Our international desks

Business and investment relations between Luxembourg and other major global financial centres are intensifying more than ever, and there is continuous growing interest from organisations based outside of Luxembourg for Luxembourg legal structures.

To address the growing inbound and outbound client demand into and from Luxembourg, our Luxembourg office has established dedicated international desks.

Measuring the importance of the Grand Duchy of Luxembourg by its size of 2,586 square kilometres or by its population of about half a million people does not do justice to its political and, more importantly, its economic significance globally. Luxembourg is now a strategic gateway for investments into Europe and, generally, for structuring investments worldwide.

Luxembourg is a global hub for asset managers and ranks as the second-largest fund distribution centre in the world. The country is also the European leader in international securities listings and is home to approximately 140+ banks, the majority of which are branches and subsidiaries of foreign banks. In addition, it has gained considerable attention from players within the FinTech space and is known for being a major centre for cross-border life insurance, non-life insurance and captive reinsurance.

To better service international clients interested in what Luxembourg has to offer them with respect to the establishment/expansion of their activities in Europe, and, conversely, to better coordinate the accessing of international markets for European clients interested in expanding abroad, we offer the services of our international desks which include our:

- Luxembourg-U.S. desk (headed by Yannick Arbaut)

- Luxembourg-LatAm desk (headed by Marc Tkatcheff)

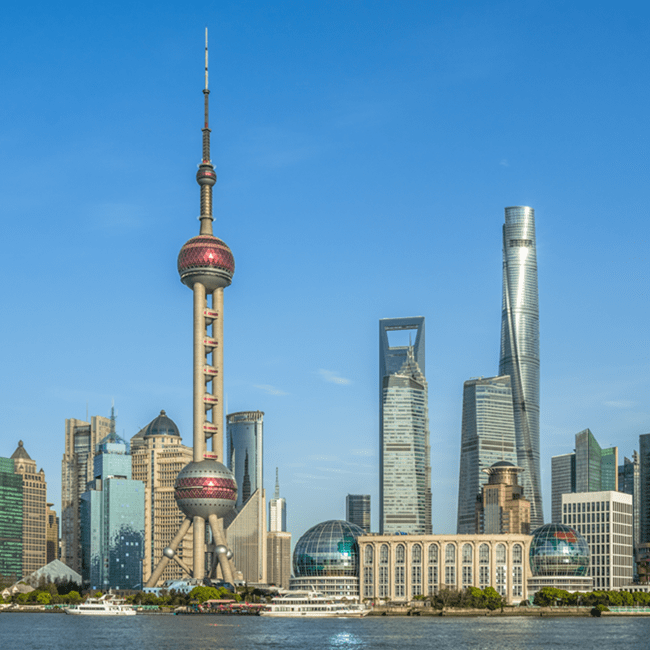

- Luxembourg-China desk (headed by Miao Wang)

Our desks work hand-in-hand with the various practice groups of our Luxembourg office, which is full-service, as well as with our wider network of offices based in our desks’ regions of focus. This includes, for instance, working with our offices located in New York and Washington DC for the U.S.; New York and São Paulo for LatAm; and Beijing, Shanghai and Hong Kong for China.

Our international desks are experienced in advising on all Luxembourg legal, tax and regulatory matters our clients may be facing. Our expertise includes advising on, among other things:

- The structuring and establishment of Luxembourg-based regulated and unregulated investment funds (UCITS and AIFs) managed or advised by foreign asset managers, in view of reaching new investors.

- The structuring of deal-specific Luxembourg investment vehicles to conduct domestic and cross-border investments/acquisitions.

- The structuring of investments into offshore funds through Luxembourg investment vehicles.

- The migration/redomiciliation of companies and investment vehicles from offshore locations to Luxembourg.

- The listing of bonds and shares on the Luxembourg Stock Exchange.

- The setting-up of securitisation vehicles for the purpose of repackaging instruments for investors.

- Obtaining the necessary regulatory approvals for the establishment of banking and FinTech-related activities.

- Employment matters, including resettlements and immigration law for multinationals operating or seeking to operate in Luxembourg.

- Matters of IP rights, IT, data protection, GDPR compliance and commercial contracts.

Our expertise

Our office

-

Luxembourg

5 Avenue John F. Kennedy, L-1855

Luxembourg

- +352 44 44 55 1

- Send email