Islamic Capital Markets

The sukuk practice forms part of Allen & Overy's award-winning International Capital Markets practice which has enjoyed a long established reputation for its global reach and top tier position across the full range of financial products.

Sukuk are Shari'a-compliant certificates which are issued in order to raise finance in a Shari'a-compliant manner and, like conventional bonds, can be listed on international exchanges and, if structured properly, will be tradable instruments in the international markets. However, there are also significant differences between sukuk and conventional bonds, including the fact that sukuk, as trust certificates, are not debt instruments and instead convey a beneficial ownership interest in one or more underlying assets.

In addition, the periodic payments on sukuk are not interest but instead represent a return earned through the underlying assets, for example on an ijara (lease) based sukuk the periodic return represents the rental payments made on the underlying lease.

Explore our services

Recognition

sukuk, for which the firm is often rated the ‘best in the world’

Chambers UK, 2009 (Islamic Finance)

a particularly notable track record of high-value sukuk issuances.

Chambers Global, 2015 (Middle East, Islamic Finance)

News and insights

Publications: 23 November 2023

Sustainable lending – a growing role for Islamic finance and Middle Eastern financiers

The aims of ESG investing and Islamic Finance structures are already closely – though not perfectly – aligned. Middle Eastern governments are looking to diversify away from oil and gas. This, Samer…

Key take outs

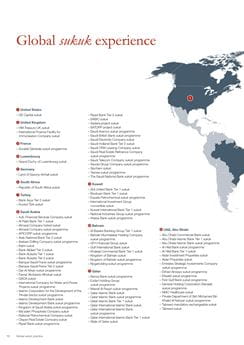

Global sukuk experience

The sukuk practice forms part of Allen & Overy's award-winning International Capital Markets practice which has enjoyed a long established reputation for its global reach and top tier position across the full range of financial products. Read more

Market-first transactions

Our specialist global Islamic capital markets team consists of lawyers who are considered by independent directories and publications as the leading lawyers in the world for advising on sukuk transactions. The team has advised issuers (whether corporates, banks, governments or supranationals), managers and delegates on the most high profile and innovative transactions, many of which are market-firsts. Read more