution(s). This is an approach requiring deep technology and change skills.

The default expectation of those outside the legal function (for example, an organisation’s IT department) will often be that the organisation already licenses numerous generic (ie non-legal specific) applications that serve other functions and that can therefore be configured to suit the needs of Legal. On the face of it, this makes perfect sense since those applications are already installed and paid for. The experience of many legal functions, however, is that those applications can be hard to adapt to the special needs of the legal function with the result, if they are ‘clunky’ or not intuitive for lawyers, that they are not adopted and fail to achieve impact.

22: Four ways to future proof the in-house legal function’s technology stack

Whichever of the five approaches to procuring technology suggested in my last two articles is adopted, in the fragmented and dynamic world of legal marketplace technology it is important for an organisation to insulate itself as far as possible from dependency on any one technology provider and from the delays involved in adapting an organisation’s technology stack to changed circumstances.

A tech company which today appears to offer a leading technology could easily be eclipsed by better technology tomorrow, or it could change the direction of its technology development. The company could even undergo a financial setback.

There are certain principles to follow in ‘future-proofing’ a legal function:

- Build and select systems to be interoperable, in other words with application programming interfaces (APIs) which allow them to integrate with and ‘talk’ to other applications easily. It is likely that any one solution or platform will involve several technology applications. If it makes sense to change any one of those to another application, the easier it is to unplug the old one and plug in the new one, the better. In that sense, think of technology platforms as app stores.

- Keep your data and your documents in a ‘data lake’ separate from your technology applications so that unplugging one application does not result in a loss of data or documents and, on plugging in another, you can easily give it access to the existing data and documents.

- Find a way of hosting appropriate applications in the cloud. This is a complex topic and one on which many organisations have strong views, for example related to information security. However, the cloud offers many benefits, not least the ability to buy software-as-a-service where the burden of ensuring the technology is always available and always operating off the most recently enhanced version rests with the provider, not with the organisation’s IT department. In a world where storing and processing extremely high volumes of data is becoming commonplace, the ability to scale storage and processing capability up and down to meet unexpected or short-term business needs without incurring the delays implicit in buying, installing and integrating additional servers and other hardware is attractive.

- Where established, global technology leaders, with high and scaled levels of engineering capability, can be used, give serious consideration to using them even if they are relatively new in prioritising the legal market. Their long track record and scale makes it more likely that they will be there continuously developing their capability tomorrow.

Adherence to these principles will also help with the deployment in a cost-effective and agile way of new technology solutions that not only cut across different business lines and product types, but are also capable of operating together with legacy systems that can take years to retire.

23: What does a data-driven in-house legal function look like?

The legal market, both law firm and in-house legal function, has been slow to seize the opportunity created by capturing, analysing, manipulating and deriving insight from data and documents. While other industries and other functions within a corporation are forging ahead with this endeavour, legal market participants in general remain frozen in the headlights.

The digital transformation of in-house legal functions can be harnessed so as to crack this challenge. The use of workflow, collaboration and automation technologies is often thought of as having the fortunate side-effect of creating useful data. Over time, the data will come to be seen as the primary benefit of technology adoption because the data captured through digital transformation will make it feasible to manage legal risk and legal functions on a data-driven basis, rather than on the basis of tacit knowledge and intuition. The workflow, collaboration and automation will seem like a useful side-effect of the data generation.

What types of data should the legal function be storing, managing and analysing?

First, information about what the legal function is doing: what matters are being worked on, by whom, at what unit cost and what spare capacity remains, all broken down by category, geography and business line; what stage each matter has reached; how much effort is being expended on the matter and so on.

This in turn will assist in determining the cost of an internal legal service at the point of request, ensuring transparency of the resource being committed and demonstrating which internal clients are benefiting from the legal function and what value is being delivered.

Discussions with a business unit about its allocation of legal function costs are much more constructive if this data is available. It can lead to collaboration between the legal function and the business unit over ways to reduce the flow of work or the cost.

Second, comprehensive management information about the relationship between an organisation and its legal service providers. This will allow the legal function to assess the outcomes being delivered by its external providers and the related cost, to compare one provider with another and to budget future costs on a data-driven basis, rather than a ‘finger in the air’.

Third, all the contracts and other transaction documents that pertain to the organisation – these should not be stored solely as words in a PDF or Microsoft Word document. They should be organised and stored in data format so that it is possible to search, retrieve, organise, analyse and share, both at a portfolio level and at the individual contract level, granular information about what contractual commitments an organisation has concluded, with which counterparties and on what terms.

This digitisation of an organisation’s contract portfolio will create the foundations for the automation of post-signing activities: monitoring contractual risk and performance by the counterparties, processing of the organisation’s own performance obligations and meeting reporting and other regulatory obligations associated with the contract.

