- Home

- Blogs

- Investigations Insight

FCA sees 28% increase in whistleblowing disclosures

Author

Browse this blog post

Whistleblowing is a real hot topic in the financial services industry at the moment. Earlier this summer, the FCA announced that it had received 1,340 whistleblowing disclosures in 2014/15 - an increase of 28% from the previous year.

Given that a substantial number of these whistleblowing disclosures contributed to the FCA’s enforcement activities or were otherwise of ‘significant value’ to the FCA, it is unsurprising that the FCA is keen to maximise whistleblowers as a potential source of intelligence.

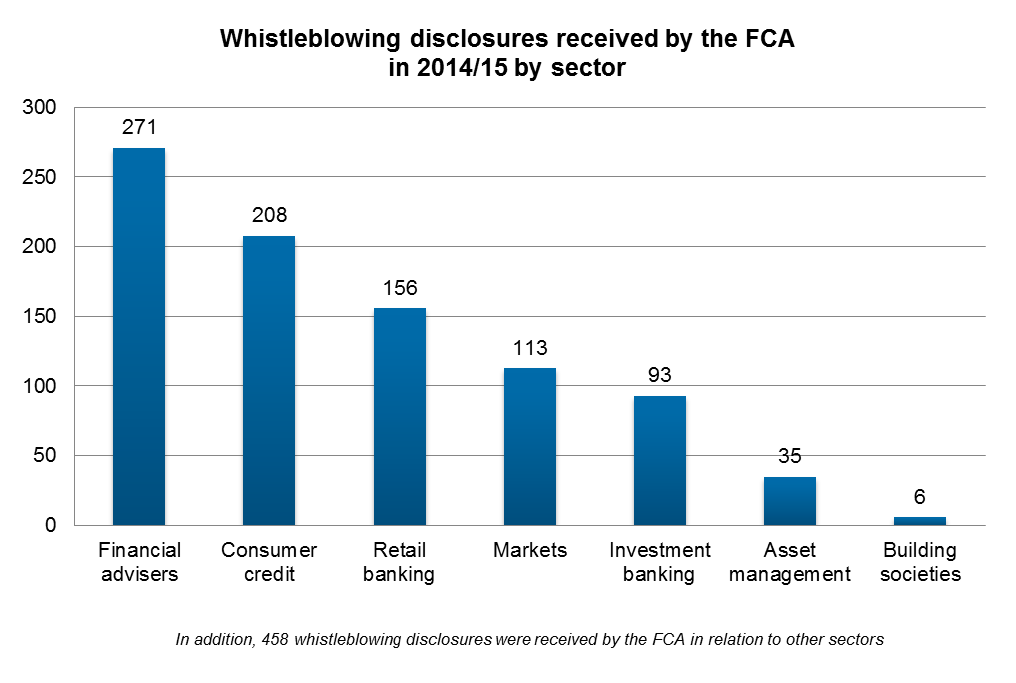

Whistleblowing disclosures by sector

The sectors set out in the graph below continue to be the subject of the bulk of whistleblowing disclosures made directly to the FCA in 2014/15. Financial advisers, consumer credit and retail banking are the three individual sectors in relation to which the FCA received the most whistleblowing disclosures. However, the FCA also received a combined total 206 of whistleblowing disclosures relating to markets and investment banking.

Of particular interest though is the number of whistleblowing disclosures received by the FCA relating to the asset management industry. For an industry which is considerably smaller than the retail and investment banking sectors, the number of whistleblowing disclosures received by the FCA in relation to asset management (35) seems disproportionately high. So does this indicate the existence of disproportionately more potential issues in the asset management industry? Perhaps. However, it is also possible that those who work in asset managers feel that it is more difficult for them to raise their hands with concerns, given that they tend to work in smaller, tighter-knit firms, which increases the risk of them being identified and subjected to detriment. This means that it is vital that asset managers have robust whistleblowing procedures in place that employees both know about and have confidence in.

What are people blowing the whistle to the FCA about?

Whistleblowers appear to be making disclosures to the FCA about a broad range of topics. We have set out a selection of the key topics in the graph below. All of these issues - especially fitness and propriety, culture, consumer detriment and financial crime - are high on firms’ agendas. These issues are also on the FCA’s radar, especially from an enforcement perspective.

Where an individual has blown the whistle directly to the FCA, it is possible that they have not also raised their concerns with the firms/individuals concerned. As a result, it is a little troubling that the most common subject of whistleblowing disclosures received by the FCA in 2014/15 was fitness and propriety. From 7 March 2016, a large number of firms operating in the UK will be responsible for ensuring and assessing the fitness and propriety of a substantial percentage of their workforce that fall within the new FCA and PRA Certification Regimes. If concerns about individuals’ fitness and propriety are being reported directly to the FCA by whistleblowers, this could pose real challenges for firms that are trying to assess the fitness and propriety of their Certified Persons, as there are no guarantees in terms of when – if at all – the FCA will pass information received from whistleblowers about individuals’ fitness and propriety to their employers.

