Covid-19 triggers rapid shifts in private M&A tactics

Related people

Headlines in this article

Related news and insights

Publications: 03 April 2024

Chief Information Security Officers and cyber whistleblowing: considerations for PE firms

Publications: 21 March 2024

Publications: 21 March 2024

Publications: 21 March 2024

Global transactions ground to a near standstill in the first half of 2020 as Covid-19 swept the world.

However, there was a remarkable resurgence in activity during the second half of the year, and this has been sustained in the early days of 2021.

Some commentators speculated that the economic impact of the coronavirus would lead to the return of a fully-fledged buyers’ market in private M&A.

But our research, drawing on analysis of some 1,400 private transactions that Allen & Overy has advised on globally over recent years, shows a far more nuanced picture.

2020 was not just a year of two halves in terms of deal volume, but there were also significant shifts in the tactics used by buyers and sellers.

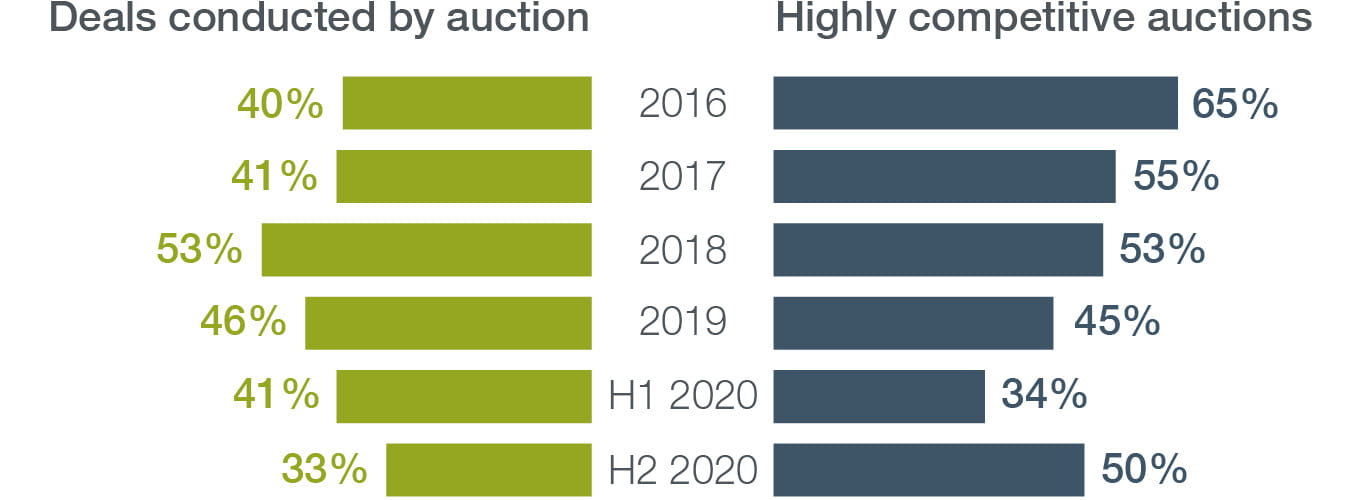

Fewer auctions, more competition (eventually)

Auction activity had already been in decline in 2019.

That decline continued in the first half of 2020, with just 41% of our private deals done by auction, compared to 46% the year before, and with just 34% of those being highly competitive.

We saw even fewer auctions in H2, but there was a sharp uptick in competition in those deals that were conducted as auction processes, with strategic and financial bidders entering contract races and even putting in pre-emptive bids.

Private equity increasingly dominant, but few distressed deals

The surge in confidence after the summer of 2020 was particularly evident among private equity (PE) funds, which dominated the market, particularly in the final quarter of the year, as positive news on vaccines fuelled optimism and activity. Our figures even show that the proportion of auctions on which we advised involving a PE buyer or seller was higher in 2020 than the year before.

Surprisingly, given the difficulties faced by businesses in certain sectors, we only saw a slight increase in distressed deals, up from 2% in 2019 to 8% of the private deals on which we advised.

Distressed activity may increase later this year, particularly when government support schemes for troubled businesses are withdrawn (see our article on distressed deals and insolvency in this report).

Distressed M&A deals

Sellers’ focus on execution risk intensifies

Having seen signed deals unravel during the early stages of the pandemic, sellers became noticeably more focused of execution risk.

The proportion of our deals that contained conditions to completion decreased from 79% in 2019 to 73% in the first half of 2020 and again to 65% in H2. Two factors were at play here. First, if more than one deal was on the table, sellers would take the unconditional over the conditional. And second, sellers resisted ‘non-mandatory’ conditions, such as those designed to deal with a due diligence issue.

Where deals required antitrust or regulatory approval, sellers tried to push execution risk onto buyers through “hell or high water” clauses, committing buyers to do everything in their power to clear regulatory hurdles.

Such clauses appeared in half of our PE exits requiring antitrust approval in 2019. In H1 2020, that number had risen to two-thirds of deals, and to three-quarters in H2.

One big surprise from our review was a decline in H1 2020 in the use of reverse break fees. Appearing in 10% of conditional deals in 2019, they were used in just 3% in the first half of last year. But there was an about-turn as the year progressed, with 14% of conditional deals involving such fees in the second half.

