- Home

- Blogs

- ECB in focus

ECB reports that banks’ climate risk disclosure falls far short of expectations

Author

Browse this blog post

Related news and insights

Blog Post: 04 April 2024

EU court’s judgment sheds new light on how the ECB should apply national administrative measures

Publications: 03 April 2024

Publications: 22 March 2024

Background

The Paris Agreement on climate change provides a global framework for companies to commit to the target of limiting global warming to 1.5 degrees Celsius. Putting transparency, comparability and peer pressure at the heart of the new system, disclosures, particularly in the private sector, became all the more important.

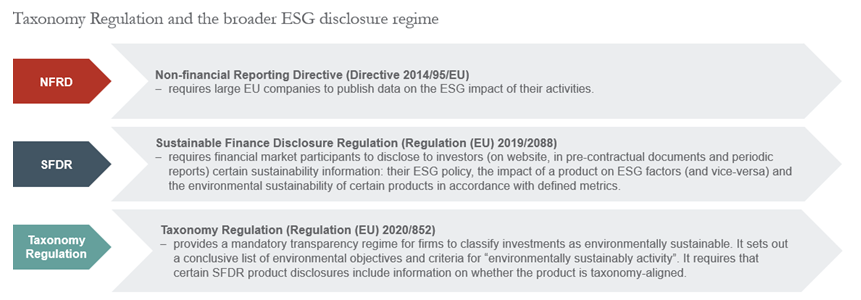

The ECB sees the transition to a carbon neutral economy as a clear part of its secondary objective. In this context, disclosure of the financial impacts of climate-related and environmental risks (“C&E risks”) is key for attaining the transparency required to maintain market discipline. In the EU the regulatory regime for ESG disclosure (with particular focus on the “environmental” component) rests significantly on the Taxonomy Regulation that broadly establishes a framework to classify if an investment is environmentally sustainable.

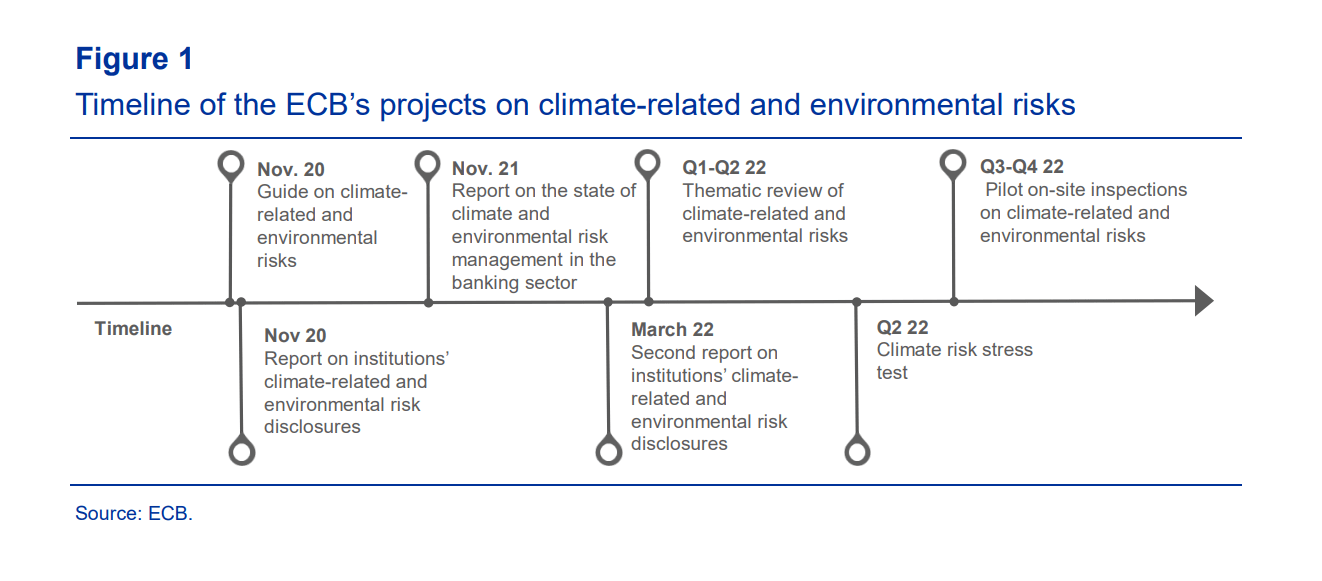

The ECB aims to use peer pressure to push banks to manage and reduce their individual risk. In the banking industry, disclosures also provide transparency to market participants on institutions’ exposures to physical and transition risk. In that context and relying in particular on the provisions in Articles 431 et seq. of CRR, the ECB published its 2020 Guide on climate -related and environmental risks (the “ECB Guide”). The ECB Guide includes a set of expectations on C&E risk disclosures.

In its first report on institutions’ C&E risk disclosures in November 2020, the ECB concluded that the vast majority of banks’ disclosures fell significantly short of these expectations. Hardly any institution met even the minimum requirements set out in the ECB Guide and in related recommendations.

Report

The March 2022 Supervisory assessment of institutions’ C&E risk disclosures (the “2022 ECB Report”) takes stock of the C&E risk disclosure practices of significant institutions and measures their progress against the ECB’s expectations. It contains the ECB’s observations on those practices, areas for improvement and good practices.