It can also allow the legal function to deliver commercial insight and become a valued contributor to its organisation's bottom line. For example, by demonstrating correlations between the most profitable revenue sources in their organisation and the presence or absence of certain contractual terms.

Finally, legal risk management data, based on metrics, taxonomies and tolerance levels agreed for the relevant business that allow the legal function to plan resource more strategically and facilitate risk reporting in line with the expectations of the wider organisation and the regulators.

24: Basic building blocks for a data-driven in-house legal function

Over and above the technology and other capabilities discussed in this series, an in-house legal function which is data-driven will need to find ways of storing various types of data and documents in a central repository – a data lake or layer – that complies with company security and privacy standards. All technology applications will need easy access to this data repository to draw seamlessly those data and documents that it needs in order to accomplish a particular task, and to redeposit them, without huge integration or interface challenges and without disrupting other applications which wish to access the same data or documents.

Transitioning from a world of text to a world of data and text also requires an organisation to have available to it a clearly understood language or taxonomy that allows it to classify text as data – to allocate all text that has the same meaning or contains the same type of information to the same descriptor.

To take a very simple example, there are numerous ways in which an agreement can express the principle that the governing law of the agreement is New York. An agreed taxonomy might tag all such clauses as “Gov law – NY”. Similarly, there are numerous ways in which an agreement might express the principle that the agreement can be terminated if the Borrower’s credit rating with Moody’s falls below BBB. An agreed taxonomy might tag all such clauses as “Termination Event – Borrower – Moody’s downgrade - <BBB”.

Such a language or taxonomy is necessary at the enterprise level. But it makes no sense for each enterprise to incur the cost of developing its own. Far better for the enterprise simply to adopt a standard that is open source. This has the added advantage that the contents of documents can then be shared as data between counter parties to the contract and more widely, allowing efficiencies, for example, in how they reconcile the terms of agreements they have concluded with each other and how they perform those terms, confident that they both have the same understanding of what the terms are.

Nor is it wise for an enterprise’s technology systems to become dependent on a taxonomy that is proprietary to a third party, lest the creator abuses that dependency.

Given that every business organisation in the world is challenged to know in any degree of detail what the terms of its contractual commitments are, it is surprising that such a taxonomy covering most of the contents of legal documents has not yet been created.

25: Developing a strategy for in-house legal function transformation - 4 practical steps

Faced with all the challenges outlined in this series of articles about innovation among in-house legal functions, the way forward for the in-house legal function is exciting, but can be daunting. This 25th article addresses: Where to start? How to engage with the challenges?

Although some legal functions are moving fast to catch up, most today are not configured to tackle the change and innovation challenge (and incidentally the same can be said of most law firms).

Law firms and legal departments alike lack the expertise to enable them to analyse, at the necessary level of detail, the work they do and, within each work area, the tasks they perform, and to re-engineer their processes in the way necessary to become the legal function of the future.

They lack the familiarity with the technology market necessary to be discerning buyers of technology with a coherent master plan and management capacity to implement change. In-house legal functions are expert at selecting and managing law firms, but often they are not familiar enough with the world of technology and alternative legal service providers to make the right selections.

This and the next three articles propose practical steps for tackling transformation of the in-house legal function, looking in turn at strategy and vision; implementation; change skills; and technology and data. There is no right or wrong approach. These practical steps are prompts, from which you can pick and choose the elements that resonate for you.

Starting with strategy and vision:

- Build your market knowledge about the full range of legal service providers and legal tech available and how other organisations are transforming their legal function. The field is bewildering and knowledge is key.

- Understand your legal function’s ‘as is’ state. Most helpfully that will involve creating an in-house task and service catalogue and usage data. Understanding at a granular level how your lawyers spend their time, where their pain points and inefficiencies are, who the principal internal clients are and where the client experience can be improved. Develop a catalogue of services provided by the legal function. Perhaps use questionnaires or interviews. Would time recording over a fixed period help?

- Develop a vision for how you want to position the legal function within your organisation: trusted counsel, business partner, risk and reputation guardian, deal executor, first-line response to routine questions or self-serve enabler and ultimate responder? Where are the overlaps and handoffs with Compliance, Risk, HR, Government Relations, Corporate Secretarial and other functions? This will shape your course.

- Map corporate needs and legal solutions. Using all these inputs, build a map of your organisation’s legal needs and the legal function’s response. Which do you wish the legal function to execute and, just as importantly, not to execute? Which do you wish to send out to external providers? Where can technology intervene?

26: Implementing in-house legal function transformation – 4 practical steps

The challenges of in-house legal function transformation are by now well-rehearsed in this series of articles. But what practical steps can one take down that path? The last article covered the development of a strategy and vision. This one will cover 4 practical ways of tackling the implementation of that strategy and vision.