Indeed, there was a further change. Previously, most reverse break fees were payable only if the buyer failed to gain regulatory or antitrust approval. In 2020, some 70% of such fees were payable if approvals were obtained, but the buyer then chose to walk away.

Hell or high water obligation on buyer (private equity exits)

Shifting price structures

The pandemic rendered many business models instantly out-of-date, making it very hard to value assets and price deals.

As a result, we saw dealmakers adopt new pricing structures in an attempt to mitigate risk and bridge valuation gaps.

Between 2016 and 2019, the deal price was paid in full by completion in 70% to 80% of private transactions. In 2020, however, that figure dropped to 62%, with the remaining 38% involving either an earn-out or a deferred consideration.

- Earn-outs were seen in 20% of our deals in 2020, compared with just 9% in 2019.

- The proportion of deals involving a deferred payment rose from 15% in 2019 to 20% in the first half of 2020, but fell back to 13% later in the year as the market rallied.

In a further significant change, we saw the use of price adjustments increase, leaving the seller at risk of fluctuations (pandemic related or otherwise) up to completion.

In 2019, 37% of our deals included a price adjustment. But this figure climbed to 44% in the first half of 2020, and to 47% in the second.

Timing of payment

Warranties and indemnities as buyers regain lost ground

Sellers took a very cautious approach to warranty and indemnity packages in the first six months of 2020, using various strategies to dilute the coverage they provided – a sign that they preferred to see risk priced into the deal upfront, rather than chance an erosion in value later on.

However, buyers regained the upper hand after the summer, signalling that they were only prepared to return to the market if they were properly protected. Sellers sometimes had no option but to concede and we saw coverage return to normal levels, with fewer materiality and so-called “sellers’ knowledge” qualifiers and higher liability caps.

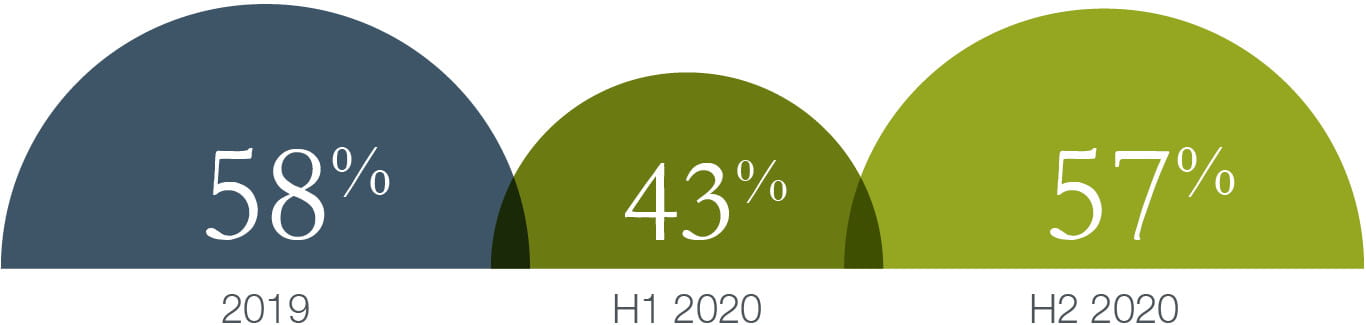

One notable change was in relation to warranty repetition, which gives buyers the right to claim damages if a warranty is incorrect at closing.

Although market practice on warranty repetition varies by region, it consistently appeared in some 58% of our deals globally between 2014 and 2019. But its use dropped to 43% in the first part of 2020 – with fewer sellers willing to stay on risk past signing of the deal given the unpredictable market environment.

As the year went on, however, levels of repetition returned to a more normal 57%.

Warranty repetition (2020)

W&I insurance back on track

In early 2020, we saw a reversal of the trend towards greater use of warranty and indemnity (W&I) insurance, as underwriters tried to exclude the one issue that was at the forefront of their minds: Covid-19.

Consequently, W&I insurance featured in just a third of our PE exits in the first half of the year, compared to 62% the previous year, and in just 16% of other sales (down from 23%).

In the second half of 2020, that decline completely reversed. Covid-19 related exclusions disappeared or were specifically tailored to the target business, and the product was once again used in 64% of PE exits and a quarter of other sales globally.

W&I insurance in private equity exits

Foreign direct investment controls surge

One other area where the two halves phenomenon was apparent was around foreign direct investment (FDI) controls (something we discuss in greater detail in our Merger Control article later in this report).

With FDI scrutiny being tightened across the world, including in Europe, the U.S., Australia and Japan, we saw a significant increase in deals conditional on FDI clearance as the year progressed. In the first half of 2020, just 7% of our deals required approvals. That had increased to 19% in H2.

% of deals subject to foreign investment approval

Outlook

In the private M&A market, as elsewhere, the question is whether the recovery in transactions seen in the second half of 2020 can be sustained in 2021.

While there is good reason to believe it can, there are reasons to be wary too. The pandemic is not yet under control and the scope for longer term economic shocks in its wake remains very real.

If you would like a full briefing on global trends in private M&A please talk to your usual A&O contact.