China maintains outward-looking approach

Related people

Headlines in this article

Related news and insights

Publications: 04 April 2024

Integrating Sustainability: Luxembourg's Legal Advancements with the CSRD

Blog Post: 03 April 2024

European Commission opens unprecedented abuse of dominance probe in animal medicines sector

Publications: 02 April 2024

Blog Post: 28 March 2024

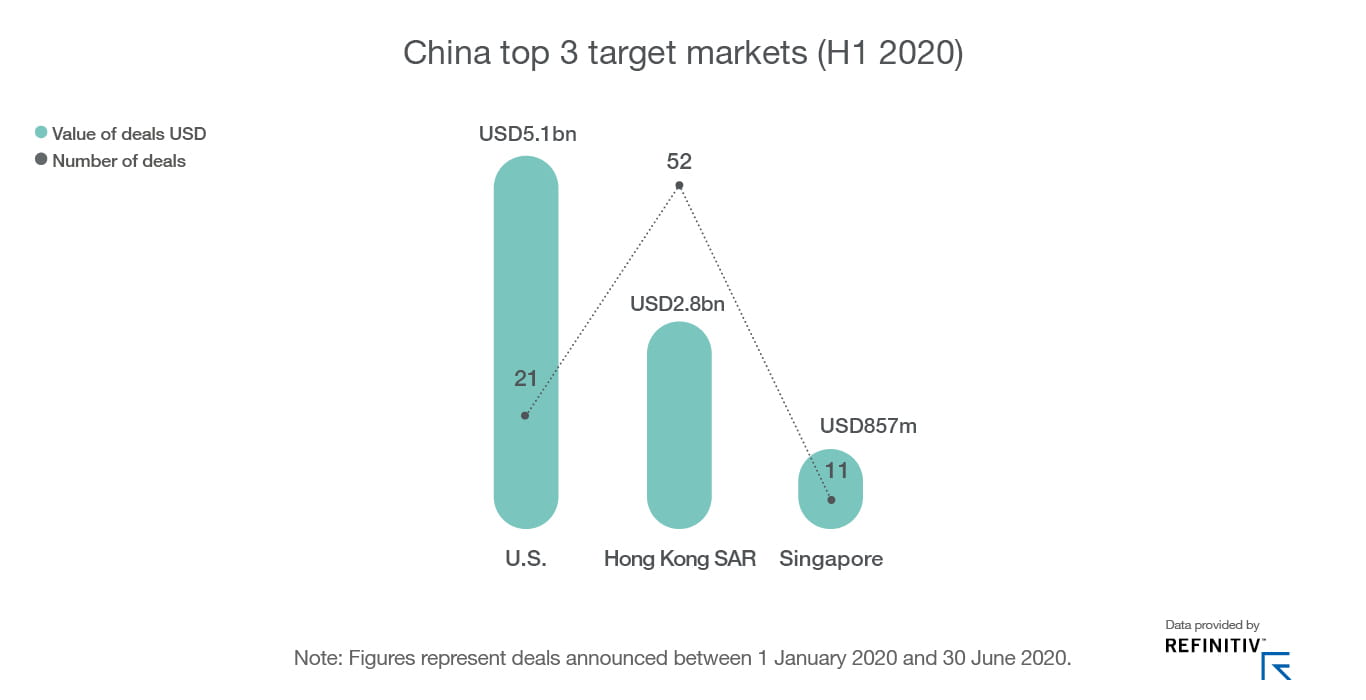

The Covid-19 coronavirus crisis has slowed Chinese deal activity. Activity remains sluggish even though the country is emerging from the crisis earlier than the rest of the world.

- While deal value for China was stable in H1, with a 0% change, volume fell 13%.

- The picture was worse for outbound deals, with value and volume down by 26% and 25%, respectively.

Despite tougher controls on FDI in many countries, it is expected that China will continue, as part of its ongoing strategy, its international and outward-looking approach to outbound and inbound M&A.

With the economy shrinking for the first time in decades (GDP fell by 6.8% in Q1), strategic M&A transactions will play an important part in the recovery.

That seemed to be the message from May’s National People’s Congress, where the government did not publish a target for GDP growth.

In part, that reflects deep uncertainty about how quickly the Chinese domestic economy can return to normal and where the global economy is going. It also indicates that China wants to avoid the often speculative investment boom following the financial crisis.

Support for strategic outbound deals

China is likely to back sensible outbound investments in key jurisdictions and sectors, not least as part of the ongoing Belt and Road initiative. China will be much more careful in how it describes its engagement with both the developing and developed world.

Deals in strategic sectors designed to upscale and bring new technologies to Chinese industries are expected to continue, such as those targeting:

- Technologies

- Renewable energy

- Infrastructure

- Advanced manufacturing technologies

- Biotech and healthcare

The need to raise additional capital could also see a growth in international fundraising; for instance through cross-border listings. One example is the Shanghai-London Stock Connect programme.

But outbound investors face a range of hurdles, alongside tougher FDI controls that have been erected by other countries.

Increased competition for assets, particularly from nimble and well-funded private equity funds, will require buyers to be more flexible over pricing and deal terms.

As the bitter trade standoff with the U.S. continues – exemplified by the battle over Huawei’s involvement in western 5G networks – Chinese buyers also face the task of building trust in overseas markets.

Open to inbound investors

China continues to ease restrictions on inbound investment.

Regulations governing the pharmaceutical sector, for instance, have been modernised and we are seeing strong activity here. The clean energy and infrastructure sectors also remain active.

Multinational companies that no longer see China as a cost-effective base are making an exit, in a trend accelerated by the crisis.

However, those wanting a stronger presence in China are finding it an increasingly investor-friendly market.

Download report

Read our latest report, Global M&A outlook: Adjusting to adversity.

Download PDF