- Develop an implementation plan. At one extreme, this is a target operating model for the legal function with a target technology stack, organisation chart, process maps and staffing/skills plan, phased in over a period, with milestones, priorities, a benefits analysis, accountabilities and some idea of budget. But for most organisations that is a counsel of perfection. There is value simply in identifying your legal function’s top five pain points and working to solve them. This exploratory approach will build confidence and knowledge and may point the way forward.

- Identify sources of funding to implement any plan. What will the plan cost? Do you have budget? Can the costs of the plan be justified against savings in future years? Do other, perhaps revenue generating, parts of your organisation benefit sufficiently from your plans to be willing to fund any part of the transition? What is your business case and who do you sell it to?

- Communicate the opportunity which change offers to all stakeholders (colleagues in the legal function, key internal clients and senior management). Generate enthusiasm. This will help overcome inertia, whether caused by conservatism, entrenched habits, concerns about the future or scepticism as to whether the in-house legal function can deliver on a vision.

- Revisit your plan continuously. Your organisation and its needs will change. The technology and supplier market will change too.

27: Harnessing the skills needed for in-house legal function transformation – 4 practical steps

In surveys that A&O is conducting, ‘lack of special skills / knowledge to implement innovation’ is cited by nearly half of respondents as one of the three main barriers to innovation. That makes sense: if innovation in the legal market is about technology, process, data and creative ways of resourcing, it is hardly surprising that conventionally run legal functions do not have that skillset in the depth and breadth needed.

Finding and harnessing the right skills therefore needs to be a core priority:

- Build change skills within Legal so that you can undertake a digitally enabled change programme. Do you need to appoint a COO, an innovation leader, legal tech experts, data scientists, knowledge managers, process engineers, project managers? Lawyers already in the legal function may take too long to retool into these roles. Those primarily charged with implementing the plan need to be accountable and therefore freed from other commitments.

- Understand your organisation’s skill sets outside Legal. The necessary skills need not all be housed in the legal function. Understand your organisation’s strengths in the change arena and establish the willingness of those outside your department with the relevant skills to support the legal function in any transition, perhaps most importantly the IT department. This can have the upside of fostering connectivity with the wider organisation.

- Create lower cost resource. Much innovation starts with unbundling transactions or projects into their component tasks. Does your organisation need its own service centre in a lower cost location to handle high-volume or routine tasks? Or do you prefer to outsource those tasks to external managed service providers.

- Use the external provider market. Where you cannot find the skills or scale you need internally, look to the external provider market. The breadth and depth of the provider market in managed services, lower cost resource, interim lawyers and all areas of consulting (business, regulatory, legal function transformation and vendor procurement) is growing by the day.

28: Developing a technology roadmap and data strategy for in-house legal function transformation - 3 practical steps

This is the 28th - probably the last - article in my series about innovation among in-house legal functions.

How well a legal function harnesses technology, and with it data and process, will define how effectively that legal function transforms. That challenge is complicated by the dynamic and fragmented nature of the legal technology market.

These three practical steps will help tackle the challenge:

- Understand your organisation’s technology estate since that is already installed and paid for. Establish which legal function challenges are generic and can be solved using existing enterprise technology and which are specific to Legal and require tailored solutions. If you can accomplish 75% of a task quickly and without material cost using existing enterprise technology, that may be better than 100% sometime in the future, funded by the legal function.

- Develop a data strategy. Think through what data you need to run a data-driven legal function: data about your legal function operations, your external provider relationships, your contract portfolio, your risk metrics. That will almost certainly require you to think through your operating processes - to identify where in your processes is the optimal place to capture the data and how you will capture them. All innovation decisions should be designed to bring the realisation of the data vision and model closer.

- Develop a technology roadmap. Prioritise your technology needs: are there foundational technologies such as a document, or legal department work, management system that you must have to enable change, or a contract lifecycle platform because contracts make up a high proportion of the work of your legal function? What will your approach be to procuring technology: out-of-the-box, generic software, build own, software as a service or managed service (see article 21)? Pay careful attention to the 4 big picture future-proofing challenges outlined in article 22: inter-operability; data lakes; the cloud; and the attractions of established, global technology providers.

This and the previous three articles have listed in total 15 practical steps you can take to tackle the challenge of in-house legal function transformation, across four areas: strategy and vision; implementation; change skills; and technology and data.

One last word on technology: the law firm and legal function world is littered with examples of firms or functions that identified and licensed an intriguing technology without having first identified a pressing challenge for the technology to fix and an enthusiastic user base. The result has generally been disappointment. Far better to do the preparatory work of identifying and prioritising your organisation’s most pressing challenges and then looking for the right technologies to solve them.

I hope you have found this series of articles interesting.

DISCLAIMER: aosphere ceased to be affiliated with Allen & Overy on 8 February 2024 and is no longer part of the Allen & Overy group. aosphere is a separate business that is not regulated by the Solicitors Regulation Authority. A&O does not receive any referral fees from aosphere.