European M&A set for tough autumn

Headlines in this article

Related news and insights

Publications: 04 April 2024

Integrating Sustainability: Luxembourg's Legal Advancements with the CSRD

Publications: 27 March 2024

Increased Focus on Forced Labor in the U.S. and EU: Enforcement and Legislation

News: 27 March 2024

Allen & Overy advises on the sale of majority stake in GasNet

Publications: 26 March 2024

European M&A markets performed more strongly than expected in H1, buoyed by a small number of very big transactions. However, the underlying picture was far less rosy, and the short-term outlook is uncertain.

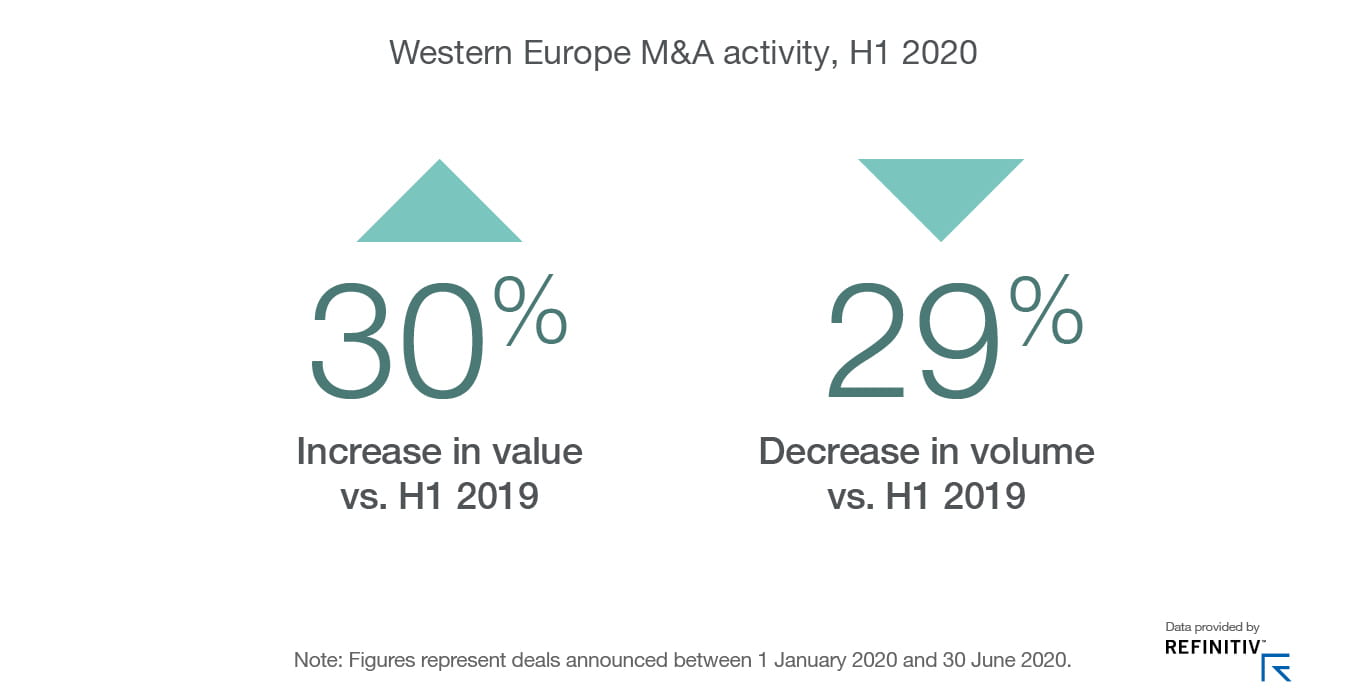

Deal value in Western Europe rose by 30%. However, a steep 29% decline in deal volume, perhaps, provides a more accurate picture of underlying activity.

Big transactions that did complete were, generally, well advanced before the Covid-19 coronavirus pandemic took hold or had to be completed for strategic reasons.

That is true of Thermo Fisher’s USD11.5billion acquisition of Qiagen. Even more so for ThyssenKrupp’s EUR17.2bn sale of its lift business to an investor group, led by Advent and Cinven. Without a deal, the group would be in severe financial difficulties.

The GBP31bn merger of Virgin Media and O2 in the UK reflects the continuing rapid convergence of mobile, fixed broadband and entertainment services.

Placing a value on the alliance was made easier since it was free of any cash element. More widely, valuing assets has become difficult given the uncertain economic outlook.

Safety first for investors

The pandemic has forced nervous investors to take a “safety first” approach and has left businesses focused primarily on conserving cash rather than M&A.

Deals are getting done. With share prices recovering, potential public deals are under review. Well-funded private equity houses also continue to assess significant “take-private” deals, when prices stabilise.

Targets with business plans that remain viable are still attracting attention, notably in the healthcare and technology sectors.

More fragile sectors – such as aviation, leisure, hotels, travel and automotive supply – are off the radar. However, we could see consolidation and distressed deals, and, in some cases, government intervention in these areas.

An uncertain outlook

It will take time for M&A activity to revive and Q3 is likely to be a tough one, with investor confidence remaining subdued.

That is even more likely with major political uncertainty hanging over future trading plans and the need to reconfigure supply chains.

Most businesses are now banking on a hard Brexit, given the lack of progress in the EU/UK trade talks as the end-of-year deadline looms. This will prolong uncertainty.

It will take time for M&A activity to revive and Q3 is likely to be a tough one, with investor confidence remaining subdued.

Download report

Read our latest report, Global M&A outlook: Adjusting to adversity.

Download PDF