- Home

- Blogs

- Investigations Insight

Whistleblower update: SEC & CFTC programs busy in 2018

Browse this blog post

It has been a busy year for the SEC and CFTC whistleblower programs. From time to time, we like to update our readers on key whistleblower developments in the U.S., and there have been a number of noteworthy developments this year that warrant a closer look. As discussed below, already in 2018, the U.S. Supreme Court issued a landmark decision that clarifies the scope of Dodd-Frank’s whistleblower protection provision, the CFTC and SEC each announced their largest-ever whistleblower awards, and the SEC announced a first-of-its-kind whistleblower award under a little-known “safe harbor” provision.

In addition to those key programmatic developments, it is worth noting that the SEC whistleblower program has been particularly active in 2018. To date, the SEC has awarded more than $266 million to 55 whistleblowers and, during a one-month span this spring, the SEC’s Office of the Whistleblower approved nearly $90 million in whistleblower awards. According to Jane Norberg, Chief of the SEC’s Office of the Whistleblower, the awards demonstrate that the SEC’s whistleblower program continues to attract high-quality tips.

U.S. Supreme Court changes the whistleblower protection landscape in Digital Realty v. Somers

U.S. Supreme Court changes the whistleblower protection landscape in Digital Realty v. Somers

In Digital Realty Trust Inc. v. Somers, the U.S. Supreme Court held that the Dodd-Frank Act’s anti-retaliation provision is available only to individuals who provide whistleblower tips to the SEC. The whistleblower protection provision is not available to an internal whistleblower (e.g., someone who reports only to a supervisor or using an anonymous complaints hotline). As such, an employee who suffers workplace retaliation after reporting suspected misconduct internally, but does not make a report to the SEC, is ineligible for Dodd-Frank whistleblower protections.

Whistleblower advocates and compliance professionals bemoan possible unintended consequences of the ruling, warning that it may undermine the goals of the SEC whistleblower program, disincentivize whistleblowers to report possible violations internally, and deprive companies of the opportunity to investigate and voluntarily disclose, when appropriate, alleged violations of the securities laws. The ruling could also be broadly construed to limit other agencies’ whistleblower programs, including the CFTC program.

The actual impact of Digital Realty is not yet clear, but it will undoubtedly alter the SEC whistleblower protection landscape by narrowing the class of whistleblowers who may sue for workplace retaliation under the Dodd-Frank Act. Indeed, in at least one case since Digital Realty, a court found that an individual who provided information about potential securities laws violations, but did not report to the SEC, could not sue under the Dodd-Frank Act’s whistleblower protection provision.

CFTC to pay out largest-ever whistleblower award

Like the SEC, the CFTC has a whistleblower incentives and protections program. Both the SEC and CFTC whistleblower programs were created by the Dodd-Frank Act, and key features of the SEC and CFTC programs are nearly identical, including the range of awards available to eligible whistleblowers (10-30% of the sanctions collected in certain enforcement actions).

In February, Bloomberg reported that the CFTC plans to pay $30 million to a single whistleblower, the largest-ever whistleblower award by the CFTC. The award has not yet been finalized, but it “would be the CFTC’s fifth since its first whistle-blower award five years ago, eclipsing a $10 million award the agency granted in 2016. It’s just the CFTC’s second in excess of $1 million.” (I wrote about possible implications of the $10 million whistleblower award in April 2016.)

SEC announces largest ever whistleblower awards

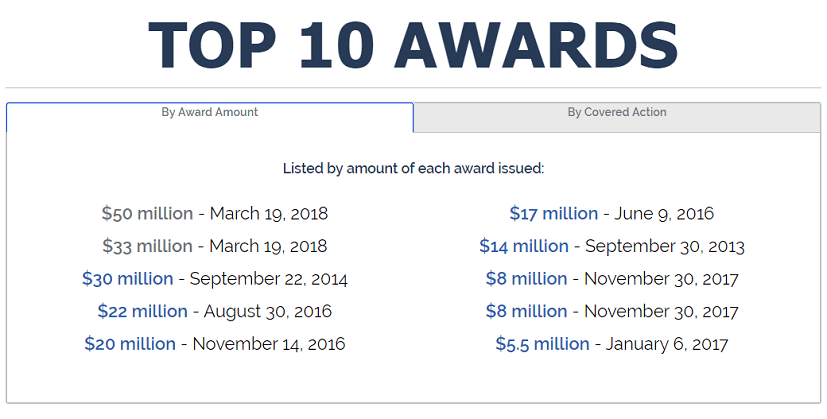

In March, the SEC announced its largest-ever whistleblower awards. According to the SEC, two whistleblowers will split a $50 million award and a third whistleblower will receive more than $33 million. (Previously, the record was a $30 million whistleblower award in 2014.)

As it has in the past, the SEC is using the awards to promote its whistleblower program—inviting individuals to come forward with information about potential securities laws violations. Indeed, in announcing the record-breaking whistleblower awards, Ms. Norberg plugged the program, “We hope that these awards encourage others with specific, high-quality information regarding securities laws violations to step forward and report it to the SEC.”

SEC announces first award under a whistleblower “safe harbor” provision

In April, the SEC announced a $2.2 million award to a former company insider who first reported potential violations of the federal securities laws to another federal agency. According to the SEC, while the whistleblower first reported the information to another agency, he later provided the same information to the SEC. The SEC whistleblower program includes a “safe harbor” for individuals who submit information to another federal agency, but submit the same information to the SEC within 120 days. In such a case, the SEC will treat the information as though it had been submitted to the SEC directly; and the whistleblower may still qualify for an award.