- Home

- Blogs

- Investigations Insight

Financial reporting and auditors under the spotlight in Australia

Browse this blog post

ASIC review of 2019 financial reports

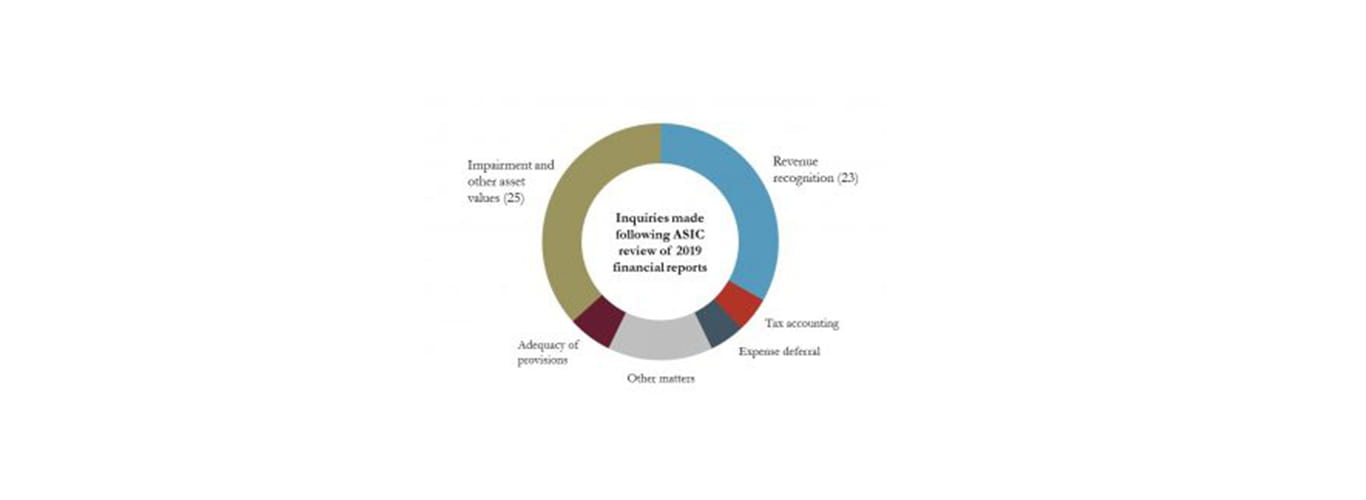

ASIC reports that it has conducted 80 inquiries on matters relating to 47 entities arising from its review. The number of inquiries is up from previous years (79 in 2018 and 54 in 2017). The inquiries can be broken down into the following categories:

Impairment and other asset values

ASIC identified that one of its primary concerns is the use of assumptions to support asset values that are unreasonable having regard to matters such as historical cash flows, economic and market conditions, and funding costs.

Three categories of assets were of particular concern to ASIC: goodwill, exploration and evaluation expenditure, and property, plant and equipment. ASIC recommended that companies should:

- Have sufficient regard to impairment indicators, such as significant adverse changes in market conditions or (for listed companies) where market capitalisation is less than the net assets reported in the financial statements.

- Make necessary disclosure of sensitivity analysis and key assumptions (including discount rates and growth rates).

Other issues

Revenue recognition was another key concern. ASIC identified instances where revenue was not disaggregated with regard to how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors. Directors and auditors were advised to focus on the impact of the newer accounting standards on revenue, financial instruments and leases, which can materially affect reported financial position.

Companies must ensure the completeness of their disclosures in relation to estimation uncertainties and significant judgements in applying accounting policies. ASIC is encouraging companies to include key assumptions, reasons for judgements, alternative treatments, and appropriate quantification in their financial reports.

Greater focus on auditors

In ASIC’s enforcement update (from January to June 2019), auditors and liquidators were identified as having the potential to cause significant harm to the financial sector. In terms of corporate governance-related outcomes, action was taken against eight auditors, which resulted in administrative remedies.

ASIC’s most recent audit inspection report for the year ending June 2019 stated that it will adopt a “more intensive supervisory and enforcement approach as regards to audit”. ASIC has flagged that there are several current investigations being undertaken, with a focus on pursuing criminal or civil liability for relevant auditor misconduct.