Only a very small proportion of whistleblowing disclosures made to the FCA during 2014/15 related to competition issues. This figure may be set to increase during the current financial year in light of the FCA’s new competition powers (which it obtained on 1 April 2015) and the publicity that there has been around these new powers.

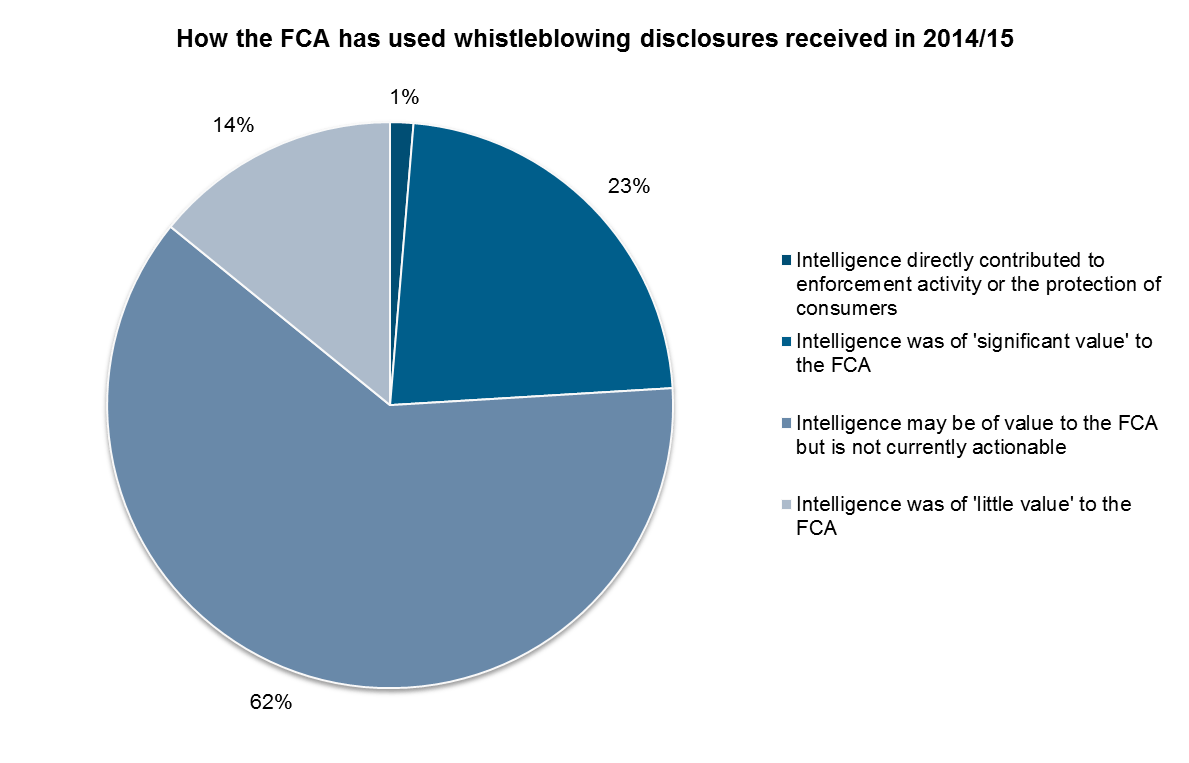

What value do whistleblower disclosures have for the FCA?

The short answer to this question is considerable value. As the chart below shows, 24% of whistleblower disclosures received directly by the FCA in 2014/15 contained intelligence that either contributed to enforcement activity or the protection of consumers or was otherwise of ‘significant value’ to the FCA. As a result, it is unsurprising that the FCA is keen to maximise whistleblowers as a source of potentially valuable intelligence.

So what comes next for the FCA and whistleblowing?

The FCA and the PRA have consulted on a set of formalised whistleblowing arrangements in UK banks, building societies and PRA designated investment firms. These proposals include the requirement for firms to train their employees that they can blow the whistle directly to the regulators and casting the net wider in terms of what types of disclosures may attract whistleblower status. The FCA is intending to publish its feedback to this consultation and final rules relating to whistleblower arrangements in the autumn. The regulators have already mooted extending these whistleblowing arrangements so that they apply to UK branches of overseas firms.

However, the FCA has made it clear that it does not intend to offer financial incentives to would-be whistleblowers. This, in part, may have contributed to the increasing number of UK whistleblowers who are approaching regulators in the US (who do offer financial incentives to whistleblowers) to make disclosures. Kurt Wolfe from Allen & Overy's Washington D.C. office reported on this development earlier this month.

Our Employment Team has published further information about the FCA and PRA proposals relating to whistleblowing, which is available on their blog, Employment Talk.

Source of data used in this post: FCA Annual Report 2014/15, a copy of which is available on the FCA’s website.