Against the background of the 26th UN Climate Change Conference of the Parties in Glasgow in late 2021 and given the increasing number of commitments by banks to achieve net zero emissions, particular attention is dedicated not only to the metrics and targets disclosed by institutions, but also to their substantiation.

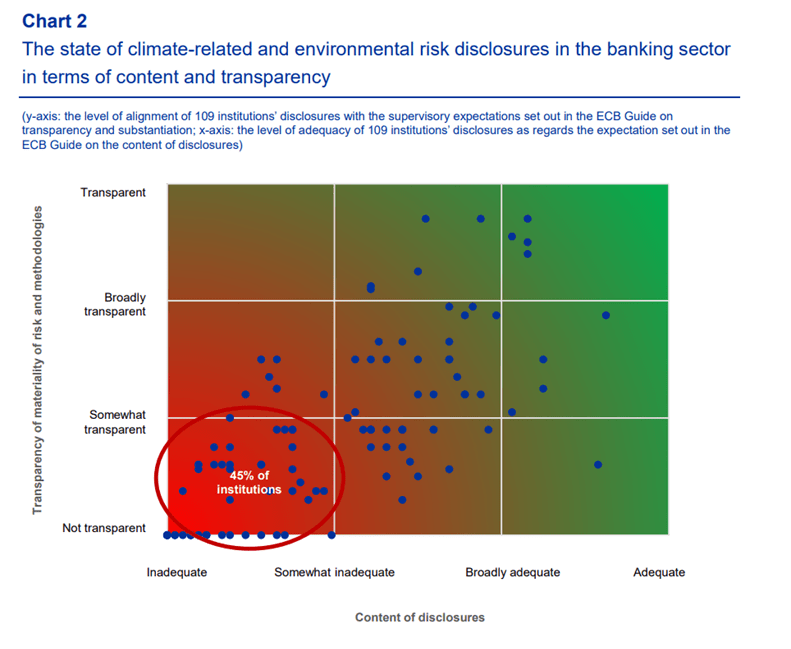

The 2022 ECB Report is based on a supervisory assessment of significant institutions’ publicly available disclosures with a reference date of 2020 (or later, where available). The ECB’s analysis shows that while institutions have shown clear progress in several areas compared with 2020, virtually none of the banks discloses all the information on C&E risks that would align them with the ECB’s expectations.

45% of the banks’ disclosures were even assessed as insufficient from both a content and substantiation perspective.

The ECB finds that one-third of institutions do not transparently disclose that they are materially exposed to C&E risks. In general, banks hardly substantiate their C&E metrics and targets – only 20% of institutions comprehensively disclose the factors connected to reaching their target; one-third of institutions do not disclose these aspects at all. The remainder disclose these only for some of the metrics.

Parallel developments impacting C&E risk disclosures

At the same time, several legislative proposals affecting ESG disclosures going forward are making their way through the European legislative process:

- CSRD proposal: The Corporate Sustainability Reporting Directive is currently at the stage of first reading in the Council. It aims to ensure that companies report the relevant, comparable and reliable sustainability information needed by investors and stakeholders. CSRD extends the scope of reporting requirements to all large companies and most listed companies, and creates an audit requirement for reported sustainability information.

- CRR III proposal: The European Commission published a proposal to amend the CRR in October 2021, which would extend the disclosure requirements on ESG risks to all institutions (currently only large, listed banks are in scope) while tailoring the standards proportionately to the size and complexity of the bank. Information on exposure to ESG risks would also be made part of supervisory reporting.

Outlook

In individual feedback letters to significant banks, the ECB sets out key gaps in their disclosures and expects the banks to take decisive action. Ensuring that banks appropriately deal with C&E risks forms part of the ECB’s 2022-24 supervisory priorities. The extent to which the banks have addressed the individual feedback will be a central feature in the supervisory activities for 2022.

Planned activities include an in-depth review of banks’ preparedness to manage C&E risks scheduled for the first half of 2022. The ECB also plans to gradually integrate C&E risks into its methodology for the supervisory review and evaluation process, which will influence Pillar 2 capital requirements, as well as its on-site inspection methodology.

In his keynote speech Frank Elderson, Member of the Executive Board of the ECB and Vice Chair of the Supervisory Board of the ECB, emphasised that the ECB stands ready to use “the full array of supervisory tools” and that the ECB expects banks to make “major progress” in their disclosures by the end of the year.

- An institution aiming to manage its portfolio to achieve net zero emissions by 2050: It has a publicly available climate strategy and discloses a number of (interim) targets and related metrics, as well as the progress made against them. The institution discloses the sectors covered for each target, the underlying methodology and the scenarios used to draw up benchmarks. For the methodologies and scenarios disclosed, it reports on the options chosen (where applicable), its data sources and changes from the previous disclosure. The institution also provides an explanation of its alignment indicators.

- An institution disclosed its procedure for the management and monitoring of ESG risks in its corporate financing business: Its loan approval process includes ESG risks. Approval will be given where risks are acceptable and/or the beneficiary agrees to the additional risk control measures and the implementation of mitigation measures. As part of the periodic loan review, it also monitors ESG risks, and the institution can terminate credit facilities where ESG risk conditions agreed are not met.

It is clear that the ECB fired a warning shot with its 2022 ECB Report and will insist on “full disclosure” of C&E risks.

Further Reading

Read the full 2022 ECB Report here.

Read the ECB press release accompanying the 2022 ECB Report here.

Read Frank Elderson’s keynote speech here.

See our blog post for more detail on the ECB 2022-24 supervisory priorities.