The audit inspection report targets auditors that, in the regulator’s view, failed to obtain reasonable assurance that financial reports are free from material misstatement in a number of core audit areas. ASIC has indicated that failing to obtain this reasonable assurance will constitute a “prima facie” breach of Section 307A of Corporations Act 2001 (Cth). Penalties for the fault-basedoffence underSection 307A(3) include a maximum prison sentence of 2 years for an individual and fines of up to $504,000 for companies.

ASIC has also expressed its concerns about audit quality and independence to the ongoing inquiry into audit regulation being conducted by the Parliamentary Joint Committee of Corporations and Financial Services. In its submission to the Committee, ASIC stated that it is “concerned that some auditors may not apply enough professional scepticism and sufficiently challenge management estimates”.

Confidential internal ASIC figures, inadvertently published by the Parliamentary Joint Committee, were obtained by The Australian newspaper. These figures revealed that three of the big four Australian auditors have experienced worsening audit inspection results since 2012. The data was used by ASIC to substantiate its observation that audit quality had deteriorated over recent years.

The Senate recently extended the deadline of the final report of the Parliamentary Joint Committee to 1 September 2020. Nonetheless, audit quality will remain a focus of ASIC’s supervisory and enforcement divisions, as the corporate regulator seeks to cement the independence and integrity of auditors in the financial reporting framework.

Edward is grateful to Georgina Calvert, paralegal, for her assistance in preparing this post.

Related expertise

Impairment and other asset values

ASIC identified that one of its primary concerns is the use of assumptions to support asset values that are unreasonable having regard to matters such as historical cash flows, economic and market conditions, and funding costs.

Three categories of assets were of particular concern to ASIC: goodwill, exploration and evaluation expenditure, and property, plant and equipment. ASIC recommended that companies should:

- Have sufficient regard to impairment indicators, such as significant adverse changes in market conditions or (for listed companies) where market capitalisation is less than the net assets reported in the financial statements.

- Make necessary disclosure of sensitivity analysis and key assumptions (including discount rates and growth rates).

Other issues

Revenue recognition was another key concern. ASIC identified instances where revenue was not disaggregated with regard to how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors. Directors and auditors were advised to focus on the impact of the newer accounting standards on revenue, financial instruments and leases, which can materially affect reported financial position.

Companies must ensure the completeness of their disclosures in relation to estimation uncertainties and significant judgements in applying accounting policies. ASIC is encouraging companies to include key assumptions, reasons for judgements, alternative treatments, and appropriate quantification in their financial reports.

Greater focus on auditors

In ASIC’s enforcement update (from January to June 2019), auditors and liquidators were identified as having the potential to cause significant harm to the financial sector. In terms of corporate governance-related outcomes, action was taken against eight auditors, which resulted in administrative remedies.

ASIC’s most recent audit inspection report for the year ending June 2019 stated that it will adopt a “more intensive supervisory and enforcement approach as regards to audit”. ASIC has flagged that there are several current investigations being undertaken, with a focus on pursuing criminal or civil liability for relevant auditor misconduct.

The audit inspection report targets auditors that, in the regulator’s view, failed to obtain reasonable assurance that financial reports are free from material misstatement in a number of core audit areas. ASIC has indicated that failing to obtain this reasonable assurance will constitute a “prima facie” breach of Section 307A of Corporations Act 2001 (Cth). Penalties for the fault-based offence under Section 307A(3) include a maximum prison sentence of 2 years for an individual and fines of up to $504,000 for companies.

ASIC has also expressed its concerns about audit quality and independence to the ongoing inquiry into audit regulation being conducted by the Parliamentary Joint Committee of Corporations and Financial Services. In its submission to the Committee, ASIC stated that it is “concerned that some auditors may not apply enough professional scepticism and sufficiently challenge management estimates”.

Confidential internal ASIC figures, inadvertently published by the Parliamentary Joint Committee, were obtained by The Australian newspaper. These figures revealed that three of the big four Australian auditors have experienced worsening audit inspection results since 2012. The data was used by ASIC to substantiate its observation that audit quality had deteriorated over recent years.

The Senate recently extended the deadline of the final report of the Parliamentary Joint Committee to 1 September 2020. Nonetheless, audit quality will remain a focus of ASIC’s supervisory and enforcement divisions, as the corporate regulator seeks to cement the independence and integrity of auditors in the financial reporting framework.

Edward is grateful to Georgina Calvert, paralegal, for her assistance in preparing this post.